SUGS Lloyd IPO Overview

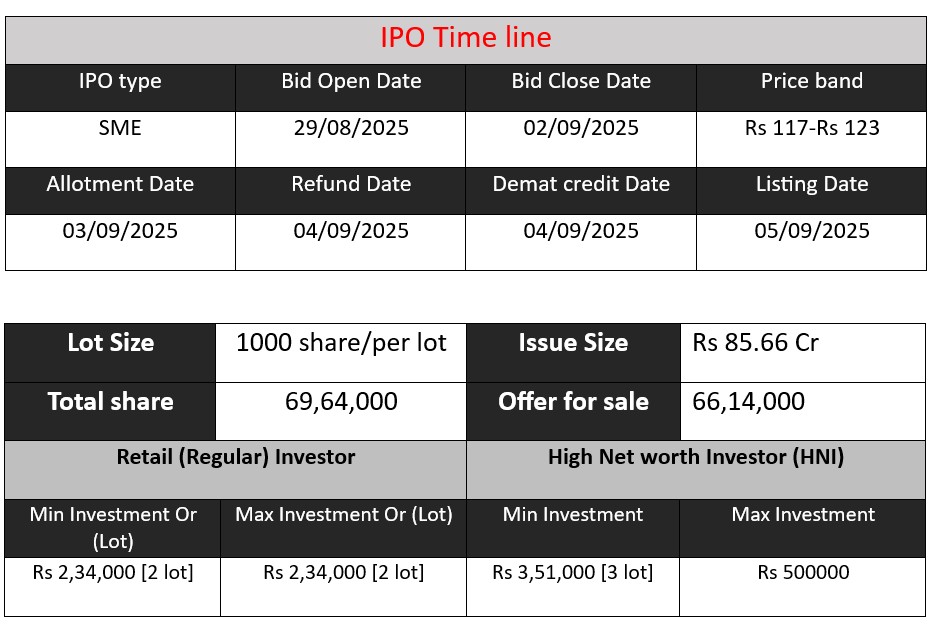

Sugs Lloyd Ltd. IPO opens on August 29, 2025, and closes on September 2, 2025. It comprises a fresh issue of 69.64 lakh equity shares (face value ₹10) at a price band of ₹117–₹123, raising up to ₹85.66 crore. Proceeds—about ₹64 crore—will support working capital, with the remainder allocated for general corporate purposes and issue expenses. The IPO will list on the BSE SME platform on September 5, 2025.

SUGS Lloyd Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 2.03 |

| NIIs | 5.34 |

| Retails | 1.90 |

| Total | 2.78 |

| Last Updated: 02 Sep 2025 5 PM Source: NSE/BSE | |

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 117-123 | |

| Last Updated: 02 Sep 2025 5 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

Originally incorporated on 16 September 2009 as Sugs Lloyd Energy Private Limited.

Renamed to Sugs Lloyd Private Limited in October 2020. Converted to a public limited company and renamed Sugs Lloyd Limited in June 2024.

Business & Operations

- A technology-driven engineering and construction firm, offering EPC services in renewable energy (particularly solar), electrical Transmission & Distribution (T&D), and civil infrastructure.

- Provides products and solutions such as Outage Management Systems, Fault Passage Indicators, Auto-reclosers, Sectionalizers, cable joints/terminations, substation infrastructure, and smart metering.

- Offers Project Management Consultancy (PMC), Detailed Project Reports (DPR), staffing & manpower services—especially for power DISCOMs and government entities.

Strengths

- Combines solar EPC, electrical T&D, civil works, smart metering, and staffing—enabling turnkey project delivery across sectors.

- Entered technical collaborations with Nortroll (Norway) and Jin Kwang E&C Corp. to bolster engineering and technological capabilities.

- Won the “Emerging Solar EPC of the Year” award at Rajasthan Sustainable Renewable Revolution for its outstanding solar project execution.

- Transitioned from proprietorship to private limited, now public limited company—reflecting institutional maturity and enhanced capital-raising capabilities.

Potential Risks

- Much of its business relies on winning competitive government or private bids—making revenue vulnerable to fluctuations in order inflows.

- Heavy focus on renewable energy and T&D infrastructure in India could become a vulnerability if government policy or demand shifts.

- Complex project execution—especially across remote or large-scale EPC, solar, and civil projects—imposes inherent operational risk (e.g., timeline delays, cost overruns).

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 35.79 | 2.29 | 24.65 |

| FY 2024 | 65.12 | 10.48 | 48.23 |

| FY 2025 | 176.20 | 16.78 | 133.50 |

Revenue

- FY 2023: ₹35.79 Cr

- FY 2024: ₹65.12 Cr

- FY 2025: ₹176.20 Cr

Revenue has shown massive growth, especially in FY 2025 with a jump of over 170% compared to FY 2024, reflecting strong business expansion and higher order execution.

Profit

- FY 2023: ₹2.29 Cr

- FY 2024: ₹10.48 Cr

- FY 2025: ₹16.78 Cr

Profitability improved significantly, with FY 2024 showing a sharp rise (over 350% growth YoY). FY 2025 continued profit growth, though the pace is moderate compared to revenue, indicating possible rising costs or reinvestment.

Assets

- FY 2023: ₹24.65 Cr

- FY 2024: ₹48.23 Cr

- FY 2025: ₹133.50 Cr

Assets have expanded consistently, showing strong capital buildup and resource growth, supporting business scalability.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.