Jaro Institute IPO Overview

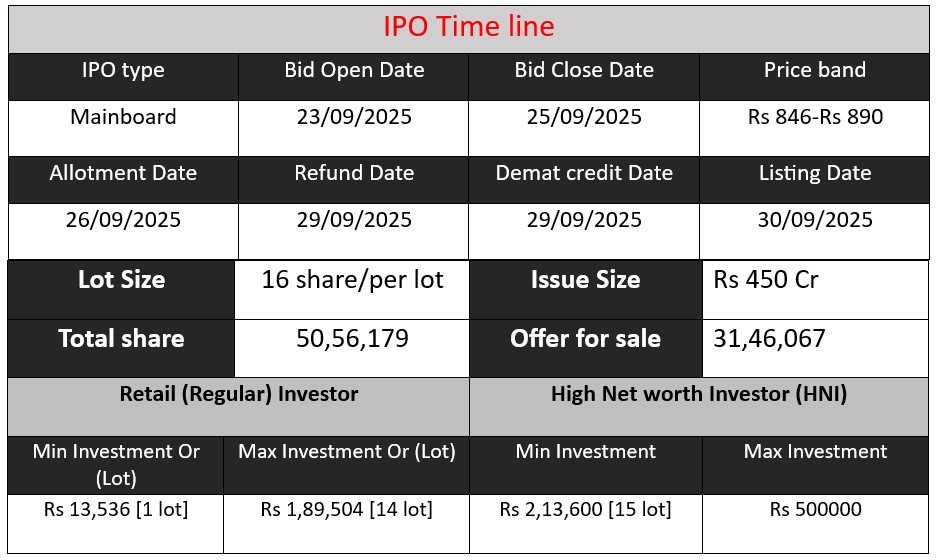

Jaro Institute of Technology Management & Research Ltd is launching a ₹450 crore IPO from 23-25 September 2025, with a price band of ₹846-890 per share. The issue comprises a fresh issue worth ₹170 crore and an offer for sale (OFS) of ₹280 crore by promoter Sanjay Namdeo Salunkhe. A total of 5,056,180 shares are on offer. Proceeds will be used for marketing & brand building, repayment of borrowings, and general corporate purposes.

Jaro Institute GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 73 | 846-890 |

| Last Updated: 25 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Jaro institute Core Business & Overview

Jaro is an online higher education and upskilling services provider. It markets and facilitates degree programs and certification courses that are developed and awarded by partner institutions/universities. It does not itself directly create all the academic content or grant degrees (that is done via its partner institutions).

Founded & Leadership:

It was founded in 2009 by Dr. Sanjay Namdeo Salunkhe. The CEO is Ranjita Raman.

Geographical Footprint & Infrastructure:

Pan-India presence with over 22 offices / learning centres and 17 immersive tech studios across India as of FY25.

It also has collaborations with global institutions (e.g. Swiss School of Management, Rotman School of Management etc.).

Program Portfolio:

Offers a large & diverse set of programs: specialized certificate courses, undergraduate, postgraduate, and doctoral type programs (MBA, DBA, MCA, etc.) via partners. As of FY25, 260-+ programs. Delivery in multiple formats: online, hybrid (immersive studios), etc.

Revenue Model:

Revenue comes largely from fee sharing and facilitation agreements with partner institutions. Jaro handles marketing, admissions, learner support, technology, etc., and in return gets a share of fees (or sometimes collects fees) depending on the partner contracts.

Strengths

- Strong Partner Network & Brand

Jaro has tie-ups with many premier institutions (IIMs, IITs, global universities). That helps with credibility, helps in attracting students. - Diverse Program Portfolio & Multi-format Delivery

Many courses across domains (management, tech, data science etc.), in different durations and formats. Also immersive studios, online, etc. This diversity helps spread risk and appeal to different learner segments. - Good Financial Growth / Profitability

They’ve shown strong growth in both revenue and profit in recent years. For example, sharp growth in revenue from FY23→FY25 and increasing margins. - Pan-India Reach + Physical + Digital Infrastructure

Having both online/digital delivery and physical/immersive centres gives flexibility. Also helps with learner satisfaction (e.g. for hybrid or in-person components). - First-mover / Early Entrant + Strong Learner Outcomes

Being in business since 2009, earlier than many newer online edtech players, gives experience. Also, data on good completion rates in many courses.

Risks

- Dependence on Partner Institutions

Since Jaro does not generate all the academic content and does not itself confer degrees (for most programs), much depends on the partner institutions. If partners change terms, reduce fee share, reduce quality, or decide to compete directly, that could hurt Jaro. - Revenue Concentration / Key Partner Dependence

A large chunk of revenue comes from a few top partner institutions. If any of them reduce business, or do not renew contracts, or change terms unfavorably, the impact can be large. - Regulatory / Policy Risks

The higher education sector in India has rules around online education, accreditation, recognition, etc. Any unfavorable change (or stricter regulation of online / distance learning) might affect how Jaro operates. - Competition

The edtech / upskilling space is crowded and competitive, with well-funded players, both Indian and international. Maintaining differentiation, margins, and scaling sustainably amid competition is a risk. - Dependency on Technology / Learning Management Systems (LMS) / Infrastructure

Disruptions, legal/compliance issues, or instability in third-party technology vendors may affect service delivery, learner satisfaction, and hence reputation. - Financial / Borrowing Risks

Though the company has shown profitability, the IPO prospectus lists borrowings, planned debt repayment, etc. If cash flows dip, or revenue sharing or renegotiations affect margins, servicing debt or finance costs may become burdensome.

Financial Performance Overview (₹ in Crore)

| Fiscal Year | Revenue | Profit | Assets |

| FY 2023 | 122.14 | 11.65 | 175.75 |

| FY 2024 | 199.04 | 37.97 | 201.76 |

| FY 2025 | 252.26 | 51.67 | 276.70 |

Revenue

- FY23: ₹122.14 Cr → FY24: ₹199.04 Cr → FY25: ₹252.26 Cr

- Growth: 63% (FY23–FY24), 27% (FY24–FY25)

Strong revenue expansion showing scaling of operations and widening course portfolio. The growth rate slowed in FY25 compared to FY24 but remains healthy.

Profit

- FY23: ₹11.65 Cr → FY24: ₹37.97 Cr → FY25: ₹51.67 Cr

- Growth: 226% (FY23–FY24), 36% (FY24–FY25)

Profit growth is sharp, especially between FY23–FY24, showing operating leverage. Even with slowing growth, margins improved, highlighting efficiency and stronger partner tie-ups.

Total Assets

- FY23: ₹175.75 Cr → FY24: ₹201.76 Cr → FY25: ₹276.70 Cr

- Growth: 15% (FY23–FY24), 37% (FY24–FY25)

Asset base expanding steadily, reflecting investment in technology, infrastructure (learning studios, centres), and possibly stronger receivables base with scaling operations.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.