Canara Robeco AMC IPO Overview

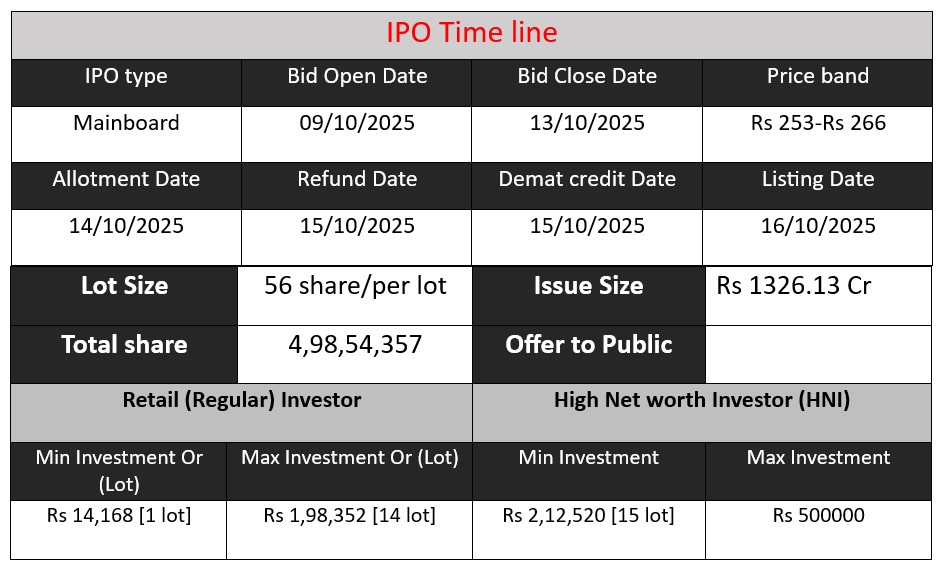

Canara Robeco AMC’s IPO opens Oct 9 and closes Oct 13, 2025. It is a 100% Offer-for-Sale of 49854357 equity shares (face value ₹10) by promoters Canara Bank and ORIX, with no fresh capital raised. The issue size is ₹1,326 crore. Proceeds will go entirely to selling shareholders. Key objectives: achieve stock exchange listing, provide liquidity to existing investors, and raise public visibility.

Canara Robeco AMC GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 13 | 253-266 |

| Last Updated: 14 Oct 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Basic Detail

Canara Robeco AMC Core Business & Overview

The AMC was incorporated on 2 March 1993. It is a joint venture between Canara Bank (holding 51 %) and ORIX Corporation Europe N.V. (holding 49 %) (formerly Robeco)

Core Work:

The primary business is asset management / mutual fund operations, managing various schemes (equity, debt, hybrid) under the Canara Robeco Mutual Fund brand. It also provides investment advisory services on Indian equities to Robeco Hong Kong (a part of the promoter group) It earns management fees and other fees based on the assets under management (AUM) of its funds. The AMC operates under the regulatory framework of SEBI for mutual funds in India.

Scale / AUM / Reach (recent):

- As of 30 September 2025, its website states its AUM (per RTA records) is about ₹1,17,605 crores.

- According to its Red Herring Prospectus (RHP) / public disclosures, as of June 30, 2025, it managed 26 schemes (12 equity, 10 debt, 4 hybrid) with a Quarterly Average AUM (QAAUM) of ₹1,110.52 billion (i.e. ₹1,11,052 crores).

- It has a broad distribution network: as of June 2025, it had 52,343 empaneled distribution partners and 25 branches/offices across India.

- Its reach is enhanced by leveraging the promoter, particularly Canara Bank’s branch network (Canara Bank has 9,861 branches)

Historical / Brand Legacy:

- The AMC traces its roots to Canbank Mutual Fund (sponsored by Canara Bank). Over time, Robeco (a global asset manager) took a stake, and the AMC was rebranded as “Canara Robeco.”

- It is often described as India’s second-oldest AMC.

Strengths

Here are several key strengths of Canara Robeco AMC, based on available information:

- Strong Parentage & Brand Leverage

- Being backed by Canara Bank (a large public-sector bank) gives it brand credibility, trust, and access to bank branch infrastructure.

- The association with Robeco (global asset management firm) brings global investment expertise, research methodologies, and institutional experience.

