Laxmi India Finance IPO Overview

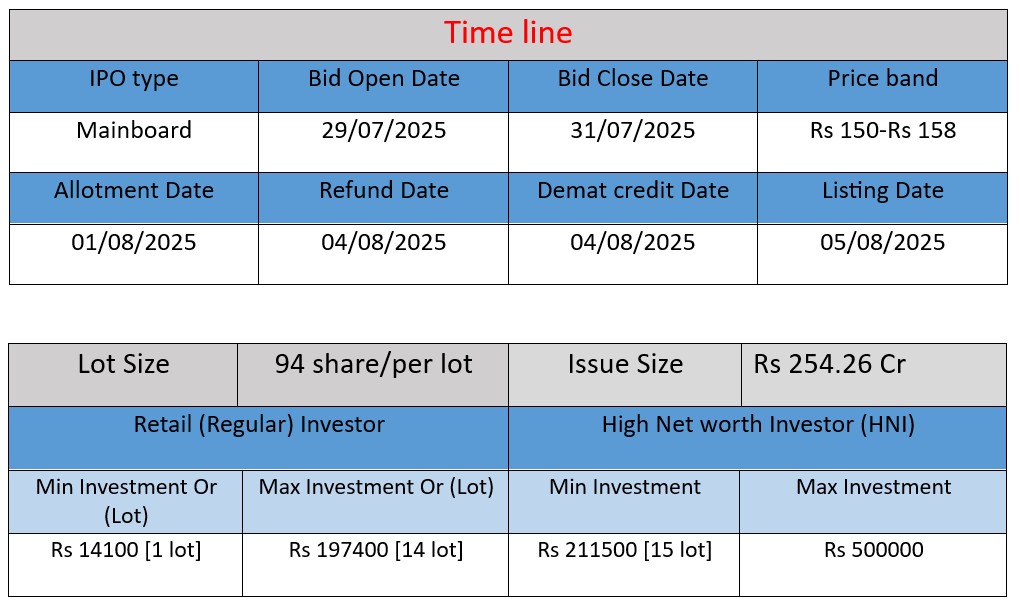

Laxmi India Finance Ltd IPO opens on 29 July 2025 and closes on 31 July 2025. The issue size is ₹254.26 crore, comprising a fresh issue of 1.05 crore equity shares (₹165.17 cr) and an offer‑for‑sale of 56.38 lakh shares (₹89.09 cr) by promoters. Price band set at ₹150–₹158 per share, lot size of 94 shares (~₹14,852 minimum). Proceeds will be used to augment the capital base to support future lending growth and for general corporate purposes. Shares proposed to list on BSE and NSE

Laxmi India Finance Subscription and GMP Status

| Subscription Rate Source: NSE/BSE | |||

| Category | Shares Offered | Shares Bid For | Subscription (x) |

| QIBs | 31,86,253 | 41,36,940 | 1.30 |

| NIIs | 23,89,691 | 44,02,678 | 1.84 |

| Retails | 55,75,944 | 1,23,74,630 | 2.22 |

| Employees | 1,60,928 | 2,52,296 | 1.57 |

| Shareholders | |||

| Total | 1,13,12,816 | 2,11,66,544 | 1.87 |

| Last Updated: 31 July 2025 Time: 7 PM (Note: This data is updated every 2 hours) Get instant updates on WhatsApp – Join now! | |||

| GMP (₹) | IPO Price (₹) |

| 1 | 158 |

| Last Updated: 31 July 2025 Time: 7 PM | |

| 📌 Warning Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

- Business Model & Segment Focus

Laxmi India Finance Limited, incorporated in 1996 and primarily active since 2011, is a Jaipur-based non-deposit-taking NBFC focused on providing secured financing to underserved borrowers—micro‑small‑medium enterprises (MSMEs), vehicle loans (used commercial vehicles, personal vehicles, tractors, EVs), and construction loans. The majority of its portfolio (75–86 %) is in secured MSME loans ranging from ₹0.5 lakh to ₹25 lakh, typically with lower LTVs (~44 %). - Geographic & Branch Presence

As of March 31, 2025, operated through ~158 branches across Rajasthan, Gujarat, Madhya Pradesh, Chhattisgarh, and Uttar Pradesh, with the densest penetration in Rajasthan. Uses a hub‑and‑branch model to optimize sourcing and decision-making in semi‑urban and rural markets.

