Praruh Technologies IPO Overview

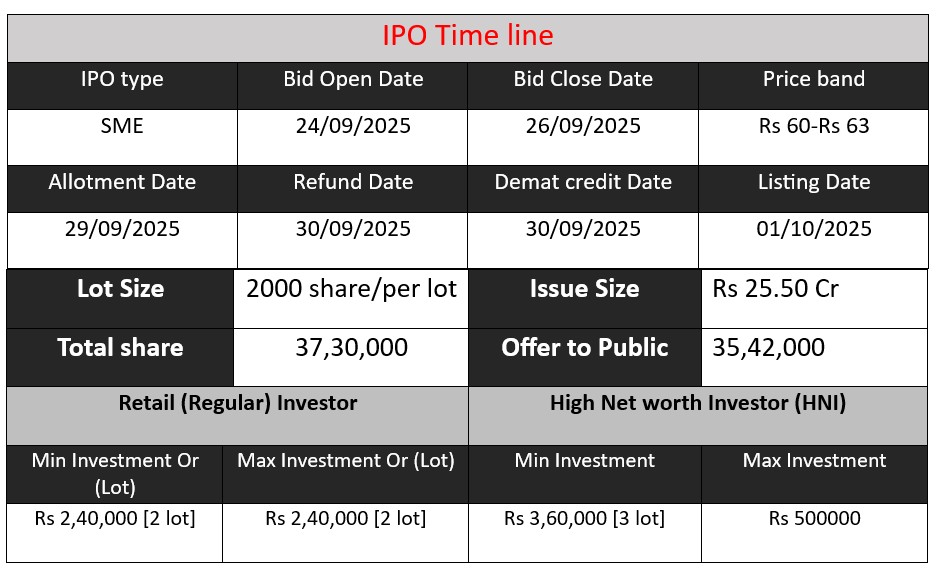

Praruh Technologies is launching an SME IPO to raise ₹ 23.50 crore through offering 37,30,000 equity shares (fresh issue). The subscription window opens 24 September 2025 and closes 26 September 2025. Proceeds will be used for repayment of borrowings, working capital, possible acquisitions in India, and other general corporate purposes. The issue is priced in the band of ₹ 60–₹ 63/share and will list on BSE SME.

Praruh Technologies GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 0 | 60-63 |

| Last Updated: 26 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Praruh Technologies Core Business & Overview

Praruh Technologies Ltd. was incorporated in 2019. It is an ICT (Information & Communications Technology) system integration and digital transformation solutions provider.

Headquarters / Location: NOIDA, Uttar Pradesh, India.

Services / Offerings: Its portfolio includes:

- Hardware & applications deployment

- Data center solutions (design, deployment, consolidation)

- Networking – LAN, WAN, audits, video‐conferencing etc.

- Security solutions – network, application, endpoint security; possibly advanced and consulting aspects.

- Audio-video integration, unified communication / collaboration solutions.

- IT consultancy including cloud strategy, disaster recovery, risk management etc.

Clients: Some of its clients include government / public sector organisations like the Delhi Metro Rail Corporation (DMRC), Airport Authority of India (AAI), etc.

Strengths

From the sources, some key strengths emerge:

- Rapid growth & improving profitability

The company has shown strong revenue growth (more than doubling in recent years) and growing profits. - Diversified service offerings in ICT & system integration

Because its offerings span from hardware to networking, security, data centers, audio‐video etc., it can cater to multiple needs and bundle services. That adds to its value proposition. - High-profile / credible clients

Working with names like DMRC and AAI (and government or public sector clients) gives both credibility and (potentially) stable order flows. - Quality & certifications

The company claims to have ISO certifications (e.g. ISO 9001 for quality management, ISO 27001 for information security) and a trained, certified team. This helps in satisfying stringent client and tender requirements. - Strategic positioning

Given the rising need for digital transformation, cybersecurity, cloud services, data center modernization etc., the marketplace demand is favorable. Praruh seems positioned to benefit from these trends.

Risks

Some of the risks that could affect the company:

- Client concentration

A large share of revenue comes from a few major clients. If the company loses any one, or if orders from them reduce, it could materially affect revenue. - Dependence on government / public sector / tender-based work

Many of its contracts are through government entities or public sector tenders. These involve risks like delays, stringent qualification criteria, rejections, competitive bidding lowering margins. - Rising debt / borrowings & working capital stress

While revenue and profits are improving, borrowings have increased significantly. Also, operations are working-capital intensive. If working capital isn’t managed carefully or if cash flows are strained, that could hurt performance. - Suppliers / supply chain risk

The company depends on third-party suppliers for hardware / components, and doesn’t have exclusive supply contracts always. Disruptions, price increases, or delays in supply could impact delivery timelines and cost structures. - Rapid technology changes / obsolescence

The ICT / system integration field evolves quickly. There is risk that certain technologies may become obsolete, or new standards emerge, requiring continuous investment in R&D / upskilling. Failing to keep pace may reduce competitiveness. - Valuation & market risk

Given the growth and profit trends, the IPO valuation may seem appealing, but market reactions will depend on execution, maintaining margins, ability to keep scaling, and macroeconomic conditions. Overhyped expectations might be hard to sustain. Some analysts point out that leverage (debt) and receivables must be watched.

Financial Performance Overview (₹ in Crore)

| Particulars | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 27.97 | 61.44 | 61.89 |

| Profit | 2.17 | 6.50 | 6.78 |

| Assets | 17.61 | 38.28 | 54.78 |

Revenue

- FY 2023 → FY 2024: Very strong growth, more than double (27.97 → 61.44).

- FY 2024 → FY 2025: Growth almost flat (61.44 → 61.89), indicating the company reached a plateau in topline expansion.

Profit

- FY 2023 → FY 2024: Jumped from 2.17 to 6.50 (3x rise).

- FY 2024 → FY 2025: Modest improvement (6.50 → 6.78), showing stabilization but limited incremental gains despite revenue holding steady.

Assets

- FY 2023 → FY 2024: Rose sharply (17.61 → 38.28).

- FY 2024 → FY 2025: Continued rising strongly (38.28 → 54.78), suggesting higher investments in infrastructure, working capital, or borrowings to support operations.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.