Studio LSD IPO Overview

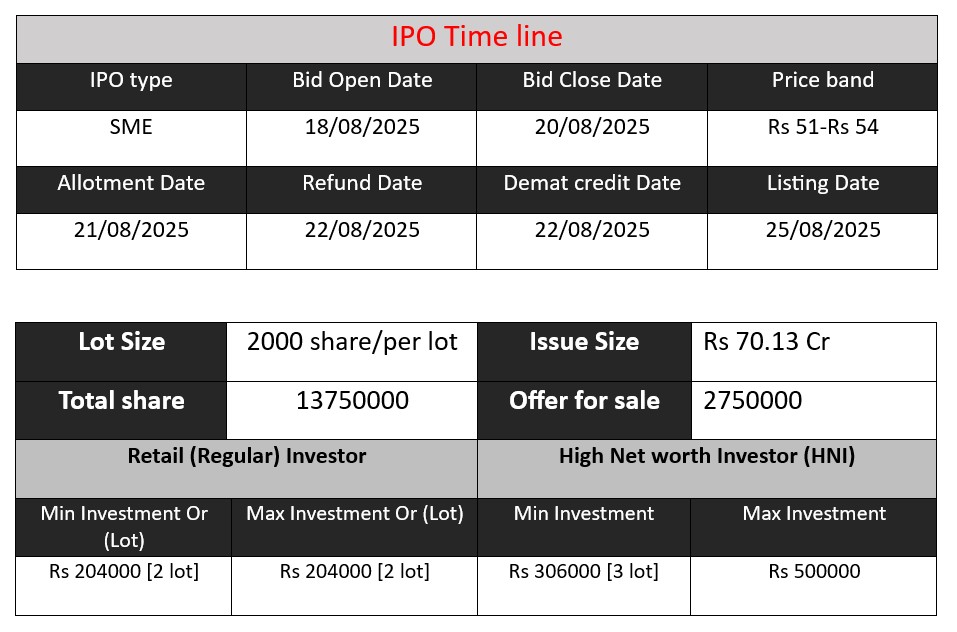

Studio LSD Limited’s SME IPO opens on 18 Aug 2025 and closes on 20 Aug 2025, offering 13.75 million equity shares (face value ₹2) through a fresh issue of 11 million shares and an offer-for-sale of 2.75 million shares. Priced in the ₹51–₹54 band, the issue aims to raise ₹70.13 crore. Proceeds will fund capital expenditure, working capital, and general corporate purposes. Listing is scheduled on NSE Emerge on 25 Aug 2025.

Studio LSD Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 1.00 |

| NIIs | 1.18 |

| Retails | 3.42 |

| Total | 2.38 |

| Last Updated: 20 Aug 2025- 12 PM | |

| GMP (₹) | IPO Price (₹) |

| 51-54 | |

| Last Updated: 20 Aug 2025- 12 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

- Studio LSD Limited was originally incorporated in February 2017 as LSD Films Private Limited, later becoming Studio LSD Private Limited in 2020, and finally converting into a public limited company in 2024.

- Headquartered in Mumbai, the company operates as a multimedia production house, creating original and captivating content for television and OTT platforms. Its services span the entire content production process:

- Concept development

- Scriptwriting & screenplay

- Project financing

- Line production (casting, location, sets, budgets)

- Post-production (editing, VFX, sound design)

- Distribution & marketing.

- The name “LSD” stands for Laxmi, Saraswati, and Durga, symbolizing creativity, prosperity, and wisdom.

Strategic

- Creative Storytelling & Diverse Portfolio

Studio LSD is well known for crafting innovative, original content across genres—dramas, thrillers, romance, mythology, reality, and special programming—for major broadcasters like Sony, Zee TV, Colors TV, among others. - Full-Spectrum In-House Capabilities

It offers end-to-end production control, ensuring quality, efficiency, and cost-effectiveness across all stages—from pre-production to post-production. - Expanding Business Model (IP Ownership)

While historically operating on a commission-based model (producing shows for broadcasters for a per-episode fee), the company is now actively shifting toward an IP ownership model—developing proprietary content to monetize via licensing, syndication, and digital platforms.

Potential Risks

- Dependency on Broadcasters & Distribution Partners

Revenue depends heavily on timely payments from TV channels and distributors; any delays could materially impact profitability. - Shifts in Audience Preferences

The media and entertainment industry is highly sensitive to changing viewer tastes; failure to anticipate trends or audience shifts could adversely affect the business. - Regulatory & Litigation Exposure

As with many media companies, there are risks associated with regulatory compliance and potential litigation, which may disrupt operations or drive up costs

Financial Performance Overview (₹ in Crore)

| Financial Year | Revenue | Profit (PAT) | Total Assets |

| FY 2023 | 46.68 | 2.79 | 18.16 |

| FY 2024 | 102.47 | 10.90 | 36.48 |

| FY 2025 | 104.48 | 11.67 | 46.67 |

Revenue

- FY 2023 → FY 2024: Revenue jumped from ₹46.68 Cr to ₹102.47 Cr (more than 2x growth).

- FY 2024 → FY 2025: Revenue rose slightly from ₹102.47 Cr to ₹104.48 Cr (flat growth).

Major growth happened in FY 2024, while FY 2025 was stable.

Profit

- FY 2023: Profit was ₹2.79 Cr (low margin year).

- FY 2024: Profit surged to ₹10.9 Cr, showing strong operational improvement.

- FY 2025: Profit inched up to ₹11.67 Cr, maintaining stability.

Consistent profitability shows better cost management and efficiency.

Total Assets

- FY 2023: ₹18.16 Cr

- FY 2024: ₹36.48 Cr (doubled)

- FY 2025: ₹46.67 Cr (further increase)

Assets have steadily grown, indicating business expansion and stronger balance sheet.

✅ Pros

- Strong revenue & profit growth with healthy margins.

- Zero-debt company with improving assets.

- Established content production house with big broadcaster tie-ups.

- Moving towards IP ownership for long-term revenue.

- End-to-end in-house production capabilities.

❌ Cons

- Heavy dependence on broadcasters for revenue.

- Highly competitive and trend-driven media industry.

- Growth slowed in FY 2025 compared to FY 2024.

- Regulatory and litigation risks in content business.

- Reliance on timely payments from clients.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.