Glaxy Medicare IPO Overview

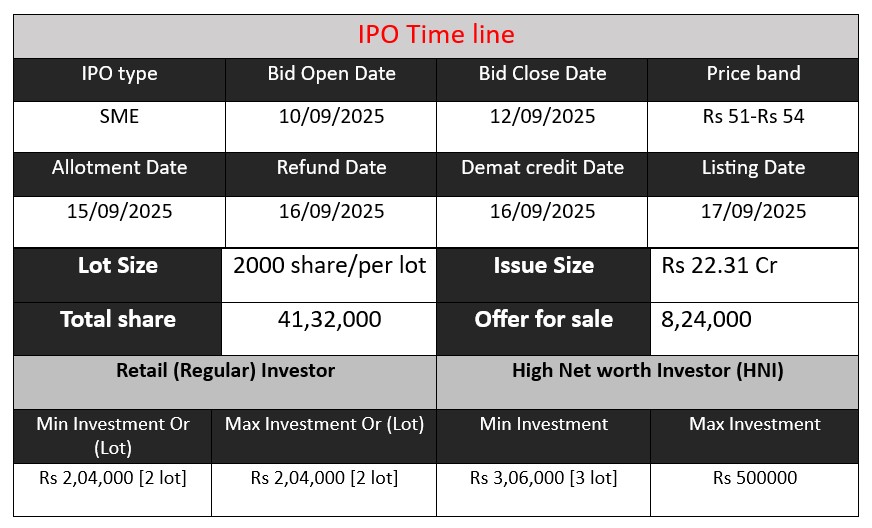

Galaxy Medicare Ltd launches its ₹22.31 cr IPO from Sept 10–12, 2025, offering 41.32 lakh equity shares at ₹51–₹54 each. The issue includes a fresh issue of 33.08 lakh shares and an offer-for-sale of 8.24 lakh shares, aimed at funding machinery expansion, working capital, and general corporate purposes. Subscribe before the close on Sept 12

Glaxy Medicare GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 5 | 51-54 |

| Last Updated: 11 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Galaxy Medicare Core Business & Overview

Galaxy Medicare Limited is a public limited company by incorporation (CIN: U24232OR1992PLC003113), founded on July 23, 1992. It is headquartered in Bhubaneswar, Odisha, India, and operates primarily in the manufacturing of medical consumables, including surgical dressings, plaster of Paris (POP) bandages, adhesive tapes, compression bandages, gauze products, and wound care items.

The company is ISO 9001:2015 and ISO 13485:2016 certified, reflecting its adherence to quality and regulatory standards in medical device manufacturing.

It serves various markets, including domestic institutional sales (e.g., government tenders via GEM Portal), exports, OEM partnerships, and direct branding under names including POP BAND, G CAST, GYPSOSOFT, CARETAPE, among others.

Strengths

- Well-Established Legacy & Certifications

With more than three decades in operation since 1992, the company has developed strong manufacturing pedigree. The ISO accreditations further underline its commitment to quality. - Diversified Sales Channels & Products

Galaxy Medicare operates with multiple revenue streams: branded products, OEM contracts, institutional/government tenders, and exports. Its wide product portfolio caters to varied healthcare needs. - Strong Financial Trajectory

For the financial year ending March 31, 2024, the company posted revenue between ₹25–50 crore, with EBITDA up 118.8 %, net profit up 135.9 %, and net worth improved by 19.95 %. Borrowings declined by about 11 %, enhancing financial health.

Risks

- Scale & Capital Constraints

Despite growth, Galaxy Medicare remains a relatively small entity (revenue under ₹50 crore). It may face limitations in scaling operations, securing large contracts, or investing significantly in new technology. - Market Exposure & Competition

The medical consumables market is highly competitive, with numerous domestic and international players. The company’s modest size could make maintaining pricing and market share challenging, especially against larger firms. - Dependence on Tender & Export Demand

A segment of its revenue comes from institutional/government tenders and exports. Policy shifts, procurement cycles, or global trade uncertainties can create revenue volatility. Additionally, compliance with evolving medical device regulations (both domestic and abroad) could pose operational risks.

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 31.2 | 1.57 | 32.31 |

| FY 2024 | 36.15 | 3.71 | 32.53 |

| FY 2025 | 39.2 | 3.37 | 31.49 |

Revenue

- FY 2023: ₹31.2 Cr

- FY 2024: ₹36.15 Cr

- FY 2025: ₹39.2 Cr

Revenue has grown steadily year-on-year. From FY23 to FY24, it increased by about 15.9%, and from FY24 to FY25, by around 8.4%. This indicates consistent demand and market expansion, though growth pace slowed slightly in FY25.

Profit

- FY 2023: ₹1.57 Cr

- FY 2024: ₹3.71 Cr

- FY 2025: ₹3.37 Cr

Profit more than doubled in FY24, showing improved cost management and higher margins. However, FY25 saw a decline to ₹3.37 Cr, despite revenue growth. This suggests increased expenses, pressure on margins, or higher interest/finance costs.

Total Assets

- FY 2023: ₹32.31 Cr

- FY 2024: ₹32.53 Cr

- FY 2025: ₹31.49 Cr

Assets remained stable in FY23 and FY24 but declined in FY25. This drop could indicate depreciation, asset sales, or lower reinvestment, possibly linked to liquidity management or efficiency optimization.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.