Classic Electrodes IPO Overview

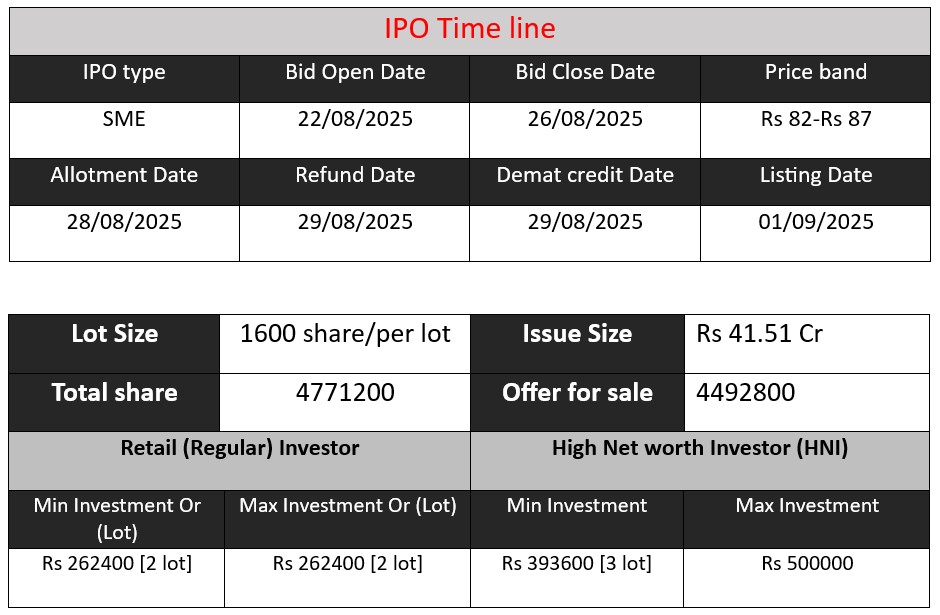

Classic Electrodes (India) Ltd has launched an SME IPO of ₹41.51 cr, offering 47.71 lakh fresh shares at ₹82–87 each. The issue opens on August 22, 2025 and closes on August 26, 2025. Proceeds will fund capital expenditure, repay borrowings, and support working capital. The IPO aims to fuel growth and strengthen its industrial manufacturing capabilities.

Classic Electrodes Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 3.01 |

| NIIs | 20.68 |

| Retails | 20.68 |

| Total | 14.35 |

| Last Updated: 25 Aug 2025 8 PM Source: NSE/BSE | |

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 20 | 82-87 |

| Last Updated: 25 Aug 2025 8 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

- Founded in 1997 and headquartered in Kolkata, West Bengal, Classic Electrodes (India) Limited specializes in manufacturing welding consumables, including a broad product range such as electrodes and MIG (Metal Inert Gas) wires.

- The company operates two manufacturing units: one in Dhulagarh, West Bengal, and another in Jhajjar, Haryana.

- Its product suite is extensive and includes:

- Mild steel electrodes

- Stainless steel electrodes

- Cast iron electrodes

- Deep-penetration electrodes

- Low-alloy, low-hydrogen, and other specialized electrodes

- MIG wires.

Strengths

- Quality & Certifications

Classic Electrodes holds several internationally recognized certifications:- ISO 9001, ISO 14001, ISO 45001

- CE (Conformité Européenne)

- Bureau of Indian Standards (BIS)

Additionally, it is approved by major Indian and global institutions such as BHEL, NTPC, ONGC, RDSO/ICF, Lloyd’s Register, IBR, among others.

- Advanced Manufacturing & R&D

The company emphasizes cutting-edge technology, with continuous R&D efforts, state-of-the-art infrastructure, and quality control supervised by experienced engineers.

Risks

- Raw Material Cost Volatility

The company may face cost fluctuations due to reliance on imported raw materials—a vulnerability in a competitive commodity-driven industry. - Intense Competition

It competes against large, well-established domestic and international players in welding consumables, which could pressure margins and market share. - Financial Leverage & Scale Constraints

A moderate debt-to-equity ratio (1.23) suggests some leverage. As an SME, the company may also face scale limitations compared to larger industry peers

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2022 | 133.84 | 1.45 | 74.99 |

| FY 2023 | 150.87 | 2.08 | 76.79 |

| FY 2024 | 193.82 | 12.28 | 92.20 |

Revenue

- FY 2022: ₹133.84 Cr

- FY 2023: ₹150.87 Cr (+12.7% YoY)

- FY 2024: ₹193.82 Cr (+28.4% YoY)

Revenue has grown steadily, showing strong business expansion, especially in FY 2024.

Profit

- FY 2022: ₹1.45 Cr

- FY 2023: ₹2.08 Cr (+43.4% YoY)

- FY 2024: ₹12.28 Cr (+490% YoY)

Profit jumped sharply in FY 2024, indicating improved operational efficiency and margin expansion.

Total Assets

- FY 2022: ₹74.99 Cr

- FY 2023: ₹76.79 Cr (+2.4% YoY)

- FY 2024: ₹92.20 Cr (+20.1% YoY)

Asset base is expanding, reflecting capacity growth and capital investment to support operations.

✅ Pros

- Strong revenue growth with ~20% CAGR over 3 years.

- Profit surged sharply in FY24, showing better margins.

- Approved by reputed institutions (BHEL, NTPC, ONGC, etc.).

- Wide product range in welding consumables and MIG wires.

- Expanding asset base indicates capacity growth.

- Certified with ISO, CE, BIS for quality assurance.

- IPO funds to be used for capex, debt repayment, and working capital.

❌ Cons

- High dependence on raw material prices may affect margins.

- Faces tough competition from larger global and domestic players.

- Moderate debt-to-equity (1.23) adds financial risk.

- SME IPOs generally have lower liquidity in the secondary market.

- Business growth sensitive to industrial and infrastructure cycles.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.