Sattva Engineering IPO Overview

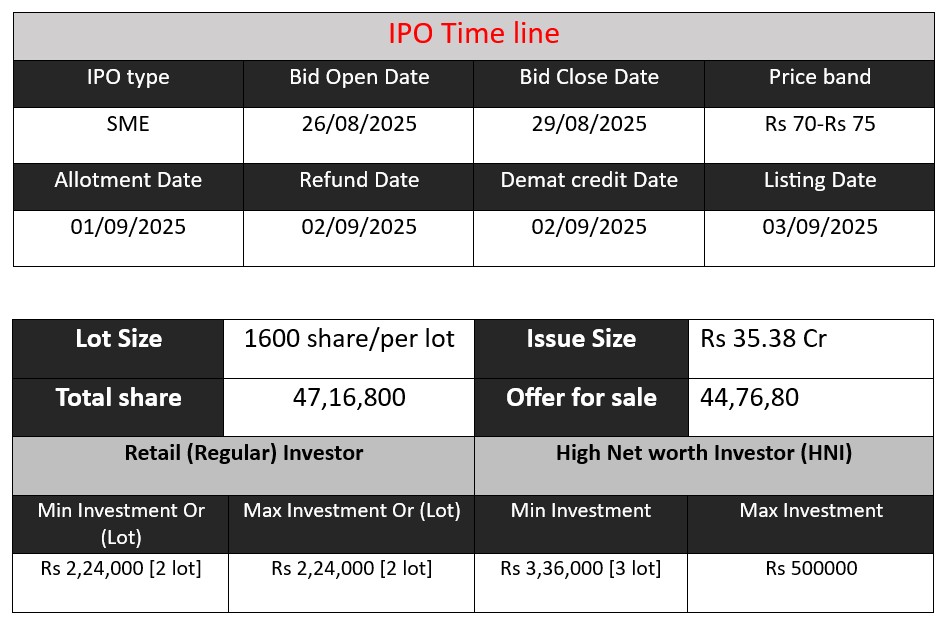

Sattva Engineering Construction Ltd. IPO opens on August 26, 2025, and closes on August 29, 2025. The issue size is ₹35.38 crore, offering 47,16,800 equity shares with a face value of ₹10 each. The price band is ₹70–₹75 per share. The listing is scheduled for September 3, 2025, on the NSE Emerge platform.

Sattva Engineering Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 96.63 |

| NIIs | 312.90 |

| Retails | 143.85 |

| Total | 153.85 |

| Last Updated: 29 Aug 2025- 6 PM Source: NSE/BSE | |

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 26 | 70-75 |

| Last Updated: 29 Aug 2025- 6 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

Sattva Engineering Construction Limited (formerly Sattva Engineering Construction Private Limited) is an ISO-certified engineering, procurement, and construction (EPC) company headquartered in Chennai, Tamil Nadu. Established in 2005, the company specializes in delivering comprehensive infrastructure solutions, particularly in the water and wastewater sectors

Sattva Engineering focuses on the construction of:

- Water and sewerage treatment plants

- Overhead and underground tanks

- Intake and pump house buildings

- Warehouses and container freight stations

- Factory buildings and commercial structures

The company has executed projects for esteemed clients such as the Tamil Nadu State Public Works Department (PWD), Chennai Metropolitan Water Supply and Sewerage Board (CMWSSB), IIT Chennai, and various other public sector entities .

Strengths

- Robust Execution Capabilities: Sattva boasts an in-house team of 39 professionals skilled in engineering, design, and project execution. This team is complemented by consultants when necessary, ensuring efficient project delivery .

- Advanced Technological Integration: The company employs technologies like SCADA and SAP to enhance operational efficiency, quality control, and real-time project monitoring .

- Diverse and Established Order Book: With over 50 completed projects and a strong ongoing order book, Sattva demonstrates operational reliability and a consistent track record in project execution .

Risks

- Project Execution Challenges: The company faces risks related to timely project completion, which can be influenced by factors such as equipment availability, raw material procurement, labor issues, and adverse weather conditions .

- Financial Liquidity Concerns: Despite a satisfactory current ratio, Sattva’s liquidity is considered stretched due to high inventory levels and substantial receivables. This situation is exacerbated by the utilization of working capital limits and limited cash reserves .

- Profitability Volatility: The company’s profitability margins are susceptible to fluctuations in raw material prices, which can impact overall financial performance .

Financial Performance Overview (₹ in Crore)

| Financial Year | Revenue | Profit | Assets |

| FY 2023 | 83.64 | 1.04 | 83.37 |

| FY 2024 | 76.93 | 4.56 | 87.48 |

| FY 2025 | 93.65 | 9.14 | 114.82 |

Revenue:

- FY 2023: ₹83.64 Cr

- FY 2024: ₹76.93 Cr (decrease due to possible lower project execution or market slowdown)

- FY 2025: ₹93.65 Cr (strong growth indicating improved project inflow and execution efficiency)

Profit:

- FY 2023: ₹1.04 Cr

- FY 2024: ₹4.56 Cr (significant increase despite lower revenue, suggesting better cost management or higher margin projects)

- FY 2025: ₹9.14 Cr (more than double previous year’s profit, reflecting robust operationalperformance and scalability)

Assets:

- FY 2023: ₹83.37 Cr

- FY 2024: ₹87.48 Cr (gradual growth, indicating investments in fixed assets or working capital)

- FY 2025: ₹114.82 Cr (sharp rise, possibly due to acquisition of new equipment, land, or expansion projects)

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.