Chatterbox Technologies IPO Overview

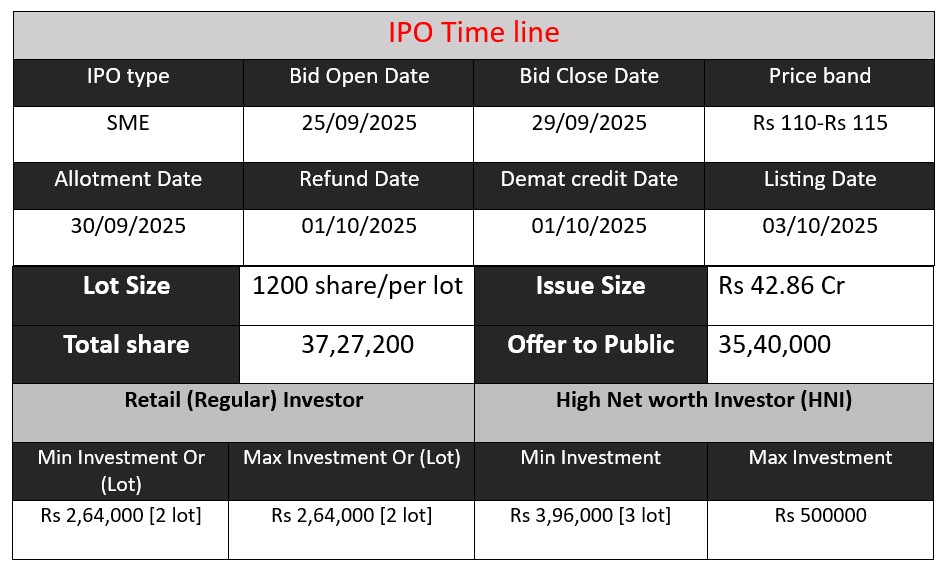

Chatterbox Technologies Limited IPO opens on September 25, 2025, and closes on September 29, 2025. The issue size is ₹42.86 crore with shares priced between ₹110-115. Funds will be used for capital requirements, setting up a new office and studio, brand building, working capital, and general corporate purposes. Investors can participate through BSE SME platform.

Chatterbox Technologies GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 12 | 110-115 |

| Last Updated: 29 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Chatterbox Technologies Core Business & Overview

Chatterbox Technologies Limited is an Indian digital marketing and influencer marketing company, incorporated on March 3, 2016, in Mumbai, Maharashtra. The company operates through two primary business segments: Chtrbox and Chtrsocial.

Chtrbox serves as an influencer marketing platform that connects brands with social media influencers, primarily on platforms like Instagram. Chtrsocial focuses on social media management services, assisting businesses in managing their online presence and engagement across various social media platforms.

Core Offerings

- Influencer Marketing: Chtrbox facilitates collaborations between brands and influencers to create authentic content that resonates with target audiences.

- Social Media Management: Chtrsocial provides services to manage and enhance a brand’s presence on social media platforms, including content creation, scheduling, and engagement strategies.

- Campaign Execution: The company has executed over 1,000 campaigns involving approximately 500 influencers, showcasing its extensive experience and capability in handling diverse marketing initiatives.

Strengths

- First-Mover Advantage: As one of the early entrants in India’s influencer marketing industry, Chatterbox has established strong industry connections and a robust network of influencers.

- Experienced Leadership: The company is led by experienced promoters and management with deep industry expertise, contributing to strategic growth and innovation.

- Diversified Service Portfolio: Chatterbox offers a comprehensive range of services, including influencer marketing and social media management, catering to various client needs and enhancing its market competitiveness.

Risks

- Client Concentration: The company may face risks associated with a high dependency on a limited number of clients, which could impact revenue stability.

- Platform Dependency: A significant reliance on social media platforms for campaign execution exposes the company to risks related to platform policy changes and algorithm updates.

- Market Competition: Intensifying competition from digital marketing and ad-tech players may lead to margin compression and increased pressure on market share.

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 39.91 | 1.28 | 17.4 |

| FY 2024 | 54.85 | 8.53 | 24.01 |

| FY 2025 | 59.12 | 8.85 | 39.84 |

Revenue

- FY 2024 revenue increased significantly from ₹39.91 crore in FY 2023 to ₹54.85 crore, a growth of approximately 37.5%, showing strong business expansion.

- FY 2025 revenue further grew to ₹59.12 crore, an increase of around 7.8%. Although growth slowed compared to FY 2024, it still indicates consistent upward momentum.

Profit

- FY 2024 profit surged from ₹1.28 crore in FY 2023 to ₹8.53 crore, a massive increase of 567%, indicating better cost management and operational efficiency.

- FY 2025 profit was ₹8.85 crore, a modest growth of 3.7%, showing stabilization in profit margins despite slower revenue growth.

Assets

- Total assets grew from ₹17.4 crore in FY 2023 to ₹24.01 crore in FY 2024 (38% growth), and then sharply to ₹39.84 crore in FY 2025 (66% growth), reflecting investments in infrastructure, working capital, and expansion activities.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.