Strengths

a. Secured Lending Focus & Asset Quality

Nearly 99% of loans are secured, with average LTVs ~43–44% (MSME) and ~73% (vehicle), yielding strong performance—GNPA 1.07%, NNPA 0.48% in FY25, among the best in its peer group.

b. Financial Resilience & Capital Access

Capital adequacy ratio of ~20.8% and a broad mix of 47 funding sources, helping lower borrowing cost (~12.0% in FY25 vs 12.24% in FY23) amid improved credit rating (Acuite A‑, positive outlook).

c. Geography & Technology Advantage

Extensive rural‑semi‑urban presence (~158 branches), leveraging both direct and DSA channels. Employs hub‑and‑branch framework and tech‑driven processes (digital underwriting, LOS) to streamline credit assessments and collections.

d. Experienced Promoters & Growth Track

Led by promoter‑manager team with over two decades of experience. Promoters hold majority equity and regularly infuse capital. AUM CAGR ~34% (2022–25) with steady profitability expansion.

Potential Risks

a. Geographic Concentration

Heavy loan portfolio concentration in Rajasthan (~80 %) exposes it to region-specific economic downturns. Expansion into Chhattisgarh and Madhya Pradesh remains nascent.

b. Borrower Profile & Sector Vulnerability

Reliance on first-time or informal borrowers (many self-employed) increases credit risk, especially in vehicle/MSME segments susceptible to income shocks during downturns or income instability.

c. Limited Portfolio Seasoning

A rapidly growing, but relatively young portfolio may be vulnerable as loans mature and repayment behavior unfolds; weak seasoning may reveal higher delinquencies over time.

d. Funding & Regulatory Reliance

Business depends on continuous access to capital; disruptions or adverse regulatory changes impacting NBFCs could affect liquidity and growth. High cost of funds or lender withdrawal poses risk to operations and cashflows

Financial Performance Table

| Financial Year | Revenue | Profit (PAT) | Total Assets |

| FY 2023 | ₹129.53 | ₹15.97 | ₹778.71 |

| FY 2024 | ₹173.14 | ₹22.47 | ₹984.85 |

| FY 2025 | ₹245.71 | ₹36.00 | ₹1412.52 |

Revenue

- FY 2023: ₹129.53 Cr

- FY 2024: ₹173.14 Cr ⬆️ (Growth: 33.6%)

- FY 2025: ₹245.71 Cr ⬆️ (Growth: 41.9%)

The company has shown consistent and sharp growth in revenue, nearly 90% increase from FY23 to FY25. This indicates strong loan disbursement, branch expansion, and market reach.

Profit (PAT)

- FY 2023: ₹15.97 Cr

- FY 2024: ₹22.47 Cr ⬆️ (Growth: 40.7%)

- FY 2025: ₹36.00 Cr ⬆️ (Growth: 60.2%)

Profitability has improved significantly. PAT more than doubled in two years, reflecting better operating efficiency, reduced credit costs, and improved margins.

Total Assets

- FY 2023: ₹778.71 Cr

- FY 2024: ₹984.85 Cr ⬆️ (Growth: 26.5%)

- FY 2025: ₹1412.52 Cr ⬆️ (Growth: 43.4%)

The asset base has grown by 81% over three years, showing expansion in the loan book and stronger balance sheet strength.

| ✅ Pros of Laxmi India Finance IPO |

| Revenue grew from ₹129.53 Cr (FY23) to ₹245.71 Cr (FY25), and profit more than doubled — showing excellent financial performance. Over 99% of loans are secured, mainly MSME and vehicle loans, which reduces credit risk and NPA exposure. GNPA at just 1.07% and NNPA at 0.48% (FY25) — among the lowest in the NBFC segment. Borrowings from 47+ lenders (banks, NBFCs, etc.) reduces dependence on a single funding source. A strong presence in underbanked areas across Rajasthan, Gujarat, MP, UP, and Chhattisgarh gives access to untapped markets. Promoters have over two decades of experience in finance and NBFC operations, supporting stability and vision. Capital Adequacy Ratio (CAR) at ~20.8% (FY25), well above RBI’s required 15%, ensuring financial safety. Tech-driven loan origination and risk assessment improves turnaround time and reduces cost. Assets increased from ₹36.91 Cr to ₹66.74 Cr in 3 years, showing company expansion through infrastructure, stock, or outlet setup. IPO proceeds to be used for repaying ₹19+ Cr loans, improving the company’s balance sheet and reducing interest burden. Business operates through both company-owned stores and retail partner stores, allowing fast expansion without heavy capital investment. |

| ⚠️ Cons of Laxmi India Finance IPO |

| Over 80% of the portfolio is in Rajasthan, increasing risk from state-specific economic or political issues. Focus on self-employed and semi-formal borrowers increases credit risk, especially during economic slowdowns. Rapid growth in recent years means many loans are still early-stage — future delinquencies may emerge. NBFCs rely heavily on borrowings; any tightening in liquidity or interest rate hike can affect margins. Operates in a segment crowded with large NBFCs and fintechs offering similar products. Some analysts believe the pricing may be slightly aggressive based on current P/E and market conditions. Being an NBFC, the company is highly sensitive to RBI regulations, which may change and impact operations. |

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.