हिंदी में पढ़ने के लिए मेनू बार से हिंदी भाषा चयन करें।

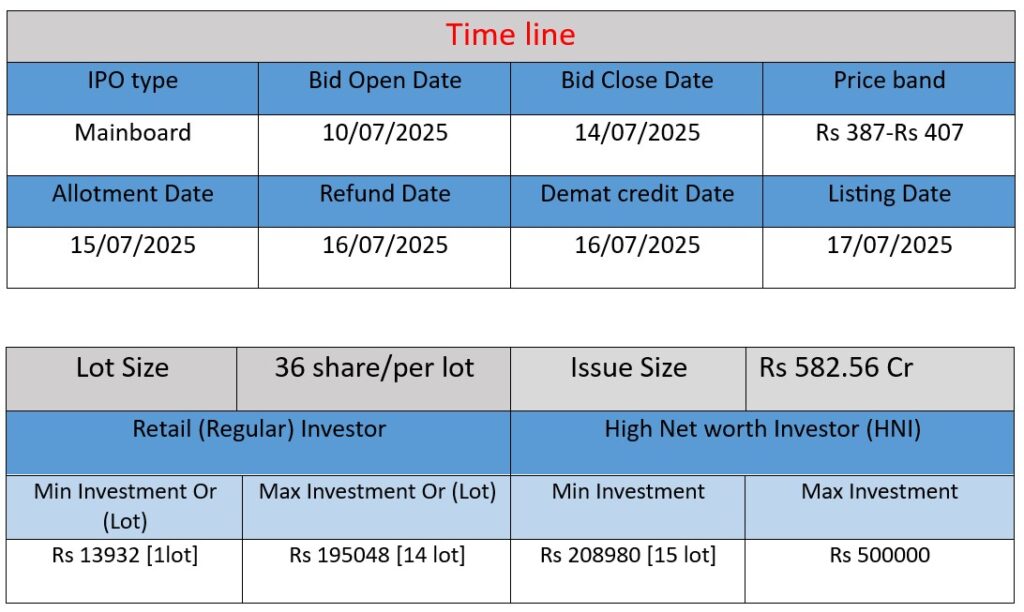

Smartworks Coworking Spaces Ltd IPO opens on 10 July 2025 and closes on 14 July 2025, with a price band of ₹387–407. Total issue size is approx. ₹582.6 cr, comprising a ₹445 cr fresh issue and ₹137.6 cr OFS. Proceeds will be used for repaying ₹114 cr debt, ₹226 cr for new centre fit-outs and deposits, and the balance for general corporate purposes.

Smartwork IPO Subscription Data

Subscription Rate Source: NSE/BSE

| Category | Shares Offered | Shares Bid For | Subscription (x) |

| QIBs | 29,03,910 | 7,08,75,864 | 24.41x |

| NIIs | 22,17,233 | 5,05,06,848 | 22.78x |

| Retails | 51,73,543 | 1,82,71,296 | 3.53x |

| Employees | 1,07,142 | 2,54,844 | 2.38x |

| Total | 1,04,01,828 | 13,99,08,852 | 13.45x |

Last Updated: 14 July 2025 Time: 7 PM (Note: This data is updated every 2 hours)

Core Business & Overview

- Managed office campuses: Leases large bare-shell properties, refurbishes them with modern design and tech, then sublets to enterprises and MNCs.

- Target segment: Focuses on mid-to-large enterprises needing 300+ seats across India; also serves startups and corporates.

- Service offerings: Wants a “campus” experience — cafeterias, gyms, creches, medical rooms, sports areas, smart convenience stores, and integrated tech solutions (facial recognition, booking app, etc.).

- Scale & growth: Operates ~10 million sq ft across 50+ centres in 14+ cities (and 2 in Singapore) as of mid‑2025.

Strengths

- Scale advantage: India’s largest managed campus operator (8–9 mn sq ft), with four of the country’s five largest leased centres.

- Enterprise clients & lock‑in: Long‑term contracts (2–5 years), especially with mid‑large clients, stabilizing revenues and retention.

- Economies of scale & cost control: Lower per‑sq ft operating costs (~₹34‑36) driven by lease efficiency and a strong vendor network.

- Asset-liability alignment: Rents from clients cover lease obligations for the next 2 years; rental revenue typically double lease costs.

- Diversification: Limits single-client occupancy to <30% per centre and spreads presence across 14 cities and multiple industries.

- Leadership & investor support: Led by experienced founders (Neetish Sarda, Harsh Binani) and backed by advisors like Keppel.

- Technology-enabled customer experience: Facets like mobile booking, touchless access, and integrated services enhance operational efficiency and value .

Potential Risks

- Financial losses & leverage: Despite revenue growth (₹712 → ₹1,374 cr FY23–FY25), the company remains loss-making (net loss ~₹63 cr in FY25). Debt coverage metrics are modest.

- Cyclical real estate exposure: While long leases cushion risk, downturns in commercial real estate could impact occupancy and rent hikes .

- Geographical and client concentration: ~80% rental revenue from top 4 cities; major enterprise clients can negotiate aggressively or exit.

- High expansion capital needs: Fit-outs and security deposits for new centres absorb large amounts of capital (~₹1,350/sq ft).

- Stiff competition: Operates in a competitive market with domestic and international flexible workspace providers.

- Lease dependency: Business model hinges on securing landlord leases at favourable terms—any disruption or inability could slow growth .

Smartworks presents a compelling value proposition in India’s flexible workspace segment:

Its strengths—scale, enterprise focus, client lock-in, operational efficiency, proprietary tech, and diversified exposure—position it well for continued growth.

However, risks remain: recurring losses, debt dependency, real estate cycles, geographic concentration, and competitive lease sourcing. Investors and stakeholders should weigh the company’s impressive growth and market leadership against its path to sustained profitability and external real estate pressures.

Financial Performance Analysis (in ₹ Crore)

| Financial Year | Revenue (₹ crore) | Profit (₹ crore) | Total Assets (₹ crore) |

| FY-2023 | 711.39 | -101.05 | 4473.50 |

| FY-2024 | 1039.36 | -49.96 | 4147.08 |

| FY-2025 | 1374.06 | -63.18 | 4650.85 |

Revenue

- FY-2023 to FY-2024: Grew from ₹711.39 Cr to ₹1039.36 Cr → 46.08% growth

- FY-2024 to FY-2025: Increased to ₹1374.06 Cr → 32.2% growth

Strong and consistent revenue growth, reflecting demand for managed office spaces.

Profit/Loss

- Loss narrowed from ₹-101.05 Cr (FY23) to ₹-49.96 Cr (FY24), indicating operational improvements.

- But widened again to ₹-63.18 Cr (FY25), showing potential cost pressures due to expansion or interest burden.

Despite growth, the company remains in losses, and profitability is not yet achieved.

Total Assets

- Dropped from ₹4473.5 Cr (FY23) to ₹4147.08 Cr (FY24) (↓7.3%) — possibly due to depreciation or asset revaluation.

- Rose again in FY25 to ₹4650.85 Cr → a 12.1% increase, showing resumed asset expansion, likely due to new centres and investments.

Asset base expansion in FY25 suggests aggressive scaling.

Overall Summary

- Strength: Impressive revenue growth with growing demand for flexible workspaces.

- Weakness: Continued net losses raise concern about path to profitability.

- Outlook: Asset growth and improving topline show long-term potential, but sustained losses and financial management remain key watch points before investing.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.