Fabtech Technologies IPO Overview

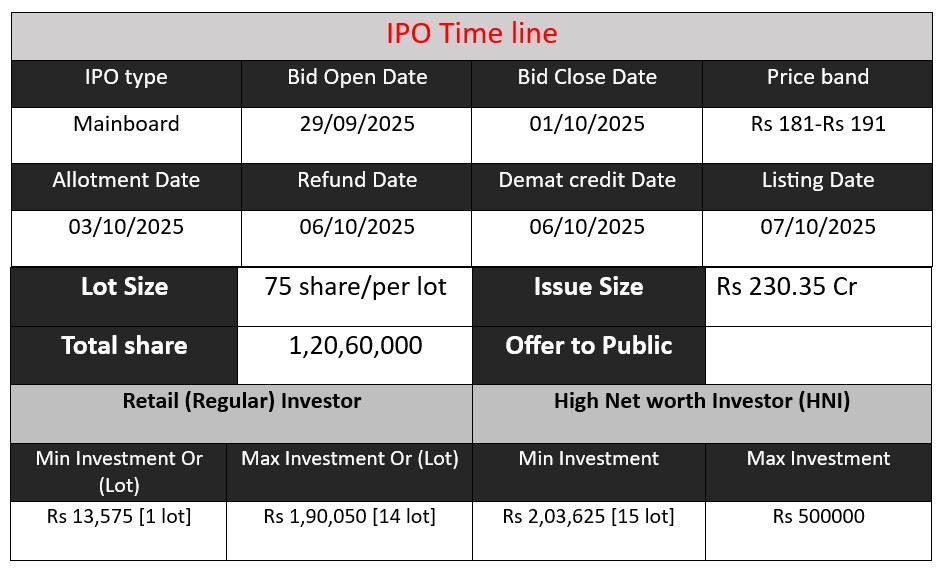

Fabtech Technologies is launching a ₹230.35 cr mainboard IPO via a fresh issue of 1,20,60,000 shares at a price band of ₹181–₹191. The IPO opens on 29 September 2025 and closes on 1 October 2025, with listing expected around 7 October 2025. Proceeds will be used for working capital, inorganic growth (acquisitions) and general corporate purposes.

Fabtech Technologies GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 0 | 181-191 |

| Last Updated: 3 Oct 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Fabtech Technologies Core Business & Overview

Fabtech describes itself as a provider of end-to-end turnkey engineering solutions for the pharmaceutical, biotech, and healthcare sectors.

Their services span design, engineering, procurement, installation, testing, validation, etc., for critical systems such as clean air, clean water, process equipment, modular panels, and containment infrastructure.

They also supply specialized equipment such as pharmaceutical granulation machinery, coating systems, blenders, etc., for drug manufacturing facilities.

One of its subsidiaries or related entities, Fabtech Technologies Cleanrooms Ltd, focuses especially on pre-engineered modular cleanroom panels, doors, partitions, HVAC, and associated infrastructure (from design through validation) serving biotech, pharma, healthcare, electronics, etc.

The group is vertically integrated to some extent — meaning they try to offer a “one-stop” solution from concept to commissioning.

The company is relatively global in reach: it claims to have served clients in many countries (over 50+), and delivers projects across regions (GCC, MENA, ECO, etc.).

According to its recent annual report, the mission emphasizes making life-saving medicines accessible and affording scalable infrastructure for pharmaceutical manufacturing.

Historical / structural notes

- The broader Fabtech “group” consists of multiple legal entities under the Fabtech umbrella (Cleanrooms, international, installation, etc.).

- The company has grown through project orders, and often works in project (capex) mode rather than recurring product sales.

Strengths

- Strong market position & domain experience

- The promoters and management have long experience in this niche industry, giving them deep technical understanding and client relationships.

- It has established relationships with many major pharmaceutical, biotech, and healthcare firms.

- Because of its turnkey / integrated offering, clients may prefer dealing with a single vendor for multiple parts rather than coordinating multiple subcontractors. This can be a competitive edge.

- Relatively healthy financial risk profile (as per rating agencies)

- The CRISIL rating rationale notes a relatively comfortable capital structure (low leverage) and strong interest coverage.

- CRISIL (in a 2023 update) affirmed ratings for Fabtech’s international arm, citing “above average financial risk profile.”

- The group reportedly had a robust order backlog (on the order of > ₹700 crore as per the CRISIL rationale) which provides medium-term revenue visibility.

- Diversification across geographies & project types

- Fabtech claims to serve multiple regions (including GCC, MENA, ECO, Asia) which reduces dependence on any single national market’s cyclicality.

