Prime Cables Industries IPO Overview

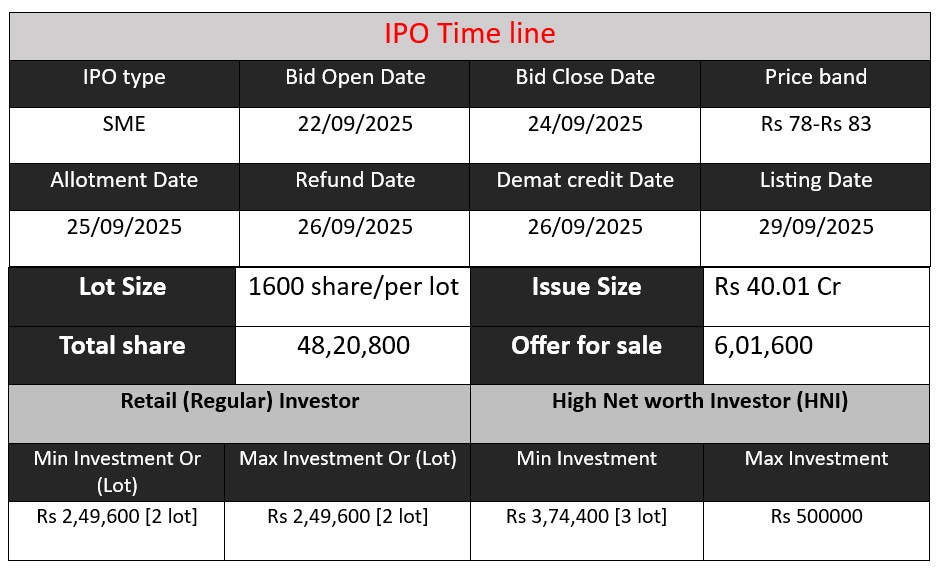

Prime Cable Industries Ltd. is launching its IPO from September 22 to September 24, 2025, with a price band of ₹78–₹83 per share. The issue size is ₹40.01 crore, comprising 4,820,800 shares, including a fresh issue of 4,219,200 shares. The minimum investment is ₹1,32,800 for 1,600 shares. The IPO will be listed on the NSE-SME platform on September 29, 2025. Proceeds will fund a new factory, debt repayment, working capital, and general corporate purposes.

Prime Cables Industries GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 6 | 78-83 |

| Last Updated: 23 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Prime cables industries Core Business & Overview

Prime Cable Industries Limited is an ISO and BIS-certified Indian manufacturer specializing in a diverse range of cables and conductors. Established in 2008, the company operates manufacturing facilities in Narela, Delhi, and Alwar, Rajasthan, producing products under the brands “PRIMECAB” and “RENUFO”.

Core Operations

Prime Cable Industries manufactures low-voltage (up to 1.1 kV) control cables, power cables, aerial bunch cables, instrumentation cables, housing/building wires, and conductors. These products cater to sectors such as power generation, transmission and distribution, electricity boards, thermal power plants, oil and gas, railways, steel plants, and port trusts.

Strengths

- Robust Financial Growth: The company has demonstrated significant financial growth, with revenue increasing from ₹82.53 crore in FY 2024 to ₹140.98 crore in FY 2025, and profit after tax rising from ₹1.79 crore to ₹7.50 crore during the same period.

- Quality Certifications: Prime Cable Industries is ISO and BIS certified, ensuring adherence to high-quality manufacturing standards.

- Diverse Clientele: The company has established long-standing relationships with both government and private clients, securing vendor approvals across multiple states and qualifying for government tenders through stringent standards.

Risks

- Raw Material Sourcing: The company faces challenges related to the procurement of raw materials, particularly copper and PVC/XLPE. To mitigate this, Prime Cable Industries is exploring backward integration, including copper rod drawing and in-house compounding of PVC/XLPE, although full integration is capital-intensive.

- Market Fluctuations: The cables industry is susceptible to sector-specific market fluctuations, which can impact demand and pricing.

- Dependence on Key Clients: A significant portion of the company’s revenue is derived from large industrial clients, making it vulnerable to any changes in these clients’ purchasing patterns

Financial Performance Overview (₹ in Crore)

| Financial Metric | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 73.62 | 82.53 | 140.98 |

| Profit | 0.12 | 1.79 | 7.50 |

| Assets | 39.09 | 48.44 | 92.08 |

Revenue:

- Revenue has shown a strong upward trend over the three years.

- FY 2024 saw an increase of 12.1% from FY 2023, while FY 2025 recorded a sharp growth of 70.8%, indicating strong demand and effective scaling of operations.

Profit:

- Profit growth has been remarkable. From a mere ₹0.12 Cr in FY 2023, it jumped to ₹1.79 Cr in FY 2024 (an increase of 1,392%) and then to ₹7.50 Cr in FY 2025 (an increase of 319% over FY 2024).

- This indicates improved operational efficiency, better cost management, and potentially higher-margin products being sold.

Assets:

- Total assets have more than doubled in FY 2025 compared to FY 2023, increasing from ₹39.09 Cr to ₹92.08 Cr.

- This shows the company is investing in expansion, machinery, and infrastructure, aligning with its revenue and profit growth.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.