Mahendra Realtors IPO Overview

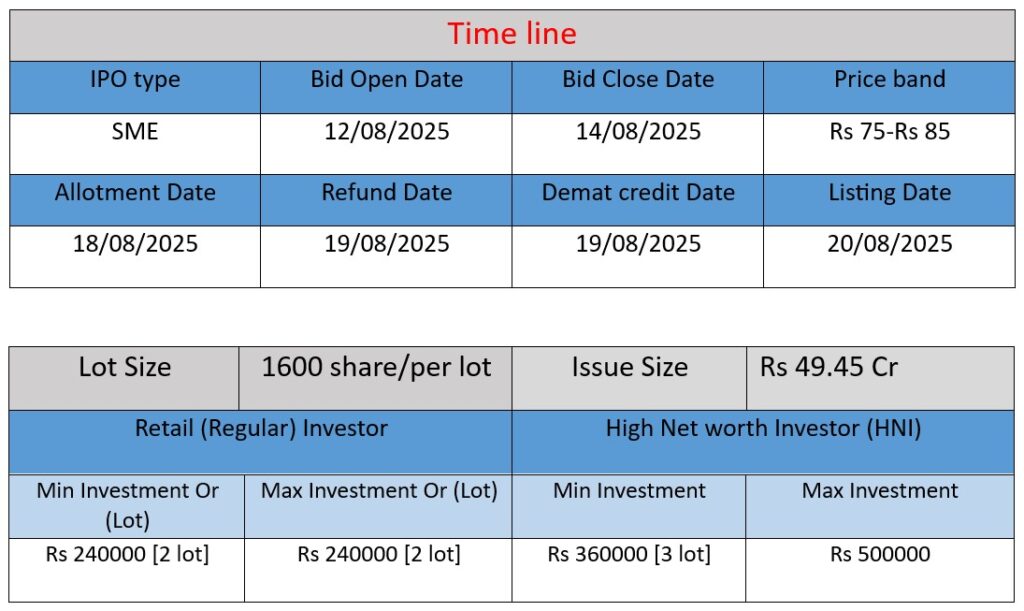

Mahendra Realtors & Infrastructure Ltd IPO is open from August 12 to 14, 2025, offering 5,817,600 equity shares at ₹75 to ₹85 per share. The total issue size is ₹49.45 crore, including a fresh issue of ₹40.17 crore and an offer for sale of ₹9.28 crore. The proceeds will be used for working capital, general corporate purposes, and issue expenses. The listing date is August 20, 2025.

Mahendra Realtors Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 43.57 |

| NIIs | 26.16 |

| Retails | 24.03 |

| Total | 24.01 |

| Last Updated: 14 Aug 2025 Time: 4 PM (Note: This data is updated every 2 hours) Source: NSE/BSE | |

| GMP (₹) | IPO Price (₹) |

| 85 | |

| Last Updated: 14 Aug 2025 Time: 4 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

Mahendra Realtors Limited is primarily engaged in the real estate development sector. The company focuses on the development of residential and commercial properties, including townships, housing complexes, and commercial spaces. Their operations include land acquisition, planning, construction, and marketing of real estate projects. The company aims to provide quality housing and infrastructure solutions that cater to urban and semi-urban customers.

Strengths:

- Experienced Management Team: The company is backed by a skilled team with years of experience in real estate development, project management, and marketing.

- Strategic Land Bank: Mahendra Realtors holds ownership of significant land parcels in developing urban areas, providing them a strong foundation for future projects.

- Diversified Portfolio: Their projects range across residential, commercial, and mixed-use developments, which reduces dependence on a single segment and spreads market risk.

- Customer-Centric Approach: The company focuses on delivering timely projects with quality standards, helping them build customer trust and brand recognition.

Risks:

- Market Risks: Real estate is highly cyclical and sensitive to economic downturns, interest rate changes, and regulatory policies, which can impact sales and profitability.

- Regulatory Risks: Changes in government policies related to land acquisition, zoning laws, and environmental regulations can delay projects or increase costs.

- Funding and Liquidity Risks: Real estate projects require heavy upfront capital investment; any disruption in funding or cash flow management can affect project completion.

- Competition: The real estate sector has many established players and new entrants, which could impact pricing power and market share.

Financial Performance Overview (₹ in Crore)

| Financial Year | Revenue | Profit | Assets ( |

| FY 2023 | 63.02 | 4.04 | 98.21 |

| FY 2024 | 101.49 | 11.58 | 93.00 |

| FY 2025 | 124.77 | 14.87 | 137.54 |

Revenue:

The company’s revenue has shown strong growth over the last three years, increasing from ₹63.02 Cr in FY 2023 to ₹124.77 Cr in FY 2025. This indicates growing sales and business expansion.

Profit:

Profit has also increased substantially, from ₹4.04 Cr in FY 2023 to ₹14.87 Cr in FY 2025, reflecting improved profitability and efficient cost management.

Assets:

Total assets were ₹98.21 Cr in FY 2023, dipped slightly to ₹93 Cr in FY 2024, but then rose sharply to ₹137.54 Cr in FY 2025. The rise in assets in FY 2025 may indicate new investments, land acquisition, or capital expenditure for new projects.

✅ Pros

- Consistent increase in revenue from ₹63.02 Cr (FY23) to ₹124.77 Cr (FY25).

- Profit surged from ₹4.04 Cr to ₹14.87 Cr over three years, showing strong earnings growth.

- Significant asset growth in FY25 indicates capacity for new projects and business expansion.

- IPO proceeds will be used for working capital and general corporate purposes, ensuring operational support.

- IPO priced between ₹75-85, making it accessible for retail investors.

- Backed by a management team with real estate industry experience.

❌ Cons

- The company operates in a cyclical and highly regulated industry vulnerable to market downturns.

- ₹49.45 Cr issue size limits large-scale capital infusion and growth potential.

- Being a small-cap SME IPO, stock liquidity and listing gains can be uncertain.

- Changes in real estate laws or delays in approvals may affect project timelines.

- Faces stiff competition from larger real estate developers with stronger financials.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.