SK Minerals & Additives IPO Overview

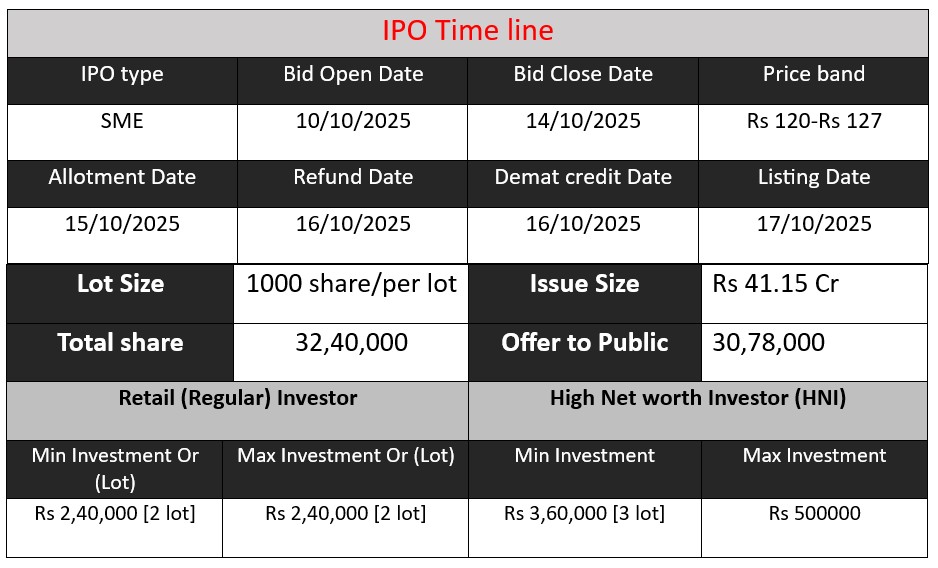

SK Minerals & Additives Ltd. is launching an SME IPO to raise ₹41.15 crore via issuance of 32.40 lakh shares (fully fresh issue). The funds will support working capital, expansion of plant & machinery, and general corporate purposes. The IPO opens on October 10, 2025 and closes on October 14, 2025.

SK Minerals & Additives GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 0 | 120-127 |

| Last Updated: 14 Oct 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Basic Detail

SK Minerals & Additives Core Business & Overview

SK Minerals & Additives Limited (formerly Private Limited, now a Public Limited company). Headquartered in Khanna, Ludhiana, Punjab. The operations began (as a private entity) in 2010, though the company was incorporated as a public limited company more recently.

Business Model / What They Do: They manufacture, trade, and supply specialty chemicals, industrial minerals, and additives. Key product lines include food and feed additives (e.g. chelated minerals such as glycinates and EDTAs of Zinc, Copper, Magnesium), preservatives (e.g. Calcium Propionate), mineral mixtures, industrial/speciality chemicals, and they are also developing next-gen products (flame retardants, Omega-3, Vitamin D2) through an in-house R&D unit.

Facilities / Certification: They have DSIR-certified R&D at Khanna, Punjab. Also have ISO certifications in at least Quality Management (ISO 9001) and Food Safety (ISO 22000). Two manufacturing units are located in Punjab.

Strengths

From source material, here are at least three major strengths:

- Diversified Product & Industry Base

- They serve multiple sectors: food & bakery, animal feed, plywood, petroleum, and allied chemical industries. This reduces dependence on any one industry.

- In addition, they combine trading/import with in-house manufacturing, which gives more flexibility.

- In-house R&D & Product Innovation

- They have a DSIR-certified R&D facility. They are developing value-added / next-generation products (e.g. flame retardants, Vitamin D2, Omega-3) which could offer higher margins.

- Growing Financial Performance & Ambitious Growth Plans

- Revenue has been increasing (e.g. from ₹ 108–109 crores in FY24 to ₹ 211.67 crores for FY25 as provisional results) with PAT also improving.

- They have set a target of growing revenue to ₹ 500 crores by FY2027-28.

- Geographical Reach & Client Mix

- Pan-India presence in multiple states, which helps in reducing regional risks.

- Significant portion of revenues comes from government customers (over 35%), which tends to provide more stable orders.

Risks

Here are at least three risks or potential weaknesses, drawn from recent filings and external analysis:

- Regulatory / Compliance Risks

- Some sources note that certain product lines may have been manufactured without requisite Consent to Operate (CTO) or other environmental / regulatory approvals.

- Strict environmental, safety, and product standards (especially for food/feed additives) could increase compliance costs. If regulations tighten, there could be impact.

- Raw Material Price Volatility / Supply Chain Disruptions

- Specialty chemicals and industrial minerals depend heavily on raw materials whose prices may fluctuate, imports may be delayed, or trade policy may affect supply.

- Delays in import consignments have been mentioned as impacting revenue in past periods.

- Financial / Margin Pressures

- The margins are somewhat modest (operating margin in the past 4-5%) and are sensitive to product mix. If more trading vs manufacturing or lower-margin products dominate, profit margins could suffer.

- The company has some leverage; financial risk profile is described as modest. If they undertake large capex financed by debt, that could strain financials.

- Dependence on Key Sectors / Customer Segments

- While diversified, still sensitive to cyclical sectors like agriculture, construction, feed industry. Downturns in those could reduce demand.

- Operational Risks

- High Gross Current Assets / receivables days, which means cash tied up. In CRISIL rating, GCAs were ~160 days in fiscal 2024, which is fairly high.

- Execution risk in expansion: new capacity, development of new products, market acceptance etc.

Financial Performance Overview (₹ in Crore)

| Financial Year | Revenue | Profit | Assets |

| FY 2023 | 132.23 | 1.89 | 37.54 |

| FY 2024 | 108.77 | 3.09 | 54.05 |

| FY 2025 | 211.67 | 10.94 | 75.18 |

Revenue

- The company’s revenue grew 94.5% in FY 2025 compared to FY 2024 (₹211.67 cr vs ₹108.77 cr).

- However, FY 2024 saw a dip of 17.7% from FY 2023, mainly due to supply chain issues and import delays (as mentioned in CRISIL reports).

- The strong rebound in FY 2025 indicates demand recovery, better operational efficiency, and expansion of product lines.

Profit

- Profit jumped sharply to ₹10.94 crore in FY 2025, marking a 254% increase over FY 2024 (₹3.09 crore).

- Profitability improved despite earlier revenue fluctuations, showing better cost control and higher-margin product contribution.

- The net profit margin improved from 2.8% in FY 2024 to 5.2% in FY 2025, a strong indicator of enhanced operational efficiency.

Assets

- Assets rose steadily from ₹37.54 crore in FY 2023 to ₹75.18 crore in FY 2025 — a 100%+ increase in two years.

- This expansion reflects investment in R&D, plant capacity upgrades, and working capital buildup ahead of the planned IPO.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.