L.T. Elevator IPO Overview

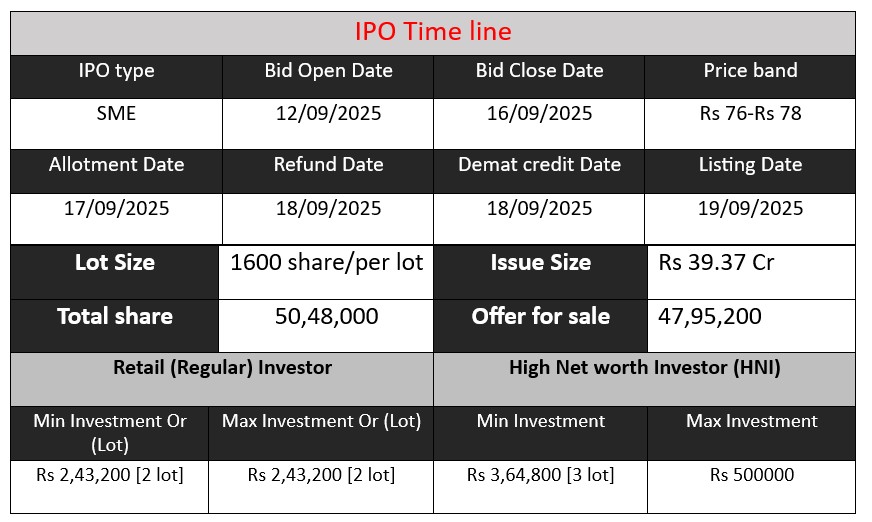

L.T. Elevator Ltd IPO opens 12-Sep-2025 and closes 16-Sep-2025. Priced at ₹76-₹78 per share, the fresh issue offers 50,48,000 equity shares aggregating up to ₹39.37 crores. Key purposes include funding working capital, investment into its subsidiary Park Smart Solutions, and general corporate uses. Lot size is 1,600 shares; listing expected on BSE SME 19-Sep-2025.

L.T. Elevator GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 30 | 76-78 |

| Last Updated: 17 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

L.T. Elevator Core Business & Overview

L. T. Elevator is active in the vertical transportation industry. Its core operations include the design, manufacture, installation, commissioning, and maintenance of:

• Elevators (manual, semi-automatic, automatic)

• Escalators, moving walkways, and similar systems

End-to-end services

They operate under both EPC (Engineering, Procurement, Construction) and O&M (Operations & Maintenance) models. They also generate recurring revenues via Annual Maintenance Contracts (AMCs).

Product expansion & subsidiary

Beyond elevators/escalators, via a subsidiary called Park Smart Solutions, they are entering the automated, multi-level car parking systems market (stack, puzzle, aisle configurations).

Geography & market presence

They are headquartered / have manufacturing in West Bengal, and have strong presence especially in eastern India. Some smart city projects in Silchar, Imphal among others.

Certifications & infrastructure

They emphasize indigenous production (80% in-house manufacturing), German technology / machinery, R&D, quality labs, etc. Also certified with ISO 14001:2015 (environmental management).

Strengths

Here are several strengths or competitive advantages drawn from the filings:

- Integrated production and control over quality

Because much of manufacturing is done in-house, supported by modern machinery and quality labs, the company has better control over lead times, component quality, cost management. - “One-stop” / full life-cycle solution

Handling everything from design to after-sales service (incl. maintenance) helps build customer relationships, recurring revenue, and better ecosystem control. - Growing product portfolio / diversification

The addition of car-parking smart systems (Park Smart) provides extension into related infrastructure verticals, which could help offset cyclical risks in pure elevator/vertical-mobility segment. - Regulatory / market tailwinds

Rapid urbanization, smart city programs, focus on safety, mobility, infrastructure in India give a favorable backdrop. Also, the IPO itself suggests growth ambitions and raising funds to scale. - Geographic foothold in less saturated areas

Strong presence in Eastern India, projects in Silchar, Imphal etc., gives advantage in markets which may have fewer established suppliers.

Risks

From the DRHP, IPO documents, and financial data, some of the risks the company (and investors) should watch out for:

- Concentration risk

- Customer concentration: Top clients contribute a sizeable percentage of revenue. Losing a major customer or failing to renew large contracts could significantly impact revenues.

- Geographic concentration: Much revenue comes from a specific region (West Bengal, Eastern India). Adverse events (political, logistical, regulatory) there could hurt operations.

- Segment dependency

A large part of the revenues comes from certain product types (e.g. automatic elevators). If demand in that segment slows, or competition increases, margins may be affected. - Cash flow / liquidity risk

The company has reported negative operating cash flows in recent years (FY24, FY25) despite growth in revenues and profits. That suggests working capital or cash management may be under pressure. - Single manufacturing facility

All manufacturing largely from one facility (West Bengal). Any disruption (natural disasters, labor issues, regulatory shutdowns) could severely affect supply/delivery. - Competition, technology & regulatory risk

Vertical transportation is a competitive market. Newer technologies, safety standards, energy efficiency norms, etc., may require ongoing investment. Also, changing regulation or policies in different states can raise compliance cost. While not always spelled out specifically, this is implicit. - Dependence on external inputs

Even with much in-house manufacturing, raw materials, parts (especially high-precision, imported components) & supply chain issues could lead to cost overruns, delays. Also transport/logistics in India can add risk. Implicit in filings. - Macro risks

Inflation, interest rates, infrastructure spending slowdowns, or economic downturns could reduce demand for new elevator or parking infrastructure. Also, real estate cycles matter here. Additionally, regulatory delays/permissions can slow project execution.

Financial Performance Overview (₹ in Crore)

| Particulars | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 34.39 | 40.14 | 56.52 |

| Profit | 1.25 | 3.17 | 8.94 |

| Assets | 42.68 | 42.78 | 86.99 |

Revenue

- FY 2023: ₹34.39 Cr

- FY 2024: ₹40.14 Cr

- FY 2025: ₹56.52 Cr

Revenue has shown consistent growth, rising by 16.7% in FY24 and a strong 40.8% jump in FY25. This indicates expanding operations and stronger order inflow, reflecting demand in the elevator and infrastructure sector.

Profit

- FY 2023: ₹1.25 Cr

- FY 2024: ₹3.17 Cr

- FY 2025: ₹8.94 Cr

Profitability has improved sharply. Margins expanded significantly in FY25, showing better cost control, operational efficiency, and higher demand. The profit grew more than 7x between FY23 and FY25, a positive sign for sustainability.

Total Assets

- FY 2023: ₹42.68 Cr

- FY 2024: ₹42.78 Cr

- FY 2025: ₹86.99 Cr

Assets remained stable from FY23 to FY24, but nearly doubled in FY25. This indicates capacity expansion, investments in infrastructure, and possible gearing up for larger future projects.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.