- They are able to do both Greenfield and Brownfield projects, and also offer standalone modules (equipment procurement) besides full turnkey.

- Asset-light model (per IPO / industry commentary)

- The IPO preview notes that Fabtech intends to operate on an “asset-light” basis: the company will not own all manufacturing assets itself but source equipment from related parties or vendors — focusing its own capital on project execution and management. This can reduce capital intensity and risk.

- This model allows flexibility and scalability without large fixed asset burdens.

These strengths give Fabtech plausible competitive advantages in its niche, especially among firms that need integrated, validated solutions in pharma/biotech.

Risks

No company is without risk, and Fabtech has several specific challenges. Here are at least three material ones, drawn from credible sources:

- Working capital intensity / receivables / project cash cycles

- The CRISIL rating reports highlight that the company’s operations are working capital intensive, with gross current assets in past years spanning 250–480 days. A lot of this comes from receivables, retention money, and project completion delays.

- Because the company must carry project costs (purchasing equipment, paying vendors) before full realization of revenue, any delay in payment or extension in receivable cycles can strain cash flows.

- If clients delay payments, or if project completion is held up, there is a risk of liquidity stress.

- Limited pricing flexibility & raw material volatility

- Fabtech is serving demanding, high-end users (pharma, biotech) who may have strong bargaining power, limiting how much margin the company can pass through.

- Also, key raw materials such as aluminum, stainless steel, specialty alloys, and modules can fluctuate in international markets. Sudden cost surges may compress margins unless passed on (which may not always be possible).

- In modular / cleanroom panel business, international competitors may put downward price pressure. CRISIL notes competition from international players in modular panels.

- Revenue / order concentration & project risk

- A large share of revenue comes from turnkey engineering projects (versus recurring maintenance or consumables). Turnkey projects are typically lumpy, non-recurring, and subject to conversion risk (i.e., bidding -> order is not guaranteed). The IPO write-up explicitly warns “uncertain revenue visibility.”

- The IPO commentary highlights that the top 5 clients contributed significant fractions (e.g. 53-74%) of revenues in some years. This client concentration means losing or delaying a large client order could materially affect revenue.

- Since many contracts are overseas, the company is exposed to geopolitical, regulatory, taxation, and currency risks in various jurisdictions.

- Execution risk & project overruns

- In complex engineering and validation-intensive sectors (pharma, biotech), delays, technical challenges, regulatory changes, or failure to meet compliance norms can lead to cost overruns, client claims, or project rework. While not always explicitly stated in reports, this is a general risk in this kind of business.

- If the group undertakes large debt-funded capex, that could destabilize the debt structure (CRISIL mentions this as a negative factor).

- Dependency on external demand & cyclical capex environment

- Pharmaceutical and biotech capital expenditure cycles depend heavily on regulatory shifts, public health funding, global demand, and government policies. A downturn or slowing in industry investments can reduce new orders.

- Also, currency fluctuations or import/export restrictions may affect international business profitability.

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Total Assets |

| FY 2023 | 193.8 | 21.73 | 213.86 |

| FY 2024 | 226.14 | 27.22 | 269.23 |

| FY 2025 | 326.67 | 46.45 | 426.56 |

Revenue

- FY 2023: ₹193.8 Cr.

- FY 2024: ₹226.14 Cr. (Growth of 16.7%)

- FY 2025: ₹326.67 Cr. (Strong growth of 44.5%)

Fabtech’s revenue shows consistent growth, with an exceptional jump in FY 2025. This reflects stronger order execution and possibly larger or more international projects. The accelerating growth rate indicates rising demand for its turnkey pharma/biotech solutions.

Profit

- FY 2023: ₹21.73 Cr.

- FY 2024: ₹27.22 Cr. (Growth of 25.3%)

- FY 2025: ₹46.45 Cr. (Growth of 70.7%)

Profits are growing at a faster pace than revenues, suggesting improved operating efficiency, better project margins, or controlled costs. FY 2025’s 71% jump in profit shows strong financial execution. The profit margin improved significantly, highlighting better cost management and stronger client demand.

Total Assets

- FY 2023: ₹213.86 Cr.

- FY 2024: ₹269.23 Cr. (Growth of 25.9%)

- FY 2025: ₹426.56 Cr. (Growth of 58.4%)

The company’s assets are expanding rapidly, aligning with its business growth. Asset growth in FY 2025 (58% jump) suggests significant investments in infrastructure, equipment, or project-related assets to support larger orders. It also shows increasing financial strength.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.