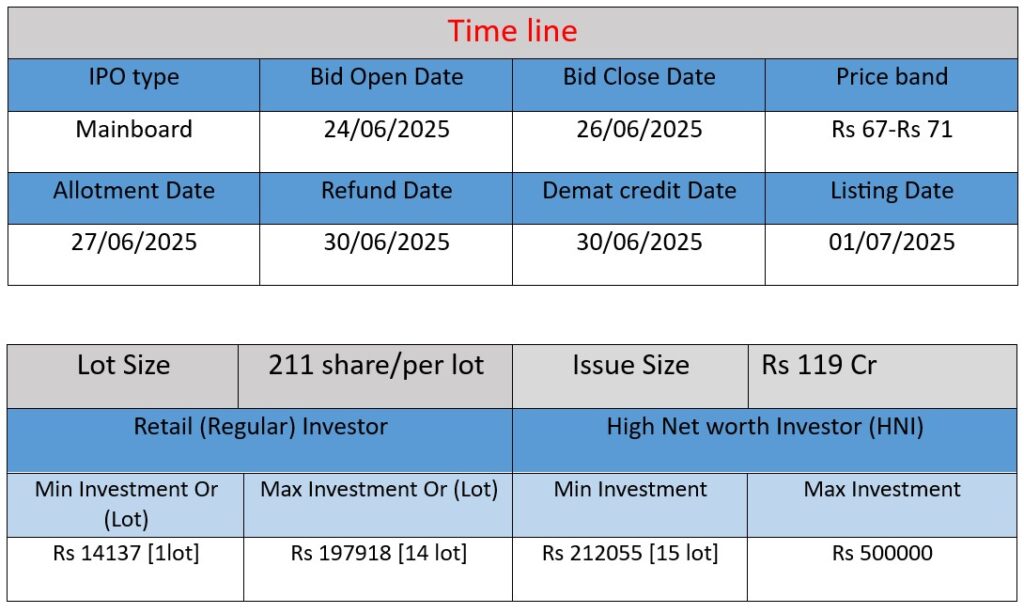

Globe Civil Projects IPO opens on June 24 with a price band of ₹67–71 per share. The issue size is ₹119.00 crore (100% fresh issue). Proceeds will be used for working capital, equipment purchase, and general corporate purposes. The company, a leading EPC contractor in civil infrastructure, aims to strengthen its project execution capacity and financial position. Listing will take place on BSE and NSE..

Work (Business Operations & Projects)

- Integrated EPC specialist: Headquartered in New Delhi, Globe Civil Projects is an engineering, procurement, and construction (EPC) company. It operates across 11 Indian states—Uttar Pradesh to Himachal Pradesh—delivering transport & logistics, social & commercial, and non-infrastructure projects like commercial offices and housing.

- Project portfolio: Over the last two decades, the company has completed 37 projects and currently has 12 ongoing—5 social/commercial, 3 transport/logistics, 3 residential, and 1 office building.

- Capabilities expansion: Initially focused on educational institutions and railway infrastructure, they’ve diversified into specialized infrastructure (railway bridges, airport terminals), along with MEP, HVAC, architectural, structural, and firefighting systems.

Strengths

- Engineering excellence & safety culture: Promoted as leaders in quality and complex structures, Globe emphasises a “No One Gets Hurt” safety mantra, dedicating ~65% of corporate training to safety.

- Solid order book & credentials: As of August 31, 2024, the order book stood at ₹892.95 cr. Recognized as a CPWD Class‑1 Super contractor, they can bid for projects up to ₹650 cr

- Experienced leadership & project management: Strength lies in capable management with proven execution ability, expanding geographical reach, and enhancing pre-qualification qualifications.

Risks

- Employee sentiment concerns: With a rating of just 3.3/5 on AmbitionBox from 30+ employees—particularly low marks for career growth (2.8/5), job security (3.0/5), and overall compensation (3.0/5)—the company might face internal challenges.

- Heavy reliance on new capital: The IPO proceeds (~₹119 cr) earmarked for working capital and equipment suggest dependence on fresh funding for operations.

- IPO market & valuation risks: Investor appetite will shape subscription; company valuation, grey-market trading sentiment, and broader EPC sector trends could affect aftermarket stock performance .

- Client mix limited: With around 89% promoter-held equity, public float is small (~11.86%), potentially impacting liquidity. Dependence on government contracts also exposes them to policy/regulatory volatility.

Investor take: Globe Civil Projects demonstrates solid growth and market positioning within India’s EPC sector. If government infrastructure investments sustain, the IPO could succeed. However, potential investors should weigh internal HR issues, funding reliance, and broader market sentiment. Checking grey‑market premiums and management’s strategic guidance may offer further clarity.

Here is a brief financial performance analysis across FY2022 to FY2024:

Revenue

- FY2022: ₹285.71 Cr

- FY2023: ₹233.34 Cr

- FY2024: ₹332.16 Cr

Analysis:

The revenue saw a decline in FY2023 but jumped significantly in FY2024, growing by ~42% YoY, indicating improved project execution and possibly larger or more lucrative contracts.

Profit (PAT)

- FY2022: ₹5.31 Cr

- FY2023: ₹4.99 Cr

- FY2024: ₹15.23 Cr

Analysis:

Profit more than tripled in FY2024 compared to FY2023, reflecting better cost control, operational efficiency, or higher-margin projects. A very positive financial indicator ahead of the IPO.

Total Assets

- FY2022: ₹229.79 Cr

- FY2023: ₹275.04 Cr

- FY2024: ₹317.83 Cr

Analysis:

Assets have consistently grown, showing strong capital investment, increased project base, and asset expansion—suggesting long-term operational growth and strengthening of the balance sheet.

📌 Summary

- Globe Civil Projects has shown strong recovery and growth in FY2024 in both revenue and profitability.

- Continuous asset growth supports their long-term sustainability and capacity expansion.

- The improved financials support the rationale behind their ₹119 Cr IPO, aimed at capitalizing on infrastructure growth in India.