Shree Refrigerations IPO Overview

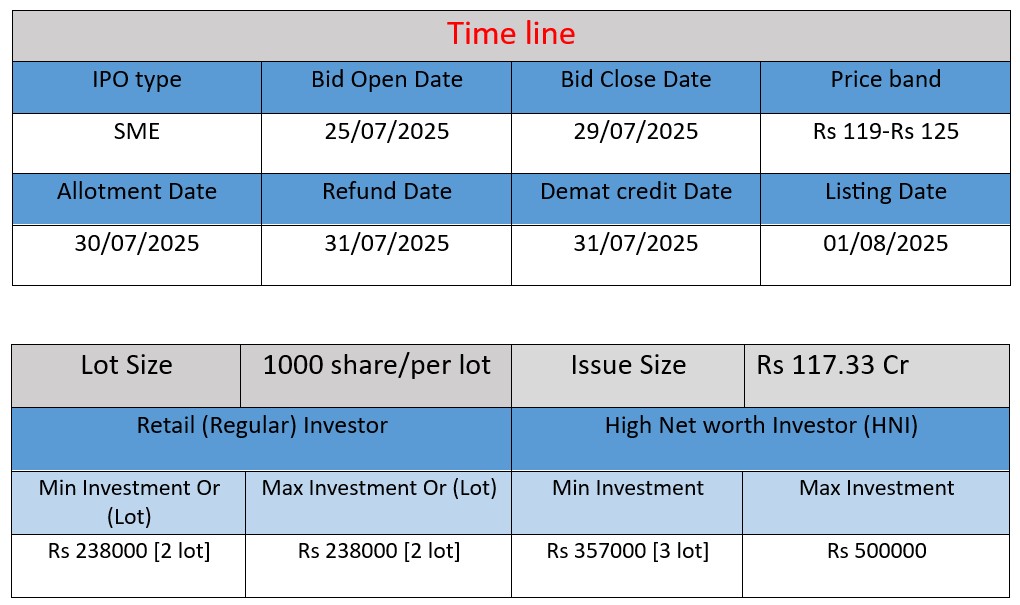

Shree Refrigerations Limited’s IPO opens on July 25, 2025 and closes on July 29, 2025. The offer comprises 9386000 equity shares (face value ₹2) totalling ₹117.33 Cr. Price band is ₹119–₹125 per share. Net proceeds are earmarked for working capital and general corporate purposes.

Shree Refrigerations IPO Subscription Status

| Category | Subscription (x) |

| QIBs | 152.13 |

| NIIs | 188.82 |

| Retails | 186.70 |

| Total | 117.92 |

| Last Updated: 29 July 2025 Time: 5 PM (Note: This data is updated every 2 hours) Source: NSE/BSE | |

| GMP (₹) | IPO Price (₹) |

| 85 | 125 |

| Last Updated: 29 July 2025 Time: 5 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

- Founded in 2006 and recently converted into a public limited company (December 2023), Shree Refrigerations operates from a modern facility in Karad, Maharashtra.

- Specializes in custom-designed HVAC and refrigeration systems, including:

- Marine chillers and air-conditioning systems (for warships and submarines)

- Industrial process chillers, test equipment, spray-dampening systems

- Electrical control panels and heavy fabrication services.

- Holds critical defense accreditations and is an approved supplier to the Indian Navy, registered under both the Directorate of Electrical Engineering and the Directorate of Quality Assurance – Warship Projects.

Strengths

- Niche focus on mission-critical defense applications

Deep sector expertise in defence-grade HVAC systems gives the company a high‑entry-barrier niche that few competitors serve. - Certifications & reputation for quality

ISO 9001:2015 certification, defense approvals, and innovation awards (e.g. GS Parkhe Award, Brig SB Ghorpade Award) highlight its quality credentials. - Strong order book and future visibility

At February–May 2025, backlog stood at ₹231–248 crore—nearly double FY 25 revenue—supporting consistent near-term visibility. - Undercapacity offers expansion potential

Capacity utilisation is modest in industrial chillers (~39%) and zero for air‑cooled marine chillers, providing headroom for scaling without large CapEx.

Potential Risks

- High client concentration

Over 83% of FY25 revenue came from marine chillers, and nearly 77% of business from government / Indian Navy orders, making the company vulnerable to contract delays or cancellation. - Liquidity and working capital stress

CARE notes extended operating cycles (net cash operating outflows for five straight years), working capital utilization of ~88%, and a cash balance of just ₹0.97 crore as on Mar 31, 2024. Execution delays may squeeze liquidity. - Modest scale and limited diversity

The company remains small relative to large-listed HVAC peers with revenue around ₹99 crore in FY25 and revenue scale still modest, as noted by CRISIL and Bloomberg. - Policy and tender dependence

Reliance on India’s defense budget and procurement policies: any policy shifts or reprioritization may significantly affect order flow and future revenues.

Financial Performance Table

| Financial Year | Revenue | Net Profit | Total Assets |

| FY 2023 | 50.38 | 2.57 | 94.32 |

| FY 2024 | 80.30 | 11.53 | 124.11 |

| FY 2025 | 98.73 | 13.55 | 185.59 |

Revenue

- FY 2023: ₹50.38 Cr

- FY 2024: ₹80.30 Cr (↑ 59.4% growth)

- FY 2025: ₹98.73 Cr (↑ 22.97% growth)

The company has shown strong and consistent revenue growth, especially between FY23 and FY24.

Net Profit

- FY 2023: ₹2.57 Cr

- FY 2024: ₹11.53 Cr (↑ 348.64% growth)

- FY 2025: ₹13.55 Cr (↑ 17.5% growth)

Profit saw a massive jump in FY24, indicating strong operational efficiency and profitability improvements.

Total Assets

- FY 2023: ₹94.32 Cr

- FY 2024: ₹124.11 Cr (↑ 31.55% growth)

- FY 2025: ₹185.59 Cr (↑ 49.56% growth)

The asset base has expanded significantly, showing that the company is investing for future growth and scalability.

| ✅ Pros of Shree Refrigerations IPO |

| The company operates in a niche segment of defense-grade refrigeration systems with limited competition. It has strong institutional clients like the Indian Navy and Defence Ministry ensuring reliable orders. Revenue and profit have grown significantly between FY23 and FY25. The company maintains healthy profit margins, indicating operational efficiency. Its debt-to-equity ratio is low, reflecting financial stability. A strong order book of over ₹231 crore provides revenue visibility. The leadership team is experienced and recognized for innovation. There is ample scope for future growth due to underutilized capacity. |

| ⚠️ Cons of Shree Refrigerations IPO |

| A large portion of revenue comes from a few government clients, creating high dependence. The business is working capital intensive, which can cause liquidity strain. The company is relatively small in scale and lacks global presence. It depends heavily on government policies and defense budgets. The IPO includes an Offer-for-Sale, indicating partial promoter exit. It has limited brand visibility among retail investors. It became a public limited company only recently, lacking a long public track record. |

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.