Chiraharit IPO Overview

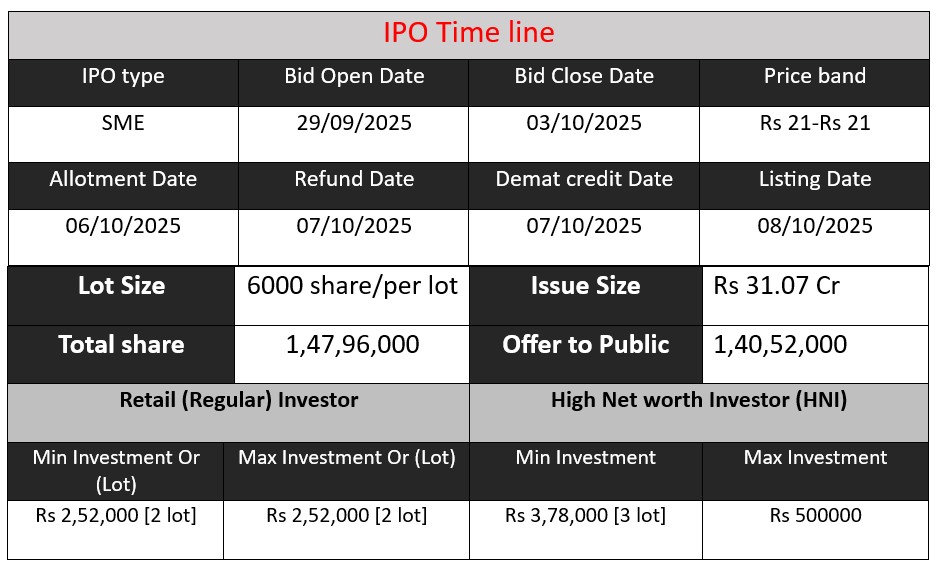

Chiraharit Limited IPO opens on September 29, 2025, and closes on October 3, 2025, with an issue size of ₹31.07 crore. The IPO offers shares at a price of ₹21 per share. Funds raised will be used for business expansion, working capital, and infrastructure development in water management and renewable energy projects. Listing is planned on BSE SME Platform, offering investors an opportunity to participate in a high-growth infrastructure company.

Chiraharit GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 0 | 21 |

| Last Updated: 6 Oct 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Chiraharit Core Business & Overview

Chiraharit Limited, headquartered in Hyderabad, Telangana, is a prominent player in India’s water movement and application solutions sector. Established in 2006 as Brahmani Ventures Private Limited, the company is now a part of the Malaxmi Group, focusing on sustainable infrastructure projects across agriculture, drinking water, and renewable energy sectors.

Operations

Chiraharit specializes in turnkey Engineering, Procurement, and Construction (EPC) solutions, offering:

- Water Management: Design and execution of piped water systems, pressurized irrigation networks, landscape irrigation, and solar module cleaning systems.

- Renewable Energy: Construction of Compressed Bio-Gas (CBG) plants, encompassing civil, mechanical, and pumping system solutions.

The company boasts a robust order book of ₹51.38 crore as of August 2025, indicating strong demand for its services.

Strengths

- Established Track Record: Proven experience in executing large-scale infrastructure projects.

- Diverse Portfolio: Engagement in both water and renewable energy sectors, reducing dependency on a single market.

- Experienced Management: Led by a skilled team with a strong focus on quality assurance and customer relations.

- Financial Growth: Significant increase in revenue from ₹30.56 crore in FY2024 to ₹59.63 crore in FY2025, and a remarkable rise in Profit After Tax (PAT) from ₹0.60 crore to ₹6.02 crore during the same period.

Risks

- Geographic Concentration: Operations primarily in Andhra Pradesh and Telangana may expose the company to regional risks.

- Sector Concentration: Heavy reliance on water and renewable energy sectors could impact performance if these markets face downturns.

- Supply Chain Dependencies: Dependence on suppliers and technology partners for critical components may pose operational challenges.

Financial Performance Overview (₹ in Crore)

| Financial Metric | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 32.89 | 30.56 | 59.63 |

| Profit | 0.42 | 0.60 | 6.02 |

| Total Assets | 22.71 | 25.77 | 40.58 |

Revenue

- FY 2024 saw a slight decline in revenue from ₹32.89 Cr to ₹30.56 Cr, a decrease of 7%.

- FY 2025 witnessed a massive jump to ₹59.63 Cr, almost doubling from FY 2024.

- This indicates strong business growth, possibly due to new orders or expansion in operations.

Profit

- Profit remained very low in FY 2023 and FY 2024 (₹0.42 Cr and ₹0.60 Cr).

- FY 2025 showed a significant surge to ₹6.02 Cr, reflecting improved operational efficiency, better margins, or successful project execution.

- Profit growth has clearly outpaced revenue growth, suggesting enhanced profitability.

Total Assets

- Assets grew steadily from ₹22.71 Cr in FY 2023 to ₹40.58 Cr in FY 2025.

- This increase aligns with business expansion and may include investments in infrastructure, equipment, and working capital.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.