Shlokka Dyes IPO Overview

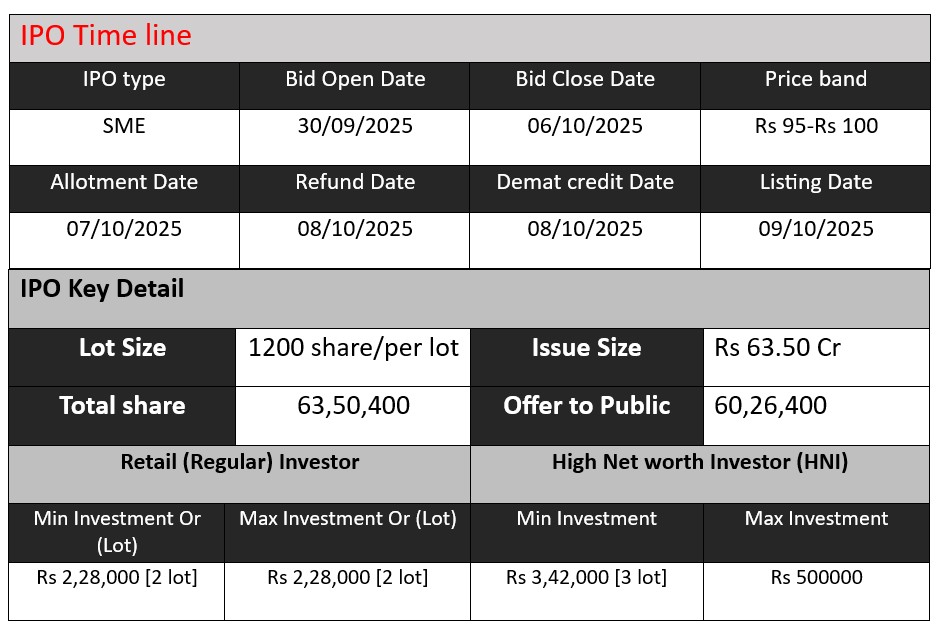

Shlokka Dyes Limited IPO opens on September 30, 2025, and closes on October 9, 2025, offering investors an opportunity in the fast-growing synthetic dyes sector. The issue size is ₹63.5 lakh with a total of 6,35,0400 shares. Proceeds will be used for business expansion, setting up new production facilities, and working capital. Don’t miss this chance to invest in a company showing strong revenue and profit growth.

Shlokka Dyes GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 0 | 95-100 |

| Last Updated: 7 Oct 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Basic Detail

Shlokka Dyes Core Business & Overview

Shlokka Dyes Limited is a Gujarat-based company specializing in the manufacture of synthetic dyes, including reactive and other specialty dyes. Established as a private company in July 2021, it transitioned to a public limited company in 2024. The company operates an ISO-certified facility located in Saykha, Bharuch, Gujarat, with an annual production capacity of 9,000 metric tons.

Core Operations

Shlokka Dyes Limited focuses on producing a diverse range of synthetic dyes used across various industries, including textiles, leather, paper, and paints. The company’s product portfolio encompasses reactive dyes, acid dyes, direct dyes, and pigments, catering to both domestic and international markets. With an in-house quality control lab, Shlokka Dyes ensures stringent quality standards and customized solutions for its clients.

Strengths

- Robust Financial Performance: The company has demonstrated significant growth, with revenue increasing from ₹8.77 crore in FY 2023 to ₹103.21 crore in FY 2025, marking a 3-year CAGR of 243%. Net profit also saw a substantial rise from ₹0.60 crore to ₹10.01 crore during the same period.

- Experienced Management: Led by promoters Vaibhav Shah and Shivani Rajpurohit, the company benefits from experienced leadership, contributing to its strategic direction and operational efficiency.

- International Market Reach: Shlokka Dyes has a growing export footprint, with shipments to countries like Uzbekistan, indicating its expanding global presence.

Risks

- Regulatory Compliance: Operating in the chemical manufacturing sector, Shlokka Dyes must adhere to stringent environmental and safety regulations. Non-compliance could lead to legal challenges and reputational damage.

- Market Competition: The synthetic dye industry is highly competitive, with numerous players offering similar products. Shlokka Dyes must continuously innovate and maintain quality to sustain its market position.

- Supply Chain Dependencies: The company’s reliance on imports for certain raw materials exposes it to supply chain disruptions and fluctuations in international trade dynamics

Financial Performance Overview (₹ in Crore)

| Financial Metric | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 8.77 | 61.27 | 103.21 |

| Profit | 0.60 | 4.92 | 10.01 |

| Assets | 38.77 | 67.19 | 91.58 |

Revenue:

- The company’s revenue has grown significantly from ₹8.77 crore in FY 2023 to ₹103.21 crore in FY 2025, reflecting a CAGR of 243% over 3 years.

- This rapid growth indicates strong market demand for its synthetic dyes and effective business expansion strategies.

Profit:

- Net profit increased from ₹0.60 crore in FY 2023 to ₹10.01 crore in FY 2025, showing a substantial improvement in profitability.

- The profit margin has improved as the company scales operations, suggesting better operational efficiency and cost management.

Assets:

- Total assets grew from ₹38.77 crore in FY 2023 to ₹91.58 crore in FY 2025, indicating ongoing investment in capacity expansion, machinery, and infrastructure.

- The increase in assets aligns with revenue growth, supporting larger production and future business scaling.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.