Sharvaya Metals IPO Overview

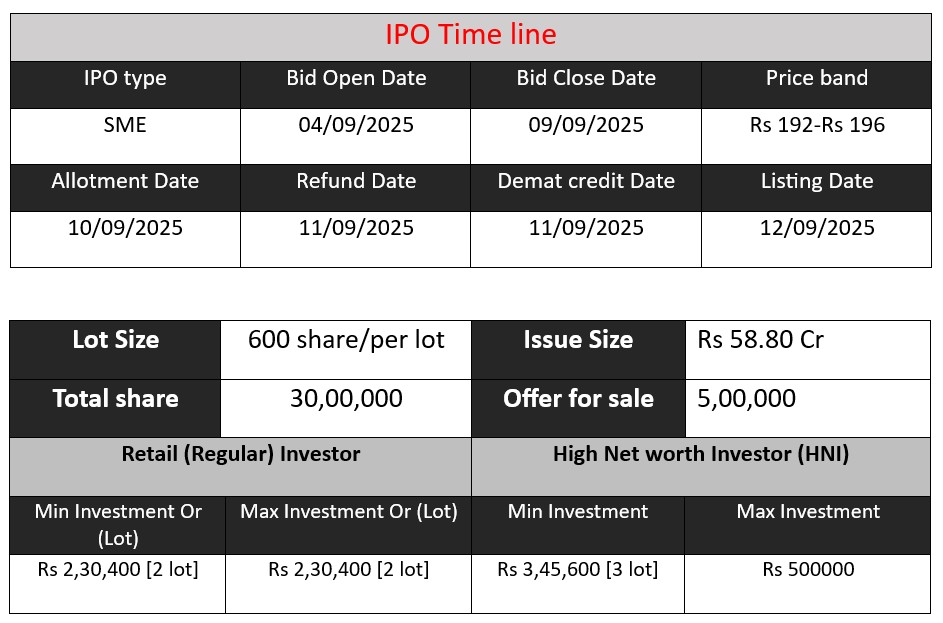

Sharvaya Metals Limited’s SME IPO opens on 4 September 2025 and closes on 9 September 2025, offering 3,000,000 equity shares (₹58.80 crore) via a mix of fresh issue (₹46.06 crore) and offer-for-sale (₹9.80 crore). Priced between ₹192–₹196 per share, proceeds will fund working capital, plant & machinery , civil construction & electrification , and general corporate purposes. Listing is proposed on BSE-SME.

Sharvaya Metals Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 0.90 |

| NIIs | 2.93 |

| Retails | 4.35 |

| Total | 2.04 |

| Last Updated: 08 Sep 2025- 6 PM Source: NSE/BSE | |

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 2.5 | 192-196 |

| Last Updated: 10 Sep 2025- 6 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Sharvaya Metals Core Business & Overview

Sharvaya Metals Limited is an integrated manufacturer and supplier of high-precision aluminium products. Incorporated in 2014 (converted to a public limited company in February 2024), it commenced manufacturing operations in 2017 from a facility located in Ahmednagar (Bhalwani), Maharashtra.

The company produces a wide range of aluminium offerings including alloyed ingots, billets, slabs, sheets, circles, extrusion dies, and electric-vehicle (EV) battery housings. Its clients span diverse sectors such as automotive, EVs, defense, aviation, consumer appliances, cookware, LED lighting, construction, and extrusions—serving both domestic and international markets.

Strengths

- Fully Integrated & Modern Manufacturing Facility

The company operates a self-sufficient, strategically located plant equipped with PLC-controlled furnaces, rolling mills, cutting systems, quality control labs, and R&D capabilities—ensuring high operational control and adaptability. - Diverse and Value-Added Product Portfolio

Sharvaya Metals offers a broad spectrum of aluminium products and is expanding into high-growth segments like EV battery housings. This positions them as a one-stop solution, particularly attractive to OEMs and tier-1 suppliers. - Quality Certification & Process Control

The company holds an ISO 9001:2015 certification and adheres to stringent quality processes—offering reliability and consistency in its products. - Strategic Location for Logistics Efficiency

Situated near Mumbai Port, the facility benefits from reduced logistics costs and proximity to key OEM customers, enhancing agility and responsiveness.

Risks

- Raw Material Supply Instability

The absence of long-term supplier contracts may lead to challenges in procuring consistent, cost-effective raw materials, which could erode margins or disrupt operations. - Commodity Price Volatility

Reliance on aluminium exposes the company to fluctuations in global raw material prices, which could adversely impact profitability if not passed on effectively. - Logistics & Infrastructure Dependence

Any disruption in transportation or logistical networks may impair raw material delivery or finished goods distribution, increasing costs or delaying operations. - Concentration Risks

– The company depends heavily on a few major customers: as of September 2024, one top customer contributed over 63% of revenue.

– Raw material sourcing is concentrated—especially from the Middle East (around 40% of purchases)—making operations vulnerable to geopolitical or regional disruptions. - Financial Strains: Inventory and Leverage

– High inventory levels (2.9 months of sales as of H1 FY 25) can strain cash flows if demand softens.

– The company’s debt remains notable—D/E around 1.38×—which, while improving, remains elevated for an SME in the metals sector. - Regional Concentration

With all manufacturing centered in one location in Maharashtra, any localized disruption—natural disaster, political, or regulatory—could severely impact operations. - Liquidity and SME Listing Risks

As a small-cap SME IPO, post-listing liquidity may be limited, and share price could experience volatility. Early profitability surges, such as those seen recently, might stem from temporary cost advantages (like reduced material expense) and may not sustain

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2022 | 40.8 | 0.39 | 24.6 |

| FY 2023 | 70.15 | 1.95 | 29.23 |

| FY 2024 | 71.15 | 1.80 | 29.55 |

Revenue

- FY 2022: ₹40.8 Cr → FY 2023: ₹70.15 Cr (strong growth of ~72%).

- FY 2024: ₹71.15 Cr (only ~1% growth vs FY 2023).

Company achieved rapid expansion initially but later faced stagnation in sales.

Profit

- Profit rose sharply from ₹0.39 Cr (FY 2022) to ₹1.95 Cr (FY 2023), showing operational efficiency.

- However, in FY 2024 profit declined slightly to ₹1.80 Cr, despite stable revenue.

Indicates possible increase in costs or reduced margins.

Total Assets

- Assets grew consistently: ₹24.6 Cr (FY 2022) → ₹29.55 Cr (FY 2024).

- The growth pace slowed after FY 2023, suggesting limited new investments or cautious expansion.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.