iValue Infosolutions IPO Overview

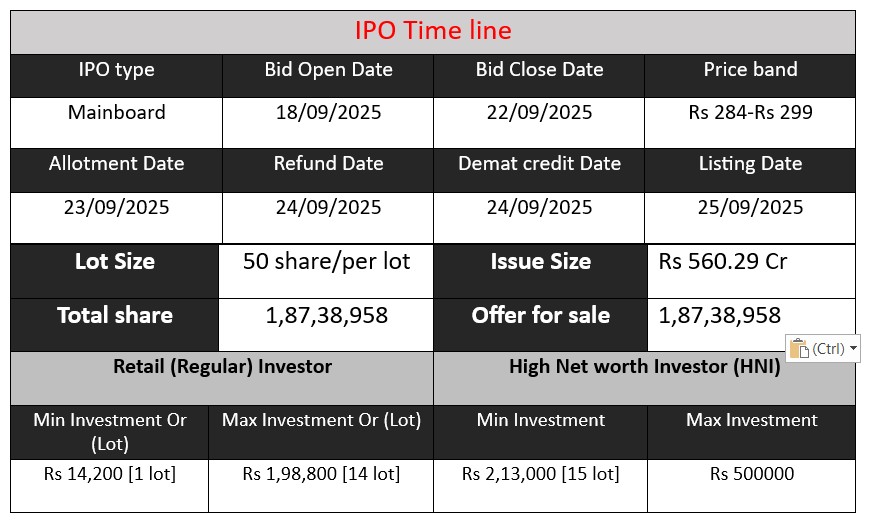

iValue Infosolutions Ltd IPO opens on 18 September 2025 and closes on 22 September 2025, with a price band of ₹284–₹299 per share (face value ₹2). The total issue size is ₹560.29 crore, comprising 18,738,958 equity shares, offered via an Offer for Sale by existing shareholders. The objective is to get the shares listed on BSE & NSE, enhance visibility & brand image, and create a public market for its equity

iValue Infosolutions GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 2 | 284-299 |

| Last Updated: 22 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

iValue Infosolutions Core Business & Overview

Based in Bangalore and founded in 2008, iValue Infosolutions is a provider of enterprise technology solutions that help large organizations secure, manage, and transform their digital infrastructure and applications.

Some key facts:

- It operates across India, SAARC and Southeast Asia (e.g. Singapore, UAE, Bangladesh, Sri Lanka, Cambodia, Kenya).

- The company works through a combination of OEMs (Original Equipment Manufacturers) and System Integrators (SIs), offering both product-solutions stacks and services (consulting, implementation, managed and professional services).

Business verticals / domain focus include:

- Cybersecurity

- Information Lifecycle Management (ILM)

- Data Center Infrastructure

- Application Lifecycle Management (ALM) & Cloud / Hybrid Cloud Solutions

Financial performance has shown growth in revenue, profit after tax, and improving metrics in recent years.

Strengths

Here are some of its major strengths:

- Strong OEM & SI Partner Ecosystem

The company has built relationships with many OEMs (over 100 in recent years) and a large, expanding network of System Integrators. This gives it breadth in technology offerings and helps in scaling its reach. - Diversified & High-Growth Domain Mix

The mix of business domains (cybersecurity, cloud, ALM, data center, ILM) positions it to capture multiple growth areas as digital transformation accelerates. E.g., cybersecurity is growing rapidly; cloud / hybrid cloud is also a fast-growing area. - Experience and Delivery Capability

With 15+ years of business maturity, thousands of customer engagements, and local presences in multiple geographies, they are relatively well-placed in terms of technical & managerial capability. Also, internal processes (lean/agile), CoE (centre of excellence) for cloud/hybrid, pre-integrated solution stacks strengthen their ability to deliver. - Financials & Growth

They’ve shown healthy growth in revenue & profitability. For example, profit after tax (PAT) has been rising year-on-year in recent financial years; metrics like ROE, ROCE are strong.

Risks

Despite its strengths, there are risks and challenges to watch out for. Some of them are disclosed in its IPO / DRHP, others inferred from the business model:

- Dependence on OEMs and Top Partners

A large portion of its gross sales is tied to a limited set of OEMs (and their ability to supply, price, contractual terms). If OEMs change strategy, cut prices, or choose to go more direct, it could harm iValue’s offering. - Concentration / Credit Risks via System Integrators and Customers

Since it sells through SIs and has many enterprise customer contracts, there is exposure to delays or defaults in payments, or weaker cash flow when customer projects are delayed. Also, some of its business is not backed by long-term, exclusive agreements, which can result in variability. - Technological / Market Change / Competitive Pressure

The domains they operate in are fast-evolving (cloud, cybersecurity, ILM etc.). Staying current on certifications, adopting new technologies, keeping talent, and maintaining margins amidst competition from global firms or disruptive smaller players is a constant risk. - Working Capital and Cash Flow Pressures

The distribution/integration business tends to have long receivable cycles (days sales outstanding are relatively high), costs for importing OEM products (import duties, exchange rate risks), inventory / procurement risks, etc. Also, the IPO disclosures show some variation or decline in revenue in certain years (e.g. a 2% drop in FY24 compared to FY23) while profits rose due to cost controls. - Geographical / Regulatory / Currency Risks

Having operations in multiple countries helps diversification, but also exposes company to foreign regulatory environments, import-export restrictions, exchange rate fluctuations, and political / economic instability in those regions. Also, reliance on imported OEM hardware/software means exposure to global supply chain issues.

Financial Performance Overview (₹ in Crore)

| Particulars | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 796.82 | 780.23 | 922.68 |

| Profit | 59.92 | 70.57 | 85.30 |

| Total Assets | 1080.19 | 1004.25 | 1162.67 |

Revenue

- FY 2023: ₹796.82 crore

- FY 2024: ₹780.23 crore

- FY 2025: ₹922.68 crore

Revenue slightly declined in FY 2024 (-2.1%) but rebounded strongly in FY 2025, rising 18.3% compared to FY 2024. This shows recovery in demand and better business momentum.

Profit

- FY 2023: ₹59.92 crore

- FY 2024: ₹70.57 crore

- FY 2025: ₹85.30 crore

Profit consistently improved year-on-year. Despite revenue drop in FY 2024, profit increased 17.7%, suggesting good cost control and efficiency. In FY 2025, profit surged 20.9%, in line with revenue growth.

Total Assets

- FY 2023: ₹1080.19 crore

- FY 2024: ₹1004.25 crore

- FY 2025: ₹1162.67 crore

Assets dipped by 7% in FY 2024, possibly due to lower working capital or repayment of liabilities. However, FY 2025 shows strong growth of 15.8%, aligning with revenue expansion and business scaling.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.