Goel Construction IPO Overview

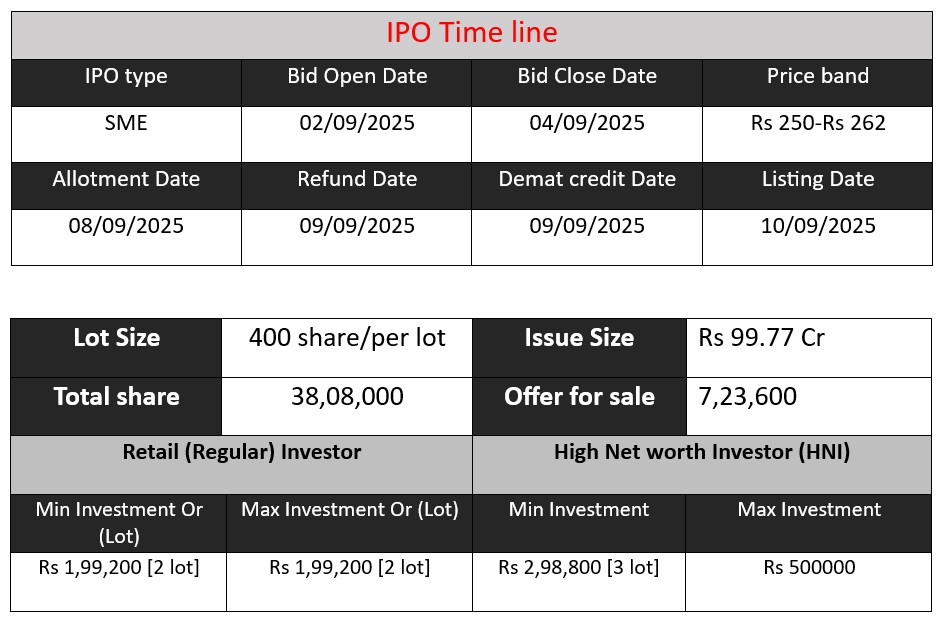

Goel Construction Company Ltd IPO opens on September 2, 2025, and closes on September 4, 2025, with an issue size of ₹99.77 crore comprising 38.08 lakh shares at a price band of ₹250–₹262. The IPO raises fresh capital of ₹75.82 crore and includes an offer for sale of ₹18.96 crore. Proceeds are intended for capital expenditure, repayment of borrowings, and general corporate purposes, with listing scheduled on BSE–SME

Goel Construction Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 88.90 |

| NIIs | 208.37 |

| Retails | 77.42 |

| Total | 70.85 |

| Last Updated: 05 Sep 2025- 5 PM Source: NSE/BSE | |

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 48 | 250-262 |

| Last Updated: 04 Sep 2025- 5 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Goel Construction Core Business & Overview

Established in 1997, and headquartered in Jaipur, Rajasthan, Goel Construction Company Ltd. (GCCL) is a seasoned civil construction firm led by directors with decades of experience. The company specializes in civil and structural engineering across diverse industrial and infrastructure sectors.

Sectoral Scope & Project Footprint

GCCL operates pan-India, with completed projects in states such as Rajasthan, Madhya Pradesh, Maharashtra, Haryana, Punjab, Uttar Pradesh, Jharkhand, Odisha, and Karnataka.

Key Project Types

The company has a strong track record in constructing: Cement plants, Power plants, Dairy plants, Steel plants, Institutional and residential buildings, Pharmaceutical and hospital projects

GCCL prides itself on timely and high-quality execution, supported by a robust workforce of hundreds of engineers and thousands of skilled workers. It has earned recognition from major clients like UltraTech Cement, Shree Cement, and JK Lakshmi Cement. Impressively, the company has maintained a clean record with no contract rescissions or litigations since its inception.

Strengths

- Diverse Sectoral Presence & Turnkey Capability

GCCL’s ability to deliver across cement, power, steel, dairy, pharma, institutional, and residential sectors demonstrates extensive versatility. - Proven Execution & Strong Orderbook

In the last three years, GCCL completed 18 projects valued at approximately ₹1,03,320.40 lakhs and, as of February 28, 2025, holds 14 ongoing projects with an order book of ₹48,861.97 lakhs. - Reputation for Reliability

The company has built a reputation for on-time delivery, contractual integrity, and no litigation history, supported by a credible workforce and technical proficiency.

Potential Risks

While not deeply detailed in publicly available corporate marketing materials, sources such as the IPO prospectus outline several key risk considerations:

- Dependence on Industrial Sector Volatility

Given its strong focus on industrial projects (e.g., cement, power, dairy), any slowdown or shift in capital expenditure within these sectors could impact business inflows. - Project Execution Risks

Construction companies naturally face risks such as cost overruns, delays, supply chain disruptions, and regulatory challenges. Efficient project management remains critical, although GCCL appears experienced in this regard. - Order Book Concentration & Pipeline Sustainability

While the current order book is solid, long-term growth depends on winning new projects. Maintaining a steady pipeline amid competitive and economic dynamics is essential.

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 270.73 | 14.30 | 205.04 |

| FY 2024 | 386.06 | 22.64 | 219.51 |

| FY 2025 | 589.98 | 38.22 | 265.09 |

Revenue

- FY 2023: ₹270.73 crore

- FY 2024: ₹386.06 crore

- FY 2025: ₹589.98 crore

Revenue has shown consistent and strong growth (117% in two years), reflecting robust business expansion.

Profit

- FY 2023: ₹14.30 crore

- FY 2024: ₹22.64 crore

- FY 2025: ₹38.22 crore

Profit margins are improving steadily, with profits nearly tripling in three years, indicating better cost management and operational efficiency.

Total Assets

- FY 2023: ₹205.04 crore

- FY 2024: ₹219.51 crore

- FY 2025: ₹265.09 crore

Assets are increasing, showing strong capital base and reinvestment in business operations to support growth.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.