GNG Electronics IPO Overview

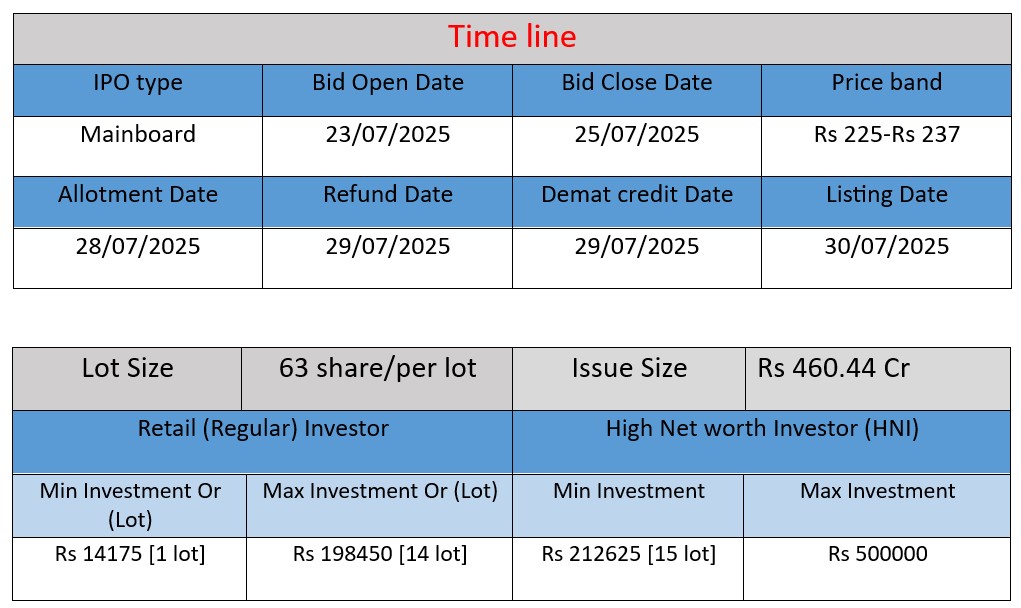

GNG Electronics Limited’s IPO opens July 23, 2025 and closes July 25, 2025, with allotment expected by July 28 and listing on July 30. Total issue size is ₹460.44 crore, comprising a ₹400 crore fresh issue and ₹60.44 crore OFS. Proceeds will be used for debt repayment ,funding working capital, and general corporate purposes

GNG Electronics IPO Subscription Status

| Subscription Rate Source: NSE/BSE | |||

| Category | Shares Offered | Shares Bid For | Subscription (x) |

| QIBs | 40,24,755 | 1,07,14,35,582 | 266.21x |

| NIIs | 30,49,167 | 69,04,84,788 | 226.45x |

| Retails | 71,14,722 | 32,24,12,076 | 45.32x |

| Employees | – | – | 0.00x |

| Total | 1,41,88,644 | 2,08,43,32,446 | 146.90x |

| Last Updated: 25 July 2025 Time: 5 PM (Note: This data is updated every 2 hours) Get instant updates on WhatsApp – Join now! | |||

IPO Key Date

Core Business & Overview

- Refurbishment of ICT Devices

GNG Electronics, founded in 2006, specializes in refurbishing laptops, desktops, servers, tablets, and other ICT hardware. Operating under the brand name Electronics Bazaar, it offers full-cycle services—from sourcing and refurbishment to sales, after-sales support, and warranty services domestically and globally. - Global Footprint & Certifications

They run five refurbishment facilities across India (Navi Mumbai), the US (Texas), and UAE (Sharjah). Certified by Microsoft (Authorized Refurbisher) and holding R2v3 accreditation, they can legally refurbish devices and offer licensed software. - Integrated Services

Besides refurbishing, GNG provides IT asset disposition (ITAD), e‑waste management, onsite installation, doorstep services, and manages buyback programs in partnership with vendors like HP and Lenovo.

Strengths

- Market Leadership

Recognized as the largest laptop and desktop refurbisher in India and a top player globally in ICT device refurbishment. - Diversified Global Reach

Revenue is split ~75% from overseas markets (USA, Europe, UAE, Africa) and ~25% from Indian markets. - Robust Network & Partnerships

- Over 4,154 sales touchpoints and presence in 38 countries.

- Partners with OEMs like HP, Lenovo, Microsoft, Dell, Amazon, etc., holding certifications that enhance credibility.

- Experienced Leadership & ESG Focus

Led by promoter Sharad Khandelwal, boasting nearly 30 years in ICT. They emphasize sustainability via repair-over-replacement and e-waste management.

Potential Risks

- Supplier & Customer Concentration

Heavy dependency on a few suppliers for components (e.g., RAM, HDDs) and on top 10 customers (46–56% of revenue). Disruptions could hinder operations or margins. - High Working Capital & Debt Levels

- Working capital days rose to 68 in FY25 (from 42 in FY24), stressing cash flow.

- Debt/equity ratio is elevated (~2.7× including leases), with low interest coverage (~0.25× for FY25 & FY24).

- CARE Ratings highlights the working capital intensity and risk of leveraged balance sheet.

- Market & Regulatory Risks

- Exposure to currency fluctuations and geopolitical shifts due to global operations.

- Risks from rising material costs (parts, software), tech obsolescence, and refurbishment competition.

Outcome

GNG Electronics holds a leading position in the ICT device refurbishment sector, backed by:

- Strong topline and bottomline growth

- Strategic global diversification

- OEM certifications boosting credibility

- Deepening presence across markets and channels

However, investors and stakeholders should weigh significant counterforces, especially:

- Concentration in laptop revenues

- Elevated working capital and debt levels

- Supplier/customer dependency

While the IPO flow is geared towards debt reduction and working capital bolstering, the company’s medium-term trajectory hinges on how well it manages these risks. The outlook remains cautiously optimistic if it sustains revenue growth, improves margins, and deleverages its balance sheet.

Financial Performance Analysis (in ₹ Crore)

| Particulars | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 659.54 | 1138.14 | 1411.11 |

| Profit | 32.43 | 52.30 | 69.03 |

| Assets | 285.50 | 585.82 | 719.46 |

Revenue

- FY 2023: ₹659.54 crore

- FY 2024: ₹1138.14 crore

- FY 2025: ₹1411.11 crore

Analysis:

The company’s revenue more than doubled in two years (↑114%). This indicates rapid business expansion, most likely driven by global demand for refurbished ICT products and an expanded footprint in overseas markets.

Profit

- FY 2023: ₹32.43 crore

- FY 2024: ₹52.30 crore

- FY 2025: ₹69.03 crore

Analysis:

Profit has grown consistently, rising over 113% from FY23 to FY25. This shows operational efficiency and good cost control, despite the increase in scale and working capital needs.

Total Assets

- FY 2023: ₹285.50 crore

- FY 2024: ₹585.82 crore

- FY 2025: ₹719.46 crore

Analysis:

Assets have grown significantly, over 150%, reflecting the company’s investments in inventory, infrastructure, and receivables to support its growing operations. The asset base expansion is aligned with revenue growth.

Summary

GNG Electronics has demonstrated strong and consistent financial growth over the last three years. Revenue and profit have more than doubled, and the asset base has expanded substantially. While the growth is impressive, investors should also be cautious of the associated increase in working capital and debt. If the company manages these risks effectively, it appears to be on a solid growth path.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.