Rubicon Research IPO Overview

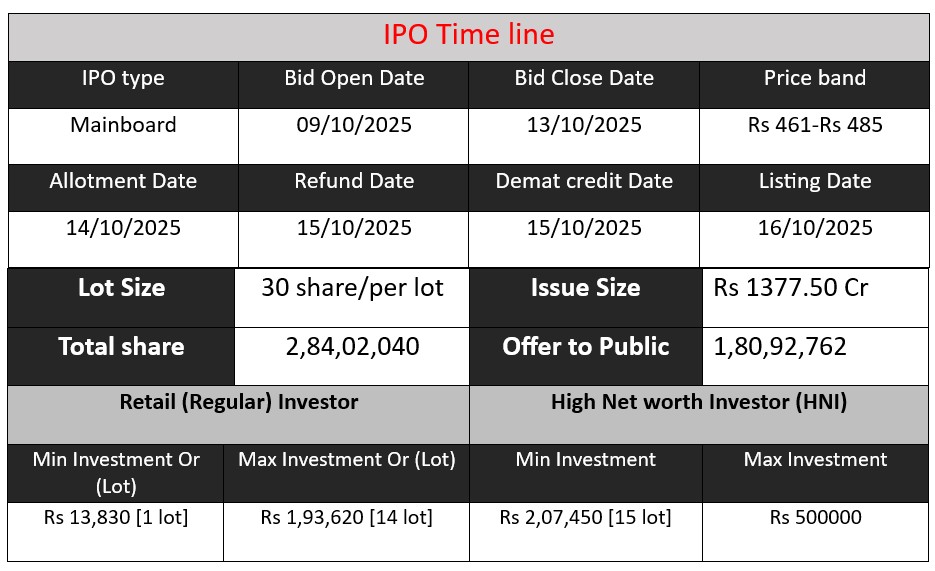

Rubicon Research IPO opens on October 9, 2025, and closes on October 13, 2025, with a total issue size of ₹1,377.50 crore. The IPO includes ₹500 crore fresh issue and ₹877.50 crore offer for sale. Funds will be used for debt reduction, inorganic growth, and strategic investments. Don’t miss key investment details of this fast-growing pharma company.

Rubicon Research GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 127 | 461-485 |

| Last Updated: 14 Oct 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Basic Detail

Rubicon Research Core Business & Overview

Rubicon Research Limited is an Indian pharmaceutical company specializing in the development, manufacturing, and marketing of specialty formulations and drug-device combination products, primarily targeting regulated markets like the United States. Established in 1999, the company has evolved from a contract research organization to a vertically integrated player with a strong focus on innovation and compliance.

Overview

- Headquarters: Thane, Maharashtra, India

- Global Presence: R&D centers in Thane (India) and Concord (Canada); manufacturing facilities in Ambernath and Satara (India)

- Regulatory Approvals: US FDA, WHO-GMP, MHRA (UK), TGA (Australia), among others

- Employees: Approximately 200 as of 2010

Work & Capabilities

Rubicon Research operates through three tightly linked verticals:

- Formulation Development: Specializing in oral solids, liquids, injectables, ophthalmic, nasal, and topical dosage forms.

- Contract Manufacturing: Providing services for generic and specialty products.

- Regulatory Affairs & Dossier Development: Expertise in ANDA/CTD filings for global markets.

The company is recognized for its strong research and development capabilities, with a data-driven product selection framework and a robust sales and distribution network in the U.S.

Strengths

- Rapid Growth: Achieved a 75.89% CAGR in revenue from FY2023 to FY2025, with revenue tripling from INR 393.52 crore to INR 1,284.27 crore

- Vertically Integrated Model: Combines formulation development, manufacturing, and regulatory expertise, enabling better control over quality and timelines

- Regulatory Compliance: Holds multiple global certifications, ensuring access to regulated markets

- Experienced Management: Led by a team with deep industry knowledge and a track record of successful partnerships

Risks

- Geographic Concentration: Over 98% of revenue is derived from the U.S. market, making the company vulnerable to regulatory changes and pricing pressures

- Customer Dependency: Top five customers contribute over 71% of revenues, posing risks if relationships are disrupted

- Regulatory and Manufacturing Challenges: The complex and highly regulated nature of pharmaceutical manufacturing means that any issues with product recalls, inspection failures, or facility shortcomings could impact business operations

Financial Performance Overview (₹ in Crore)

| Financials | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 393.52 | 853.89 | 1284.27 |

| Profit | -16.89 | 91.01 | 134.36 |

| Assets | 749.7 | 1109.49 | 1451.43 |

Revenue

- Revenue increased from ₹393.52 crore in FY 2023 to ₹1,284.27 crore in FY 2025.

- This represents a Compound Annual Growth Rate (CAGR) of 75.89%, indicating rapid business expansion and strong demandfor the company’s products, particularly in regulated markets like the U.S.

Profit

- FY 2023 showed a loss of ₹16.89 crore, but FY 2024 turned profitable at ₹91.01 crore, and FY 2025 profit further increased to ₹134.36 crore.

- The sharp turnaround from loss to profit demonstrates effective cost management, scaling of operations, and successful product launches.

Asset

- Total assets grew from ₹749.7 crore (FY 2023) to ₹1,451.43 crore (FY 2025), almost doubling in two years.

- This reflects expansion in production capacity, R&D investments, and possibly acquisitions, strengthening the company’s balance sheet.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.