- Growing Scale and Profitability

- The AMC has shown strong growth in both revenue and profits over recent years.

- It operates an asset-light business model (typical of AMCs), which allows high return on equity and efficient cost structures.

- Distribution Network & Retail Focus

- A large number of distribution partners (52,343 as of June 2025) ensures reach beyond just major cities.

- Ties with Canara Bank help reach retail investors via bank branches.

- Focused Equity Strategy / Performance Track Record

- The AMC’s focus on equity-oriented schemes is significant: as of June 30, 2025, 91.17 % of its QAAUM was in equity-oriented schemes.

- Some schemes have long term track records (e.g. some equity schemes are managed for over 10 years) and are designed to outperform benchmarks over long horizons.

- Scope for Growth in Indian Mutual Fund Industry

- The mutual fund industry in India has been growing strongly, with rising financialization, SIP inflows, and increasing retail participation. This macro tailwind benefits AMCs in general.

Risks

Even with its strengths, Canara Robeco AMC faces several risks and challenges. Here are at least three key ones:

- Market Volatility / AUM Sensitivity

The AMC’s revenues are closely tied to the size of assets under management (AUM). In equity-heavy periods, market downturns or volatility could lead to outflows or lower valuations, affecting fee income.

- High Concentration / Asset Class Risk

- The heavy tilt toward equity (91.17 % of QAAUM) means less diversification; adverse equity market performance would disproportionately affect the business.

- Further, distribution or client concentration might pose risk (e.g. significant reliance on Canara Bank distribution channels). Some analyses point to “Distribution Concentration” as a risk.

- Regulatory / Compliance Risk and Brand Transition

- The AMC currently uses “Canara” and “Robeco” trademarks under licensing agreements. Post-IPO, it may need to transition branding or deal with intellectual property / licensing risks.

- The AMC operates in a heavily regulated space (SEBI, tax, audit) where regulatory changes or compliance lapses can have material consequences.

- Competitive Pressure :The mutual fund / AMC industry in India is intensely competitive, with established giants like HDFC AMC, SBI AMC, ICICI Prudential AMC, Nippon India AMC etc. Maintaining or growing market share will be challenging.

- IPO Structure / Dilution & No Fresh Capital

- The IPO is structured as a 100 % Offer for Sale (OFS), meaning the company itself doesn’t raise fresh capital from the market; the promoters are merely reducing stakes. Thus, the business gains no additional capital cushion from the IPO.

- Because no fresh funds are raised, the AMC must rely entirely on its internal cash flows for growth, expansion, and investments in technology, marketing, etc.

- Dependence on Distribution / Promoter Channel: A portion of its distribution relies on Canara Bank and other bank networks. Changes in the relationship, or performance of bank distribution, may affect inflows.

- Macroeconomic / Interest Rate Risks (for debt schemes): For non-equity (debt or hybrid) schemes, interest rate movements, credit risks, and macroeconomic factors (inflation, interest rate hikes, credit defaults) can impact the performance, and thereby investor confidence. (This is a generic risk for mutual funds / debt schemes, applicable to this AMC as well.)

Financial Performance Overview (₹ in Crore)

| Particulars | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 204.59 | 318.09 | 403.69 |

| Profit (PAT) | 79.00 | 150.99 | 190.70 |

| Total Assets | 377.96 | 516.81 | 674.03 |

Revenue

- Growth: Revenue increased from ₹204.59 crore in FY 2023 to ₹403.69 crore in FY 2025 — nearly 97% growth in just two years.

- Reason: This sharp rise indicates expanding assets under management (AUM), higher management fees, and growing investor participation.

- Observation: Consistent year-on-year growth shows the AMC’s strong market presence and increasing trust among retail investors.

Profit

- Profit rose from ₹79 crore in FY 2023 to ₹190.7 crore in FY 2025 — a 141% increase.

- The profit growth rate is higher than the revenue growth rate, indicating better cost control and improved operational efficiency.

- The company’s asset-light model allows profits to scale faster once fixed expenses are covered, making the AMC business highly profitable as AUM expands.

Total Assets

- Total assets climbed from ₹377.96 crore to ₹674.03 crore between FY 2023 and FY 2025 — around 78% growth.

- Rising assets reflect strong internal accruals, higher retained earnings, and expansion of the company’s financial base.

- This upward trend suggests a solid balance sheet and ability to fund operations without heavy borrowing.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.