Savi infra & logistics IPO overview

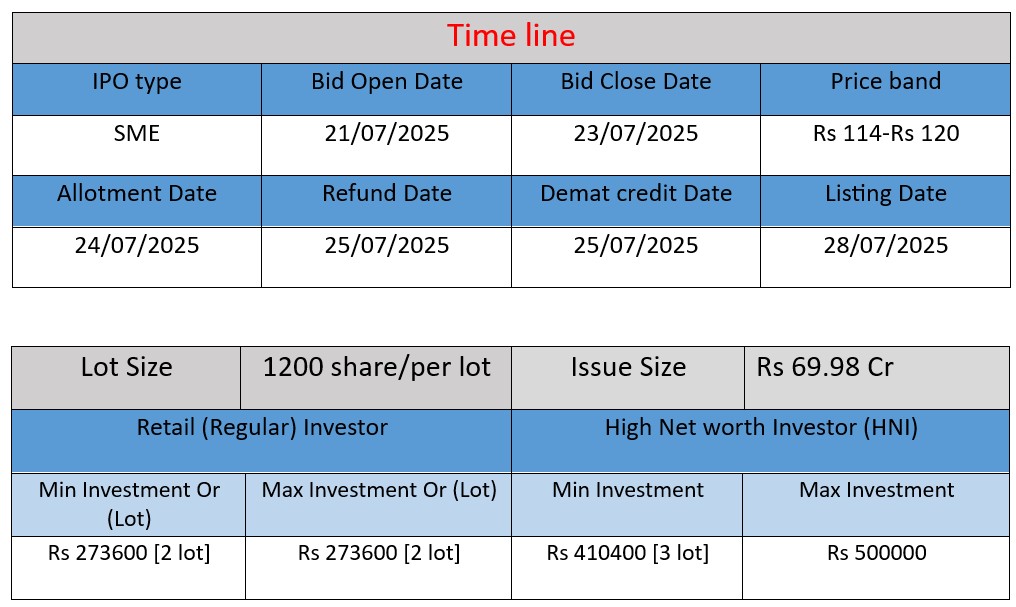

Savy Infra & Logistics IPO opens on July 21 and closes on July 23, 2025. The ₹69.98 Cr issue offers 58.32 lakh fresh shares (₹114–120 each), with 19.39 lakh reserved for retail investors. NSE Emerge listing on July 28. Funds to be used for working capital and corporate needs.

Savi infra & logistics IPO Subscription status

| Category | Subscription (x) |

| QIBs | 54.92x |

| NIIs | 131.89x |

| Retails | 58.69x |

| Total | 68.14x |

| Last Updated: 23 July 2025 Time: 7 PM (Note: This data is updated every 2 hours) Source : NSE/BSE | |

IPO Key date

Core Business & Overview :

EPC and Earthwork Services

Savy Infra & Logistics Limited (originally incorporated in 2006) delivers end‑to‑end EPC services—engineering, procurement, construction—deeply focused on earthwork and foundation preparation for infrastructure projects, including road construction, embankments, sub‑grade preparation, grading, drainage, blasting and excavation. They also offer demolition solutions and removal of debris as part of site preparation.

Logistics (Full Truck Load Model)

Using an asset-light model, the company provides specialized FTL transportation services across infrastructure, steel, and mining sectors. Trucks and drivers are typically rented and managed by Savy Infra, enabling scalability and cost-control.

Geographic Reach & Scale

Operations span multiple states—Gujarat, Maharashtra, Andhra Pradesh, Telangana, Madhya Pradesh, Chhattisgarh, Karnataka and Odisha. As of FY25, they handled over 15 lakh cu m of earthwork and logistics of 4.5 lakh+ tons using 250+ trucks (150+ EVs) and a workforce of ~550.

Strengths :

Integrated EPC + Logistics Model

The vertically integrated model allows seamless coordination—from excavation to transportation—improving project efficiency and cost effectiveness.

Asset-Light Logistics Approach

By renting trucks rather than owning, Savy Infra keeps capital expenditure low and maintains flexibility as demand fluctuates.

Strategic Push into Green Logistics

The company is deploying EV trucks (150+ recently added, plans for total 250+), enabling reduced fuel dependency and potential carbon credits.

Strong Management & Order Book

Promoted by industry veterans like Tilak Mundhra, the company maintains a growing order book (~₹240 crore) and has projects in execution across states.

Potential Risks

Dependence on a Single Segment (EPC Services)

Roughly 80% of FY25 revenues came from EPC earthwork contracts; a slowdown in infrastructure activity may hit margins.

Geographic Concentration

Majority of operations are clustered in West and South zones—Maharashtra alone contributed ~60% of revenue—which exposes the company to regional policy and regulatory changes.

Limited Customer Base & Supply-Chain Relationships

Revenues depend heavily on a few large clients in infrastructure, steel, mining sectors. No long-term contracts with clients or suppliers, which raises execution risk.

SME Platform Listing Constraints

The IPO is on the NSE Emerge SME platform, which tends to offer lower liquidity and limited analyst coverage compared to mainboard-listed peers.

Outcome:

Savy Infra & Logistics Limited presents a compelling profile as an integrated EPC and logistics player in India’s booming infrastructure space. Its asset-light model, strong profitability metrics, rapid scaling, and green logistics initiative with EV deployment provide a competitive edge.

However, the company also carries meaningful risks: high dependence on EPC revenue, regional concentration, limited client diversification, and restricted liquidity as an SME-listed entity. Investors and stakeholders should weigh these strengths against the sector and internal risks before engagement.

Savy infra & logistics Financial Performance (in ₹ Crore)

| Financial Year | Revenue | Profit | Total Assets |

| FY 2023 | ₹6.19 | ₹0.34 | ₹10.10 |

| FY 2024 | ₹101.59 | ₹9.87 | ₹41.70 |

| FY 2025 | ₹283.39 | ₹23.88 | ₹185.81 |

Revenue

- FY 2023 to FY 2024: Jumped from ₹6.19 Cr to ₹101.59 Cr (over 1,540% growth), driven by expanded EPC projects and logistics operations.

- FY 2024 to FY 2025: Grew further to ₹283.39 Cr (179% increase), indicating continued order wins and execution strength.

Overall: The company has scaled rapidly over three years, showing strong market demand and execution capabilities.

Profit

- FY 2023 to FY 2024: Profit rose from ₹0.34 Cr to ₹9.87 Cr, showing a 2,800%+ increase, reflecting higher operating efficiency.

- FY 2024 to FY 2025: Profit more than doubled to ₹23.88 Cr (142% growth), maintaining profitability despite higher scale.

Overall: Margins improved consistently, indicating cost control and favorable pricing power.

Total Assets

- FY 2023 to FY 2024: Assets grew from ₹10.1 Cr to ₹41.7 Cr (313% increase) due to investment in operations and fleet.

- FY 2024 to FY 2025: Assets surged to ₹185.81 Cr (345% growth), showing aggressive expansion and capital infusion.

Overall: Rapid asset buildup supports future scalability but also requires monitoring for capital efficiency.

Summary

- Savy Infra has shown explosive financial growth across revenue, profit, and assets over three years.

- The company’s strategic expansion in EPC and logistics is driving this performance.

- However, such fast growth also requires robust risk management and capital utilization to maintain momentum and profitability.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.