Connplex Cinemas IPO Overview

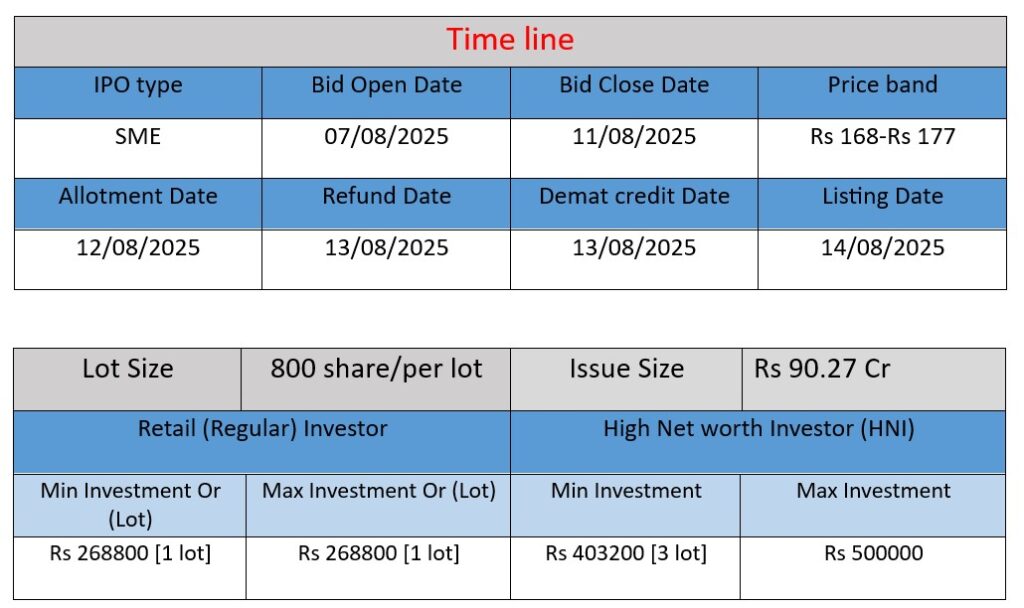

Connplex Cinemas IPO opens August 7, 2025, and closes August 11, 2025, raising ₹90.27 crore via a fresh issue of 51 lakh equity shares. Price band is ₹168–₹177 per share. The net proceeds will fund capital expenditure (corporate office, LED screens and projectors), working capital, IPO expenses and general corporate purposes. Shares will list on the NSE SME platform, with allotment on August 12 and expected listing on August 14, 2025.

Connplex Cinemas Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 40.27 |

| NIIs | 49.06 |

| Retails | 22.20 |

| Total | 30.79 |

| Last Updated: 11 Aug 2025 Time: 10 PM (Note: This data is updated every 2 hours) Source: NSE/BSE | |

| GMP (₹) | IPO Price (₹) |

| 15 | 177 |

| Last Updated: 11 Aug 2025 Time: 10 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

- Incorporated in 2015, Connplex operates boutique cinema theatres across India under its “CONNPLEX” brand using a franchise-based model (both FOFO and FOCO types). The company designs, builds, and operates smart mini-theatres through franchises, collecting revenues from ticket sales, food & beverages, advertisements, and private events.

- As of March 31, 2025, it operates 25 cinemas with 66 screens and over 5,060 seats, present in cities like Ahmedabad, Rajkot, Patna, and Bhagalpur, focusing on Tier‑2 to Tier‑4 markets underserved by large multiplex chains.

Strengths

- Asset-Light, Scalable Franchise Model

Its FOFO/FOCO model enables quick expansion with minimal capital outlay, allowing Connplex to grow efficiently across diverse markets. - Diversified Revenue Streams

Beyond ticket sales, revenue comes from F&B, advertising, event bookings, and convenience fees—lowering dependence on any single source. - Premium, Tech-Driven Customer Experience

Cinemas feature recliner seating, Dolby Atmos sound, 2K projection, and distinct formats—Express, Signature, Luxuriance—to cater to varied audiences.

Potential Risks

- Franchise Reliance & Quality Control

The heavy dependence on franchisees introduces risks related to inconsistent service or operational standards, which could damage the brand. - Competitive Pressure

Faces intense competition from large multiplex chains (e.g., PVR‑INOX) and OTT platforms—particularly in more urban or Tier 1 environments. - Revenue Sensitivity to Content & Footfall

Business performance is closely tied to film releases and customer turnout—poor content can significantly impact earnings. - Execution Risk in Expansion

Delays in launching new theatres or tech rollouts (e.g., 2K projection) could disrupt growth.

Financial Performance Overview (₹ in Crore)

| Financial Year | Revenue | Profit | Total Assets |

| FY 2023 | ₹25.37 Cr | ₹1.65 Cr | ₹27.96 Cr |

| FY 2024 | ₹60.30 Cr | ₹4.09 Cr | ₹36.40 Cr |

| FY 2025 | ₹95.61 Cr | ₹19.01 Cr | ₹61.12 Cr |

Revenue

The company’s revenue has steadily increased from ₹25.37 Cr in FY23 to ₹95.61 Cr in FY25—a 276% rise in just two years, reflecting rapid business expansion and increasing ticket & service sales.

Profit Growth:

Net profit grew sharply from ₹1.65 Cr in FY23 to ₹19.01 Cr in FY25—over 11x growth, showing improved cost control, strong occupancy, and effective revenue diversification.

Assets Expansion:

Total assets also rose significantly, indicating expansion in infrastructure (e.g., new cinemas, equipment, office space) to support higher operations.

✅ Pros

- Asset-light franchise model enables rapid expansion with low capital.

- Strong revenue and profit growth over the last three years.

- Presence in underserved Tier-2 to Tier-4 cities with less competition.

- Diversified income from tickets, F&B, ads, and events.

- Tech-enabled premium viewing experience (Dolby Atmos, recliners, 2K projection).

❌ Cons

- Heavy reliance on franchisees may affect quality and brand control.

- Highly dependent on film releases and content success.

- Faces competition from OTT platforms and big cinema chains.

- Rapid expansion brings execution and operational risks.

- SME IPO may have lower liquidity and higher price volatility.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.