Cash Ur Drive Marketing IPO Overview

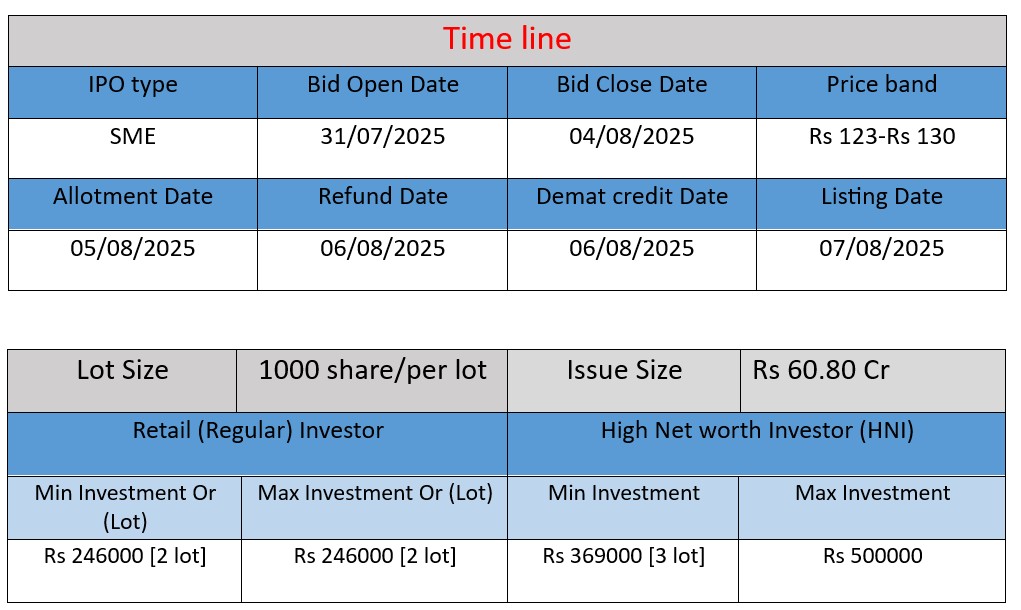

Cash Ur Drive Marketing Ltd’s SME IPO (₹60.79 Cr) opens on July 31, 2025, and closes on August 4, 2025. Offering 46.76 lakh shares (fresh issue of 44.69 lakh shares and OFS of 2.07 lakh shares) at a price band of ₹123–₹130/share. Proceeds will fund working capital, technology upgrades, capital expenditure and general corporate purposes. Shares expected to list on NSE Emerge/SME on August 7, 2025.

Cash Ur Drive Marketing Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 54.49 |

| NIIs | 118.90 |

| Retails | 50.35 |

| Total | 43.83 |

| Last Updated: 5 Aug 2025 Time: 5 PM (Note: This data is updated every 2 hours) Source: NSE/BSE | |

| GMP (₹) | IPO Price (₹) |

| 30 | 130 |

| Last Updated: 5 Aug 2025 Time: 5 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

- Established in July 2009, Cash Ur Drive Marketing Ltd. is headquartered in Noida, India, with branch operations in Chandigarh, Lucknow, Mumbai, and Noida.

- The company specializes in out-of-home (OOH) and transit advertising, particularly vehicle-wrap branding across cabs, autos, buses, and electric vehicles. They also provide print, digital wall painting, billboard, and event-based advertising services, offering end-to-end campaign solutions.

Strengths

- Low debt profile: Total borrowings stood at a minimal ₹0.18 crore in FY25, improving financial flexibility and reducing leverage risk.

- ESG/digital edge: Special focus on EV-based advertising via branding on electric buses, cabs, and charging/battery-swapping stations; holds long-term ad rights across 98 EV charging locations along with orders for 1,100 EV buses, aligning with sustainable business trends.

- Accreditations and partnerships: Registered with DAVP and INS, and associated with government-driven campaigns (e.g., Ganga mission, Kumbh Mela) and IPL teams, enhancing credibility and reach.

Potential Risks

Industry concentration risk: Heavy dependence on vehicle-wrap and transit media could expose the firm to shifts in the OOH advertising ecosystem or regulatory changes in transit spaces.

- Legal & contingent liabilities: Like any advertiser handling public domains and campaigns, potential litigation or disputes could impact operations or reputation, though specifics aren’t disclosed publicly.

- Competitive market pressure: Competes in a crowded OOH space with players like Bright Outdoor Media and DAPS Advertising, requiring constant innovation to sustain margins and market share

Financial Performance Overview (₹ in Crore)

| Financial Year | Revenue | Profit (PAT) | Total Assets |

| FY 2023 | ₹79.41 | ₹5.14 | ₹76.33 |

| FY 2024 | ₹93.75 | ₹9.22 | ₹93.36 |

| FY 2025 | ₹139.32 | ₹17.68 | ₹94.39 |

Revenue

- The company’s revenue increased steadily from ₹79.41 crore in FY23 to ₹139.32 crore in FY25.

- This shows 76% growth over 2 years, indicating strong market demand and expansion in services like EV-based advertising and transit branding.

Profit

- Net profit grew sharply from ₹5.14 crore in FY23 to ₹17.68 crore in FY25 — a 244% increase.

- This reflects better margin control, higher efficiency, and improved pricing power.

Total Assets

- Assets rose from ₹76.33 crore to ₹94.39 crore during the same period.

- The asset base grew slower than profits, which shows that the company is using its resources efficiently to drive higher returns.

✅ Pros

- Capital raised will support business expansion and working capital.

- Debt is minimal, indicating strong financial health.

- Strong growth in revenue and profit over the last 3 years.

- Focus on EV and transit advertising aligns with future trends.

- Experienced in large campaigns with government and IPL clients.

❌ Cons

- Heavy dependence on the outdoor advertising sector.

- Competitive market with many players.

- Limited asset growth compared to profit surge.

- Risk of changes in advertising regulations.

- Small-cap SME listing may lead to limited liquidity post-listing.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (DRHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.