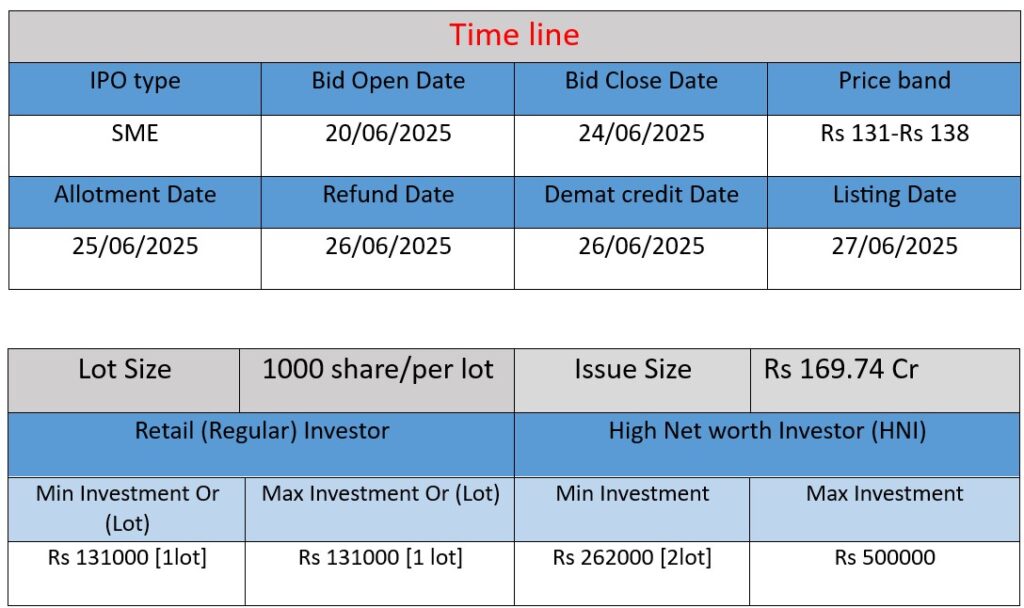

Safe Enterprises Retail Fixtures Ltd IPO opens on June 20 with an issue size of ₹169.74 crore. The SME IPO aims to fund a new manufacturing unit, meet working capital needs, and support subsidiary growth. Known for custom retail fixtures, the company brings over 40 years of experience and 42,000+ completed projects across India and the Middle East. IPO closes June 24, 2025.

Overview & Work

Foundation & Evolution

- Originally established in 1976 as a hardware trading firm, the company evolved by 1991 into India’s pioneering organized shop‑fittings manufacturer .

- In July 2024, it was restructured into a limited company (Safe Enterprises Retail Fixtures Ltd) in preparation for its upcoming SME IPO.

Core Business

- Engages in the design, manufacture, supply, and installation of both bespoke and modular shop fittings and retail fixtures across sectors like fashion, electronics, and large-format stores.

- Operates multiple factories and showrooms across India and the Middle East, with a manufacturing footprint of over 180,000 sq ft and employing more than 500 staff .

Clientele & Reach

- Serviced more than 42,000 projects, covering approximately 30 million sq ft of retail installations.

- High‑profile clients include Future Group, Tata Trent, Landmark, Himalaya Book World, and Sweet Dreams.

Strengths

- Deep Domain Expertise

- Pioneers in modular and electrified fixtures, with over 5,000 hours of R&D and 3,000 components developed under their INSYNC brand.

- Strong Execution Track Record

- Successfully delivered standardized and customized retail environments at scale, praised by clients for flexibility and timely delivery.

- Robust IPO Pipeline

- Launching a ₹169.74.13 cr SME IPO (June 20–24, 2025), aimed at expansion through new manufacturing units and bolstering subsidiary operations.

Risks & Challenges

- SME Listing Uncertainties

- As an SME platform stock, success depends on appetite in the SME IPO market; only about one-third of SME IPOs in 2025 have yielded gains.

- Competitive Landscape

- Faces competition from both unorganized and organized shop‑fitting firms; maintaining differentiation through innovation remains critical.

- Execution & Scale-up Risks

- Plans include setting up new production units and scaling subsidiary operations—cost overruns or delays could impact financials and investor sentiment.

- Dependence on Retail Sector

- Retail industry cycles and capex fluctuations can affect demand for fixtures; macro or sectoral downturns pose business risk.

Safe Enterprises Retail Fixtures is a deep-rooted player in India’s retail‑fitouts landscape, combining legacy experience with modern, R&D-backed solutions and a solid execution record. Its upcoming IPO is a pivotal growth step—but SME stock volatility, execution risks, and retail sector ties warrant close watch.

Here is a brief financial performance analysis across FY2022 to FY2024:

Revenue Growth

- FY2022 to FY2023: Revenue nearly doubled from ₹38.63 Cr to ₹77.21 Cr, indicating strong client acquisition and expansion.

- FY2023 to FY2024: Further increased to ₹100.91 Cr, reflecting sustained demand and scaling of operations.

Analysis: Over 2.6× growth in revenue within two years shows Safe Enterprises is rapidly gaining market traction in the retail fixtures segment.

Profit Growth

- FY2022 to FY2023: Profit jumped from ₹1.25 Cr to ₹12.09 Cr — nearly 9.7× growth.

- FY2023 to FY2024: Profit almost doubled again to ₹23.09 Cr.

Analysis: Profitability is improving faster than revenue, indicating stronger margins and better cost control.

Total Assets

- FY2022 to FY2023: Assets rose from ₹20.50 Cr to ₹39.39 Cr — nearly double.

- FY2023 to FY2024: Increased further to ₹54.40 Cr, showing capital investment and infrastructure expansion.

Analysis: Asset growth aligns with the company’s IPO plan and scale-up strategy.

Summary

- Consistent high growth in revenue, profit, and assets across three years.

- Indicates solid financial management and readiness for IPO.

- Attractive financials for investors looking at SME growth stories.