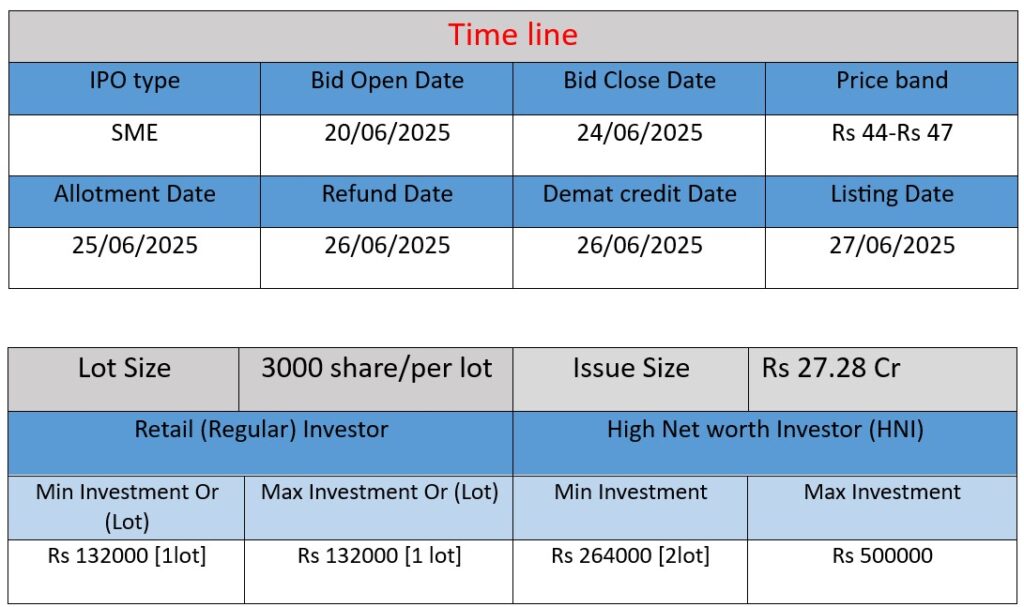

Mayasheel Ventures Limited IPO opens on June 20 with an issue size of ₹27.28 crore via fresh issue of 55.14 lakh shares. Price band set at ₹44–₹47 per share. The funds will be used for working capital, general corporate purposes, and equipment procurement. Bidding ends June 24; listing on NSE SME expected by June 27. The company is a government contractor in infrastructure and electrical EPC projects.

Overview & Operations

- Founded in 2008; incorporated as a Public Limited Company in May 2024 (CIN U42101UP2024PLC203681).

- Classified as an “A‑class government contractor”, undertaking large infrastructure projects primarily for Indian government bodies like NHIDCL.

- Core services include design and execution of highways, expressways, flyovers, bridges, drainage, street lighting, powerhouses, and transmission lines under both EPC and BOQ models.

Strengths

- Robust financial growth: FY25 revenue at ₹172 cr (↑31% YoY), net profit ₹11.33 cr (↑74% YoY); FY25 ROE ~42.8%, post-issue P/E ~9.1.

- Efficient capital utilisation: Improvements in ROCE, ROA, ROE, net profits over last two years though cash flow has weakened slightly.

- Strong execution capability: Experienced management team, quality benchmarks, government licensing, and large order book in roads & electrical sectors.

- Anchor investor support: ₹7.76 cr committed pre-IPO, indicating institutional confidence.

Work & Business Model

- Primarily government‑tender driven, focused on infrastructure contracts awarded by agencies like UP‑PWD, NHIDCL.

- Projects are executed via EPC or item‑rate contracts, including design, supply, construction, and commissioning.

- As of FY25, 294 employees and a robust order book across civil and electrical verticals.

Risks & Challenges

- High dependency on government spend: Any policy shifts or budget cuts could disrupt revenue flow .

- Geographic concentration: Significant operations in Northeast states—exposure to local regulatory/environmental risks.

- Cash flow concerns: Although profit is rising, net cash flow has been declining; borrowing has increased (assets ₹99.1 cr vs liabilities ₹99.1 cr in FY25).

- Execution risks: Delays in machinery procurement, legal proceedings, and limited insurance coverage are notable threats

Here is a brief financial performance analysis across FY2022 to FY2024:

Revenue

- FY2022: ₹115.91 Cr

- FY2023: ₹126.37 Cr

- FY2024: ₹130.32 Cr

Analysis:

Revenue grew steadily over the three years.

- FY23 growth: ~9%

- FY24 growth: ~3%

The company is maintaining growth but at a slower pace in FY24, which might indicate market saturation or project delays.

Profit (Net)

- FY2022: ₹4.88 Cr

- FY2023: ₹4.75 Cr

- FY2024: ₹6.51 Cr

Analysis:

- Profit dipped slightly in FY23, despite increased revenue, suggesting higher costs or lower margins.

- In FY24, profit jumped by ~37%, reflecting improved margin management or cost control.

Total Assets

- FY2022: ₹92.53 Cr

- FY2023: ₹79.03 Cr

- FY2024: ₹92.56 Cr

Analysis:

- A drop in FY23 may have been due to asset sales or depreciation.

- The rebound in FY24 to ₹92.56 Cr suggests asset base expansion or restoration after downsizing in FY23.

Conclusion

- Revenue is growing but at a slowing rate.

- Profitability improved sharply in FY24, showing better operational efficiency.

- Asset base recovered after a dip, which may indicate new investments or resumed project activity.