Star Imaging IPO Overview

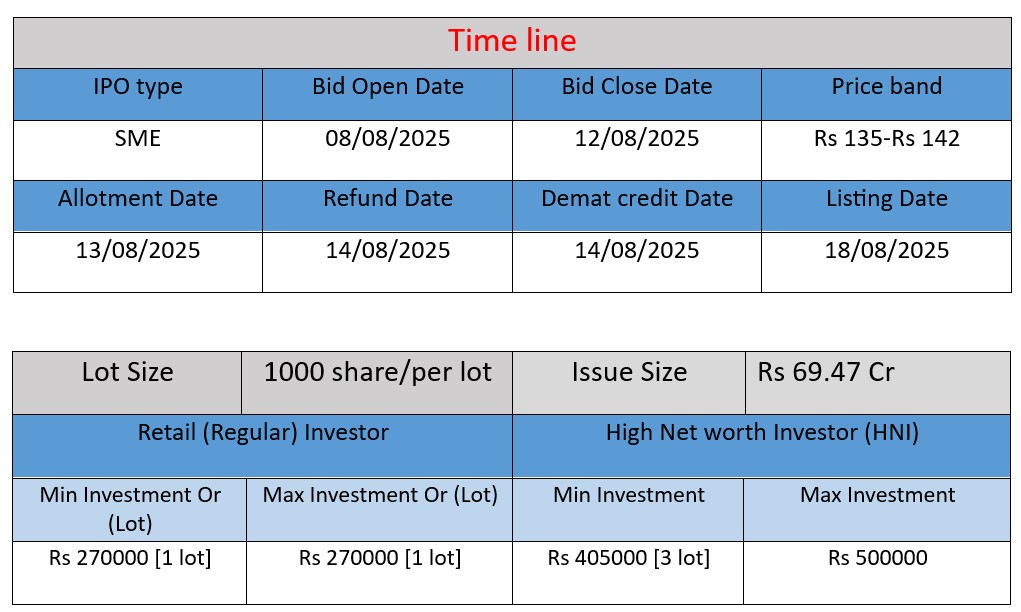

Star Imaging & Path Lab Ltd. SME IPO opens 8 Aug 2025 and closes 12 Aug 2025. The issue size is ₹69.47 cr via 48.92 lakh shares (fresh issue: 39.2 lakh; OFS: 9.72 lakh) at ₹135–₹142 per share. Proceeds will fund working capital, debt repayment, purchase of medical equipment and general corporate purposes.

Star Imaging Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 12.85 |

| NIIs | 4.58 |

| Retails | 1.78 |

| Total | 3.46 |

| Last Updated: 12 Aug 2025 Time: 8 PM (Note: This data is updated every 2 hours) Source: NSE/BSE | |

| GMP (₹) | IPO Price (₹) |

| 3 | 142 |

| Last Updated: 12 Aug 2025 Time: 8 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

Star Imaging and Path Lab Limited, founded in 2004, is a Delhi‑based healthcare diagnostics provider offering both imaging and pathology services. Its offerings include digital X‑rays, CT scans, MRIs, 4D/5D ultrasounds, mammography, and a full suite of laboratory tests such as haematology, microbiology, PCR, and histopathology.

The company evolved from a small clinic into a structured enterprise, operating retail centers, PPP-based diagnostic centers in government hospitals, and hospital tie-ups to deliver comprehensive diagnostic solutions.

Strengths

- Diversified Business Model

The company leverages a three-tier revenue stream: B2C (retail), B2G (PPP centers), and B2B (private hospitals)—creating resilience and stability. - Strategic Infrastructure & Accreditations

Its hub-and-spoke tele-radiology model allows efficient utilization of advanced imaging equipment. Accreditation (e.g., NABL) bolsters trust and supports institutional partnerships.

Risks

- Geographic Concentration

The company remains heavily focused in the Delhi NCR region, which limits diversification and exposes it to regional risks. - Working Capital Pressure from PPP

Public-private contracts can involve delayed payments or administrative delays, potentially stressing cash flow. - High Debt Leverage

While improving, the debt-to-equity ratio (~0.98 in FY24, and reducing) is higher than many listed peers, meaning leverage remains a concern. - Intense Competition & Regulatory Risk

The diagnostics sector is increasingly competitive, and reliance on PPPs exposes the business to policy/regulatory changes.

Financial Performance Overview (₹ in Crore)

| Financial Year | Revenue | Profit (PAT) | Total Assets |

| FY 2022 | ₹69.08 Cr | ₹6.29 Cr | ₹58.34 Cr |

| FY 2023 | ₹58.53 Cr | ₹0.58 Cr | ₹61.23 Cr |

| FY 2024 | ₹78.78 Cr | ₹12.45 Cr | ₹81.63 Cr |

Revenue

- FY 2022: ₹69.08 Cr

- FY 2023: Decreased to ₹58.53 Cr (down ~15%)

- FY 2024: Rebounded strongly to ₹78.78 Cr (up ~35% from FY23)

Revenue declined in FY23, likely due to post-COVID slowdown or reduced demand. However, FY24 saw a sharp recovery, suggesting strong market demand or expanded operations.

Profit

- FY 2022: ₹6.29 Cr

- FY 2023: Fell sharply to ₹0.58 Cr

- FY 2024: Jumped to ₹12.45 Cr

Profitability dipped drastically in FY23, possibly due to increased expenses or lower margins. The huge surge in FY24 shows improved cost control and better pricing or service mix.

Total Assets

- FY 2022: ₹58.34 Cr

- FY 2023: ₹61.23 Cr

- FY 2024: ₹81.63 Cr

Consistent asset growth reflects expansion—likely through setting up more diagnostic centers or investing in new equipment.

✅ Pros

- Diversified revenue model: B2C, B2B, and PPP government centers.

- Strong revenue and profit recovery in FY24.

- Accredited labs (e.g., NABL), boosting credibility.

- Expanding asset base and infrastructure.

- Experienced promoters with healthcare focus.

❌ Cons

- High dependence on Delhi-NCR region.

- FY23 performance was weak with minimal profit.

- Delayed payments risk in PPP government contracts.

- Moderate debt on balance sheet.

- Competitive diagnostic sector with pricing pressure.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.