Om Metallogic IPO Overview

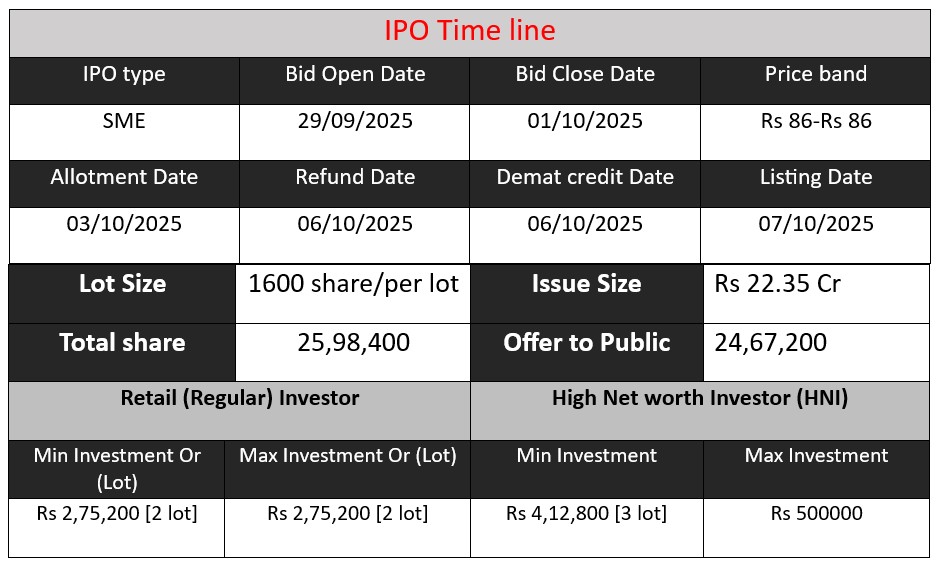

Om Metallogic Limited is launching an SME IPO to raise ₹22.35 crore by issuing 25,98,400 equity shares at ₹86 per share. The IPO opens on 29th September 2025 and closes on 1st October 2025. The minimum application lot size is 1,600 shares. The shares will be listed on BSE SME on 7th October 2025. Proceeds will fund capacity expansion, working capital, and general corporate purposes.

Om Metallogic GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 0 | 86 |

| Last Updated: 6 Oct 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Om Metallogic Core Business & Overview

Om Metallogic Limited was incorporated on 14 December 2011. Its Corporate Identification Number (CIN) is U28113HR2011PLC044569. The company is registered in the State of Haryana, India, with its registered office in Ballabhgarh, Haryana.

Business / Industry

Om Metallogic operates in the non-ferrous metal / aluminium sector. Its primary business is recycling aluminium scrap / metal scraps, and converting them into aluminium alloys (in the form of ingots).

It uses induction furnace-based melting and then secondary refining, before casting into ingots.

The aluminium alloys thus produced are meant for use in industries such as automotive (for parts), which value aluminium’s strength-to-weight ratio, corrosion resistance, etc.

Scale and Facilities

It currently operates a manufacturing facility in Ballabhgarh, Haryana, with an installed capacity of 5,280 tonnes per annum. The facility is located on a 33,600 square foot area (or the facility accreditation area) as per its documents.The company is certified under ISO 9001:2015 for its quality management systems.

Corporate Transition

Originally, it was “Om Metallogic Private Limited” prior to conversion; the conversion to a public limited company happened (fresh certificate) in June 2023.

Directors include Manish Sharma (Managing Director), Seema Sharma, Vaibhav Sharma, Ram Kishan, Piyush Kesarwani, Kritika Gupta.

Strengths

From the sources, the following are key strengths cited for Om Metallogic:

- Experienced Promoters and Skilled Workforce

The promoters and management are claimed to have domain expertise in metals / recycling, which helps in strategy, operations, and managing challenges. - In-house Manufacturing / Technology-driven Process

They control the full process from scrap to ingot in their own facility (i.e. not outsourcing critical stages). This allows better process control, cost optimization, and quality management. - Quality Certification & Timely Delivery Capability

ISO certification and focus on meeting delivery schedules are seen as differentiators. - Strategic Location / Reduced Logistics Cost

Plant’s proximity to core customer geographies (Haryana, Delhi, UP) helps reduce logistics cost and lead times. - Strong Client / Customer Relationships

Even though contracts may not always be long-term, having repeat business and existing relationships helps reduce sales risk and ensures order visibility.

Risks

While the company has promise, there are several risks you should consider (as noted in its prospectus and by analysts). Below are at least three major risks:

- Customer Concentration / Revenue Dependence on Few Customers

A very large share of revenue comes from a small number of customers. According to its disclosures, in past periods, the top 10 customers accounted for 92–99% of revenue.

This makes the company vulnerable: if one or more major customers cut orders or delay payments, its revenue could drop sharply. - Raw Material Price / Supply Volatility

Cost and availability of aluminium scrap (metal scrap) can fluctuate significantly depending on global demand/supply, import/export norms, energy costs, logistics, etc.

If suppliers fail to deliver on time, or prices spike, margins can get squeezed. - Operational Concentration / Single Plant Risk

The business depends heavily on the single manufacturing facility. Any shutdowns — due to technical faults, power failure, natural disasters, or regulatory constraints — could materially disrupt production and revenue. - Legal / Litigation Exposure

The company and its promoters face some ongoing legal proceedings. Adverse outcomes may damage reputation and also affect cash flows and financial health. - Negative Cash Flow Risk

In recent years, some negative cash flows have been observed. If such patterns continue, the company could face liquidity stress, especially when scaling. - Geographic / Market Concentration

Since a large share of operations and revenue is concentrated in a few states (Haryana, Delhi, UP), adverse regional developments (policy changes, infrastructure issues, local disruption) could disproportionately affect performance.

Financial Performance Overview (₹ in Crore)

| Financial Metric | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 37.81 | 38.54 | 60.00 |

| Profit | 1.10 | 2.22 | 4.12 |

| Assets | 23.33 | 25.11 | 30.98 |

Revenue

- Revenue increased modestly from ₹37.81 crore in FY 2023 to ₹38.54 crore in FY 2024 (1.95% growth).

- FY 2025 shows a significant jump to ₹60 crore, a growth of 55.6% over FY 2024.

- This indicates a strong uptrend in sales, possibly due to higher capacity utilization, new customers, or better pricing.

Profit

- Profit doubled from ₹1.10 crore in FY 2023 to ₹2.22 crore in FY 2024.

- FY 2025 saw another substantial increase to ₹4.12 crore (85.6% growth).

- This shows improved operational efficiency and cost management alongside higher revenue.

Asset

- Assets grew steadily from ₹23.33 crore in FY 2023 to ₹30.98 crore in FY 2025 (32.8% growth over two years).

- Growth in assets supports higher production capacity and indicates potential for further expansion.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.