Shanti Gold International IPO Overview

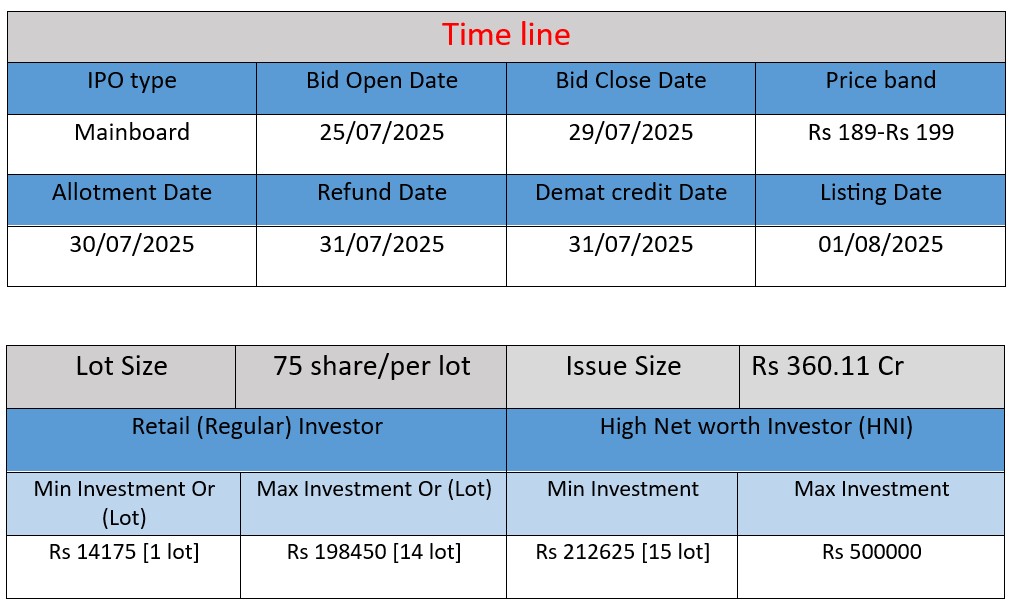

Shanti Gold International Ltd IPO opens on July 25 and closes on July 29, 2025. The issue size is ₹360 crore through a fresh issue of 18.09 lakh shares. The price band is ₹189–₹199 per share. The IPO aims to fund working capital, expand operations, and meet general corporate purposes. With strong financial growth and pan-India presence, the company offers CZ-studded gold jewellery to B2B clients across India and abroad.

Shanti Gold International IPO Subscription Status

| Subscription Rate Source: NSE/BSE | |||

| Category | Shares Offered | Shares Bid For | Subscription (x) |

| QIBs | 36,19,200 | 42,46,33,800 | 117.33 |

| NIIs | 27,14,400 | 41,03,59,875 | 151.18 |

| Retails | 63,33,600 | 18,85,53,000 | 29.77 |

| Employees | – | – | – |

| Shareholders | – | – | – |

| Total | 1,26,67,200 | 1,02,35,46,675 | 80.80 |

| Last Updated: 29 July 2025 Time 5 PM (Note: This data is updated every 2 hours) Get instant updates on WhatsApp – Join now! | |||

| GMP (₹) | IPO Price (₹) |

| 37 | 199 |

| Last Updated: 29 July 2025 Time 5 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

- Founded in 2003 by Pankaj Kumar Jagawat and Manoj Kumar Jain in Mumbai. Primarily a B2B manufacturer of 22k CZ-studded gold jewellery including rings, bangles, necklaces, sets, etc. Skilled artisans handle complex tasks like stone‑setting; all production is largely in‑house with rapid turnaround. Annual manufacturing capacity is about 2,700 kg.

- Operations span offices in Mumbai, Hyderabad, Indore, Gujarat, Tamil Nadu; global export footprint includes UAE, Singapore, Qatar and the USA.

Strengths

Strong Operational Capabilities

Efficient in‑house manufacturing, BIS hallmark assay, and a two‑week supply cycle from design to delivery support quick fulfillment for large retail clients.

Leadership & Market Position

Promoters with over two decades of jewelry industry experience. Well‑established presence in multiple states across India and expanding export reach to numerous international markets.

Potential Risks

Leasehold Properties

The company operates from leased facilities (manufacturing plant, corporate office, showroom branches). Loss or non-renewal of leases could disrupt operations and hurt cash flows.

Compliance & Governance Issues

Instances of delayed compliance with corporate governance requirements, with suo moto applications filed with the Registrar of Companies. Any future lapses may attract regulatory scrutiny or fines.

Financial Liabilities & Borrowings

- The company has availed unsecured borrowings repayable on demand, and promoters have given personal guarantees. Adverse outcomes or guarantee revocations could impact its financial health.

- Additionally, there are contingent liabilities and pending legal proceedings that may pose risk if outcomes are unfavorable.

Industry and Operational Risks

- The business is seasonal and customer/demand-driven, typical of jewellery retail cycles.

- It faces competition in a highly fragmented gold-jewellery sector.

- It must regularly secure regulatory approvals and comply with environmental, labour, health & safety requirements—non-compliance could disrupt operations.

Financial Performance Table

| Financial Year | Revenue (₹ Crore) | Net Profit (₹ Crore) | Total Assets (₹ Crore) |

| FY 2023 | 679.40 | 19.82 | 256.88 |

| FY 2024 | 711.43 | 26.87 | 325.40 |

| FY 2025 | 1106.41 | 55.84 | 419.83 |

Revenue

- FY 2023: ₹679.4 crore

- FY 2024: ₹711.43 crore (▲ approx. 4.7%)

- FY 2025: ₹1106.41 crore (▲ approx. 55.5%)

The revenue saw a major jump in FY 2025, indicating strong business expansion, increased demand, and higher order volumes.

Net Profit

- FY 2023: ₹19.82 crore

- FY 2024: ₹26.87 crore (▲ approx. 35.6%)

- FY 2025: ₹55.84 crore (▲ approx. 108%)

The profit more than doubled in FY 2025, reflecting better operating margins, efficiency in production, and cost control.

Total Assets

- FY 2023: ₹256.88 crore

- FY 2024: ₹325.40 crore (▲ approx. 26.7%)

- FY 2025: ₹419.83 crore (▲ approx. 29%)

The consistent growth in total assets shows financial stability and the company’s investment in business expansion.

| ✅ Pros of Shanti Gold International Ltd IPO |

| Strong revenue and profit growth over the last three years. Well-established B2B model with a large and growing customer base. Fast turnaround time with in-house design and manufacturing. Presence in major Indian cities and export to countries like UAE, USA, Singapore, and Qatar. BIS-certified production and focus on CZ-studded gold jewellery – a niche and high-demand segment. Promoters with over 20 years of industry experience. Funds raised will be used for working capital and expansion, which may further boost growth. |

| ⚠️ Cons of Shanti Gold International Ltd IPO |

| Operates from leased facilities – any non-renewal may affect operations. Faces tough competition in the highly fragmented jewellery industry. Seasonal business – demand can fluctuate based on festivals and market sentiment. Instances of past delays in corporate compliance. High dependency on promoter guarantees and unsecured borrowings. Legal and regulatory risks with ongoing proceedings or contingent liabilities. Vulnerable to gold price fluctuations and import policy changes. |

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.