Ecoline Exim IPO Overview

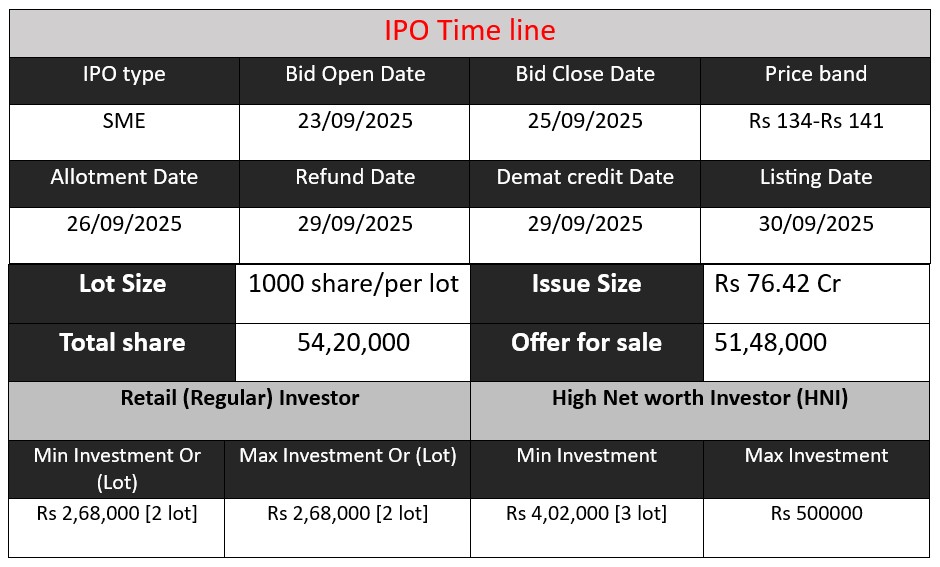

Ecoline Exim Ltd is launching an IPO of ₹76.42 crore, offering 54,20,000 equity shares (fresh issue of 43,40,000 shares and an offer-for-sale of 10,80,000 shares) at a price band of ₹134-141 per share (face value ₹10). The IPO opens on 23 September 2025, closes on 25 September 2025, and is intended to fund a new manufacturing unit in Ahmedabad and for general corporate purposes.

Ecoline Exim GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 9 | 134-141 |

| Last Updated: 25 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Ecoline Exim Core Business & Overview

Ecoline Exim Limited was founded in 2008 and is headquartered in Kolkata, West Bengal, India. The company is engaged in manufacturing sustainable, biodegradable packaging and promotional bags — especially cotton bags, jute bags, and other “made up” articles like aprons.

It is export-oriented: it serves overseas markets including the EU, USA, Japan, Southeast Asia, Mexico etc. It holds various certifications: BSCI audit (important for supply to European supermarkets & retail chains), Global Recycled Standard, Organic Content Standard, etc.

Infrastructure: 4 manufacturing units in Kolkata and Ahmedabad with 217,000 sq. ft. total in certain key units; annual stitching capacity 45.5 million bags.

Strengths

From the sources, here are some of Ecoline Exim’s stated strengths:

- Sustainable / Eco-friendly business model: Given global demand for reducing plastic, biodegradable packaging and alternatives (cotton, jute etc.) are in demand. Ecoline is positioned in this trend.

- Certifications & compliance: Being certified under recognized international standards helps its export credibility.

- Manufacturing capacity & export network: Multiple units, large stitching capacity, and a wide client base overseas.

- Financial performance (recent years): For FY25, revenue ₹269.29 crore; EBITDA ₹29.99 crore; profit after tax ₹18.82 crore.

Risks

The sources also outline several risk factors:

- Dependence on certain key customers: If a major customer relationship is lost, it could adversely affect revenue.

- Raw material supply: No long-term contracts for raw materials; dependence on certain suppliers; risk of supply disruptions or price volatility.

- Operational/production risks: Facilities can have unplanned slowdowns, shutdowns; outages etc. Any disruption in manufacturing capacity can severely affect operations.

- Labour risks: Labour unavailability, demands for higher wages, or regulatory changes can impact costs and operations.

- Implementation risk for expansion: Planned factory units or backward integration initiatives involve capital expenditure, possible delay and cost overruns. Gains may not come immediately.

- Demand / market risk: The demand for cotton/jute bags etc. is influenced by changing consumer preferences, fashion/design trends, regulations, pricing etc. These may change.

Financial Performance Overview (₹ in Crore)

| Particulars | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 303.66 | 272.18 | 269.29 |

| Profit | 18.86 | 22.59 | 18.82 |

| Assets | 104.46 | 128.72 | 146.31 |

Revenue

- FY 2023: ₹303.66 crore

- FY 2024: Fell to ₹272.18 crore (-10.37%).

- FY 2025: Slightly down again to ₹269.29 crore (-1.06%).

Trend shows declining revenue for two consecutive years, indicating pressure on sales volumes or pricing.

Profit

- FY 2023: ₹18.86 crore

- FY 2024: Improved to ₹22.59 crore (+19.7%) despite lower revenue, showing better cost control or margin management.

- FY 2025: Dropped back to ₹18.82 crore (-16.7%).

Profitability is volatile — management efficiency improved in FY 2024, but FY 2025 slipped again, possibly due to higher costs or reduced demand.

Assets

- FY 2023: ₹104.46 crore

- FY 2024: Increased to ₹128.72 crore (+23.2%).

- FY 2025: Further increased to ₹146.31 crore (+13.7%).

Asset base is expanding steadily, showing continuous investment in growth and capacity. However, revenues are not keeping pace, raising efficiency concerns.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.