Solarworld Energy IPO Overview

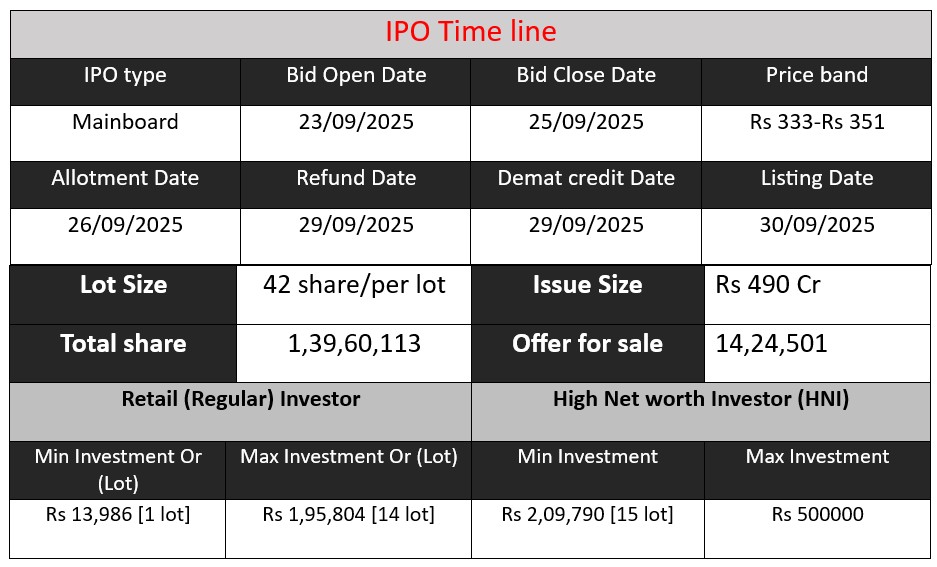

Solarworld Energy Solutions Ltd is launching a ₹490 crore IPO, offering 1.3960 crore shares, including a fresh issue of ₹440 crore and an offer for sale of ₹50 crore. The price band is ₹333 to ₹351 per share. IPO opens 23 September 2025 and closes 25 September 2025. Proceeds will be used to part-finance a 1.2 GW TopCon solar PV cell manufacturing facility in Pandhurana, Madhya Pradesh and for general corporate purposes.

Solarworld Energy GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 52 | 333-351 |

| Last Updated: 25 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Solarworld Energy Core Business & Overview

Solarworld Energy Solutions Ltd is a renewable energy company based in Noida, India, founded in 2013. Its business centres around solar power projects, specifically:

EPC (Engineering, Procurement, and Construction) services for solar power – designing, installing, and commissioning solar projects for clients in public sector undertakings (PSUs) and commercial & industrial (C&I) sectors.

It operates under two models:

CAPEX model: The client owns the solar assets; Solarworld does the EPC etc.

RESCO model: Solarworld owns the project; sells electricity to customer under long-term power purchase agreement (PPA).

It also offers Operations & Maintenance (O&M) services for solar plants, assuring performance, uptime etc.

The company is expanding / plans to expand into solar cell / module manufacturing and battery energy storage systems (BESS).

Some scale indicators:

- As of July 31, 2025, they have completed 46 projects with 253.67 MW AC / 336.17 MW DC capacity; and several others in progress.

- The order book is large: e.g. order book for EPC + O&M etc was ₹1,198.17 crore for EPC and ₹57.94 crore for O&M, covering several hundred MWs.

Strengths

Here are some of its key strengths, as per disclosures / analyst reports:

- Strong execution capabilities

The company has developed expertise in carrying out end-to-end EPC work. Having experience with both rooftop and ground-mounted solar projects, plus delivering O&M services, gives it good operational capability. - Growing revenues & profitability

There has been consistent growth over recent years. For example, revenue from operations increased from ₹232.46 crore in FY23 to ₹501.02 crore in FY24 and ₹544.77 crore in FY25. Profit after tax similarly rose. - Robust order book & pipeline

A strong order book provides revenue visibility. Projects under execution plus upcoming ones give it a backlog to work on. - Asset-light business model (for certain parts)

Under the CAPEX model, Solarworld doesn’t need to bear real estate acquisition costs (often handled by clients), which helps keep capital expenditure and fixed cost lower. - Policy tailwinds & sector growth

The Indian government has ambitious renewable energy targets, and incentives / policies are favorable for solar, for domestic manufacturing etc. The plan to set up solar cell manufacturing etc taps into government schemes. - Diversification in revenue streams

Not just EPC; adding RESCO, O&M, manufacturing, BESS etc to diversify. This helps reduce dependence on any one vertical.

Risks

As with any growing company in this space, there are several risks. Here are at least three significant ones:

- Concentration of customers

A very large portion of revenue comes from a single or few key customers. For example, SJVN Green Energy Limited accounted for 79.19% of revenue in FY25. Loss of such a customer (or delay, change) could seriously affect financials. - Geographic concentration

Much of the company’s operations / revenue is concentrated in certain states (e.g. Uttar Pradesh) or regions. Local regulatory, economic or climate factors there could disproportionately affect the business. - Cost overruns / fixed-price contract risks

EPC contracts are typically fixed price. If input costs (solar modules, inverters, labour, logistics etc.) or timelines escalate, margins can compress. Also delays and cost estimates are risk factors. - Working capital / Cash flow pressures

High receivables, large upfront deployment of costs, and past negative operating cash flows in some periods. Managing cash flow is crucial. - Dependency on supportive policies / regulatory environment

Solar and renewable energy sectors depend heavily on government policies, subsidies, tax incentives, PLI schemes etc. Any unfavourable change could adversely impact the business. Delays in approvals, changes in rules could hurt. - Supply chain risks

Dependence on key suppliers for materials (solar panels, inverters, etc.). Disruption in supply, price volatility can affect project execution.

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 232.46 | 14.84 | 120.43 |

| FY 2024 | 501.02 | 51.69 | 155.02 |

| FY 2025 | 544.76 | 77.05 | 598.01 |

Revenue

- FY 2025: ₹544.76 crore

- FY 2024: ₹501.02 crore

Revenue grew by 8.7% YoY in FY25 compared to FY24. This is a slowdown compared to the 115% surge in FY24 over FY23, but still shows positive growth momentum.

Profit

- FY 2025: ₹77.05 crore

- FY 2024: ₹51.69 crore

Profit rose 49.1% YoY in FY25, indicating improved operational efficiency. In FY24, profit had already jumped more than 3.5x compared to FY23, reflecting strong scaling and margin improvement.

Total Assets

- FY 2025: ₹598.01 crore

- FY 2024: ₹155.02 crore

Assets grew by ~285% YoY in FY25, a sharp rise compared to the 29% growth from FY23 to FY24. This signals significant capital deployment, likely linked to the upcoming solar cell manufacturing expansion and large order execution.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.