हिंदी में पढ़ने के लिए मेनू बार से हिंदी भाषा चयन करें।

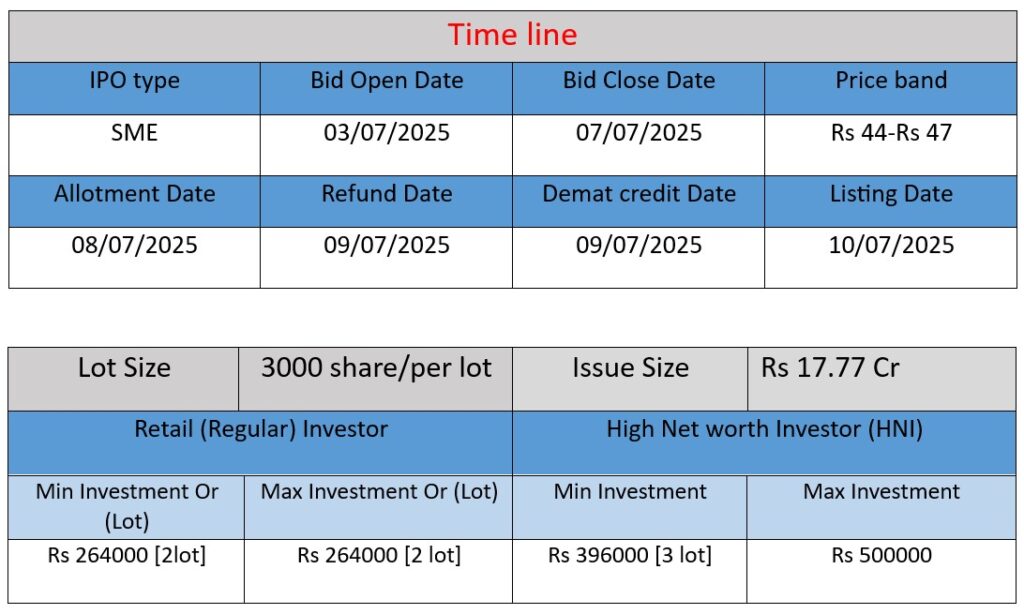

Cryogenic OGS Ltd is launching a fresh SME IPO from July 3 to July 7, 2025, aiming to raise ₹17.77 crore through issuance of 37.8 lakh equity shares (face value ₹10) at a price band of ₹44–₹47 per share. The proceeds will fund working capital and general corporate purposes, with shares set to list on BSE SME on July 10, 2025. Retail investors can bid in lots of 3,000 shares

Company Core Work

- Founded in 1997, headquartered in Vadodara, Gujarat, with an ~8,300 m² facility and 50–200 employees.

- Designs, engineers, fabricates and tests fluid control equipment—including basket strainers, air eliminators, prover tanks, dosing skids, and truck/wagon loading skids—for oil, gas, chemicals, petrochemical and even liquor industries.

- ISO-certified (9001, 45001, 14001) and adheres to API, ASME, ATEX standards; supplies turnkey and critical skids, and has served major clients like IOCL, BPCL, HPCL, ABB, Honeywell, Emerson.

Strengths

- Proprietary precision technology and ability to customize complex systems, ensuring high performance and reliability .

- Experienced leadership and skilled workforce, with 22+ years in industry and stable management.

- Strong certifications & compliance, boosting credibility for bidding and quality assurance.

- Loyal and diversified clientele, with longstanding relationships with large public and private sector firms.

Risks

- Client concentration: Top 10 customers contribute nearly 89% of revenue in FY25—loss of any key customer could significantly impact business.

- Regional exposure: Over 80% of revenue from Gujarat/Maharashtra, exposing the firm to localized economic/regulatory risks.

- Supplier dependence & input volatility: Relies on key vendors; raw material price fluctuations could erode margins .

- Product liability & warranty issues: Past “defective warranties” could lead to extra costs, brand damage, or customer attrition.

- Missing historical filings: Lapses in company incorporation/annual filings from 1997–2002 may carry legal or reputational risk.

Conclusion

Cryogenic OGS is a specialist precision-engineering firm with strong technical capability, debt-free finances, and solid YoY growth. Its certifications and marquee clients position it well to address sophisticated demands in fluid processing industries.

However, its high dependency on few customers, regional concentration, and some operational/back-office weaknesses—particularly in corporate compliance and supplier risk—introduce caution.

Overall, the company shows well-structured fundamentals and growth potential, making its IPO attractive—especially given the relatively low valuation (P/E ~8) compared to peers (~26). But prospective investors should balance this with concentration and compliance risks before participating.

Financial performance

Revenue

- FY2022: ₹23.33 crore

- FY2023: ₹22.02 crore

- FY2024: ₹24.25 crore

Analysis:

The company experienced a slight dip in revenue in FY2023 but recovered in FY2024, achieving a 10.1% growth over the previous year. The overall revenue trend shows stability with a positive growth outlook, indicating sustained business demand.

Profit (PAT)

- FY2022: ₹3.28 crore

- FY2023: ₹4.08 crore

- FY2024: ₹5.38 crore

Analysis:

Profit after tax has shown consistent and healthy year-on-year growth—24.4% in FY2023 and 31.8% in FY2024. This reflects effective cost control, improved margins, and operational efficiency.

Total Assets

- FY2022: ₹22.43 crore

- FY2023: ₹24 crore

- FY2024: ₹28.34 crore

Analysis:

The asset base has steadily increased, growing by 26.3% over 2 years, indicating reinvestment into the business and potential for scale. This suggests financial discipline and capital asset expansion to support future operations.

Conclusion

Cryogenic OGS Limited has demonstrated resilient financial growth across revenue, profitability, and asset expansion. With profits growing faster than revenue, the company is improving its efficiency. The consistent increase in assets also reflects strategic scaling. Overall, these trends signal a financially sound company with positive future prospects, especially attractive for long-term investors.