Sodhani Capital IPO Overview

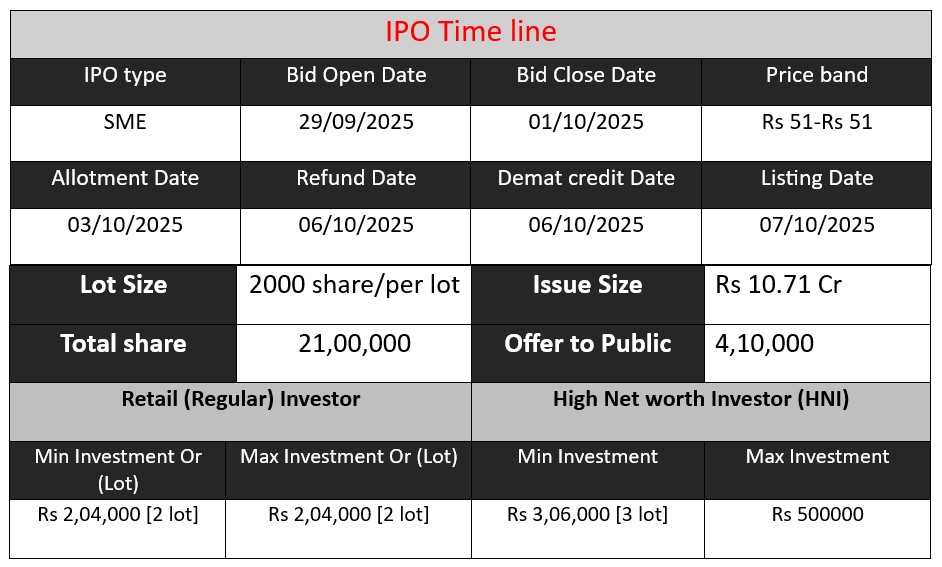

Sodhani Capital Limited IPO opens on September 29, 2025, and closes on October 1, 2025, with a total issue size of ₹10.71 crore. The company will issue 21 lakh shares at a fixed price of ₹51 each. Funds raised will be used for working capital requirements, business expansion, and general corporate purposes. The IPO is set to list on BSE SME on October 7, 2025, offering investors a chance to participate in the company’s growth.

Sodhani Capital GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 0 | 51 |

| Last Updated: 3 Oct 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Sodhani Capital Core Business & Overview

Sodhani Capital Limited is a financial services firm established in 1992 and headquartered in Jaipur, Rajasthan. The company specializes in mutual fund distribution, catering to retail investors and high-net-worth individuals (HNIs). Sodhani Capital is registered with the Association of Mutual Funds in India (AMFI) and adheres to Securities and Exchange Board of India (SEBI) compliance audits, ensuring its services meet all regulatory requirements.

Core Services

- Mutual Fund Distribution: Provides a range of mutual fund products, including equity, debt, hybrid, and ELSS funds, to suit various investor profiles.

- Financial Planning & Advisory: Offers personalized financial planning and investment advisory services to help clients achieve their financial goals.

- Portfolio Management: Assists clients in managing and restructuring their investment portfolios to optimize returns.

- Financial Education: Conducts workshops and provides resources to educate investors on financial planning and investment strategies.

Strengths

- Experienced Team: Employs a seasoned team of professionals committed to delivering high-quality services to clients.

- Regulatory Compliance: Registered with AMFI and subject to SEBI audits, ensuring adherence to industry standards and regulations.

- Client-Centric Approach: Focuses on building long-term relationships with clients through personalized services and financial education.

Risks

- Regulatory Changes: Vulnerable to changes in mutual fund distribution regulations and commission structures, which could impact revenue streams.

- Market Volatility: Exposure to market fluctuations can affect the performance of investment portfolios and client returns.

- Competition: Faces competition from banks, fintech platforms, and direct investment channels, which may offer alternative investment options to clients.

Financial Performance Overview (₹ in Crore)

| Particulars | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 2.43 | 2.96 | 4.10 |

| Profit | 1.20 | 2.21 | 2.18 |

| Assets | 2.29 | 5.36 | 7.60 |

Revenue

- FY 2023: ₹2.43 Cr

- FY 2024: ₹2.96 Cr

- FY 2025: ₹4.10 Cr

Revenue shows consistent growth over three years. FY 2024 grew by 22% and FY 2025 jumped by ~38%, reflecting strong business expansion and higher client engagement.

Profit

- FY 2023: ₹1.20 Cr

- FY 2024: ₹2.21 Cr

- FY 2025: ₹2.18 Cr

Profit nearly doubled in FY 2024, but slightly declined in FY 2025 despite revenue growth. This indicates rising operational or compliance costs impacting margins.

Total Assets

- FY 2023: ₹2.29 Cr

- FY 2024: ₹5.36 Cr

- FY 2025: ₹7.60 Cr

Assets expanded more than 3x between FY 2023–2025, showing increasing scale, reserves, and reinvestment into the business.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.