Canara HSBC Life Insurance IPO Overview

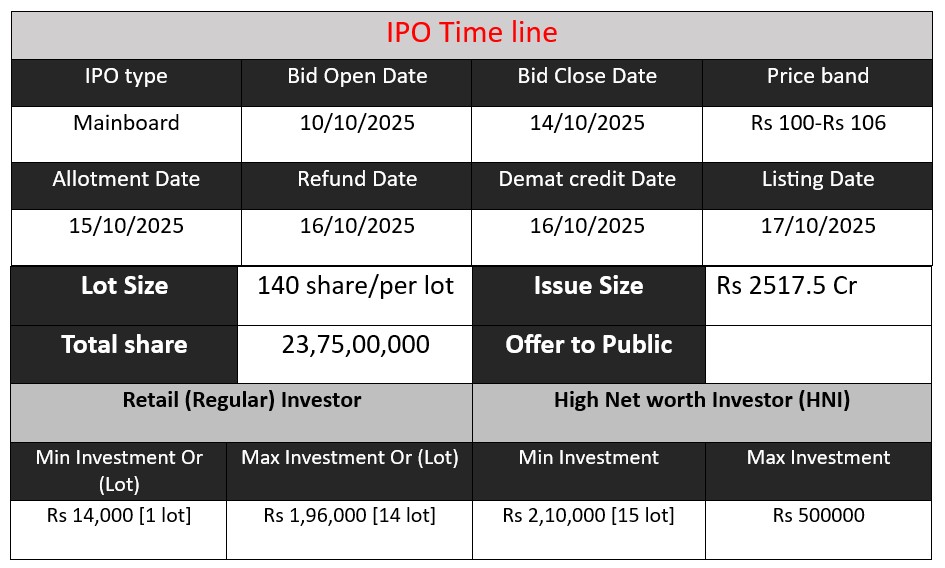

Canara HSBC Life Insurance’s IPO is a pure offer-for-sale (OFS) of 23.75 crore equity shares by promoters and existing shareholders, with no fresh issue. The issue size is ₹2,517.5 crore (at ₹100–₹106 per share). It opens on October 10, 2025, and closes on October 14, 2025. Proceeds go entirely to selling shareholders — the company itself will not receive IPO funds.

Canara HSBC Life Insurance GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 1 | 100-106 |

| Last Updated: 14 Oct 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Basic Detail

Canara HSBC Life Insurance Core Business & Overview

Canara HSBC Life Insurance was incorporated around 2007 (or early 2008) as a joint venture.

The principal promoters are:

- Canara Bank (major stakeholder)

- HSBC Insurance (Asia Pacific) Holdings Limited

In earlier times, Punjab National Bank (PNB) was also a partner; but the company later rebranded following PNB’s exit. - Headquarters & Presence

The company is headquartered in Gurugram (Gurgaon), Haryana, India.

It operates across India via multiple distribution channels, with particular strength in bancassurance (i.e., selling insurance via bank branches). - Business Lines / Products

Its offerings include life insurance, term life, unit-linked plans (ULIPs), endowment plans, money-back policies, whole life policies, retirement or pension plans, and employee benefit or group life schemes. - Recent Developments

- The company is preparing for an IPO (initial public offering) via an Offer for Sale (OFS) — i.e. existing shareholders will sell shares — and it has already secured SEBI’s nod to move forward.

- It is targeting margin recovery and channel expansion post-IPO.

Core Work / Business Model

To understand what the company does and how it generates revenue:

- Premium Collection & Renewal Business

Like any life insurer, a primary revenue source is the collection of insurance premiums (new business and renewals). Renewal premiums are important for stable cash flows and profitability. - Investment & Asset Management

The insurer invests the premium inflows into a mix of financial assets (government securities, corporate bonds, etc.). Investment returns contribute significantly to overall profitability. In many life insurers, part of the risk is borne within unit-linked portions (where policyholder bears investment risk). - Distribution & Bancassurance Focus

Canara HSBC Life emphasizes a multi-channel distribution strategy, with bancassurance (selling via bank branch networks) as a core channel. In fact, new business premiums from bancassurance form a large share of its business.

The company leverages the wide branch network of partner banks (especially Canara Bank) to reach customers across India. - Focus on Profitability, Solvency & Retention

The insurer strives to maintain high persistency (i.e. policyholders continuing to pay renewals), manage risk properly, maintain strong solvency (i.e. sufficient capital cushion), and deliver consistent profits.

Strengths

From rating agency reports, IPO documents, and market commentary, the following stand out as the company’s comparative advantages and strengths:

- Strong Promoter / Shareholder Backing & Brand Synergies

The backing by Canara Bank (a large public sector bank) and HSBC brings credibility, financial strength, and synergy in distribution and governance.

Rating agency CARE (in a report) explicitly cites the strong profile of shareholders and brand linkage as a key strength. - Robust Distribution via Bancassurance & Multi-Channels

Its bancassurance model gives it access to thousands of bank branches, enabling it to reach a wide customer base, especially in smaller towns and semi-urban regions.

The company has a pan-India reach across many bank branches via its partners. - Strong Financial Metrics / Solvency Position

- It has maintained a healthy solvency ratio — well above regulatory minimum norms — which suggests good buffer against shocks.

- Its investment portfolio is of high credit quality. One IPO analysis notes that 97.32% of investments are in AAA-rated domestic instruments.

- Improvement in customer retention (persistency metrics) is cited in some reports.

- The insurer is said to have been among the faster ones to reach profitability and sustain it in the life insurance industry.

- Diversified Product Portfolio

The range of life insurance, term, ULIP, endowment, retirement and group schemes allows it to address varying customer needs. This product diversity helps reduce dependence on any single product line. - Operational Efficiency & Risk Controls

Because much of its business flows through bancassurance, acquisition costs may be relatively lower (versus reliance only on agents).

Strong governance, monitoring, and backing by strong shareholders improve its ability to manage underwriting risk, claims, and capital allocation.

Risks

While the company has promising features, there are inherent risks and vulnerabilities:

- Heavy Dependence on Bancassurance / Distribution Risk

A large share of new business premiums comes from bancassurance. Any disruption in the relationship with key banks (e.g. contract changes, banks affiliating with competitors, regulatory or commission pressures) could materially impact business volume.

Because banks are allowed by regulation to tie up with multiple insurers, there is competitive pressure for shelf space and favorable terms. - Persistency / Lapse / Policyholder Behavior Risk

Insurance companies depend on policyholders continuing to pay premiums over long periods. If persistency weakens (i.e. frequent policy lapses or surrenders), the expected cash flows may deteriorate, hurting profitability and reserves. Many IPO prospectuses and analyses flag this as a risk.

Adverse changes in economic environment or financial stress on households may accelerate lapses. - Market / Investment Risk & Interest Rate Risk

Since part of the returns depends on investment portfolios, fluctuations in interest rates, bond yields, or market volatility can affect returns on invested assets. This becomes more critical especially in unit-linked segments where policyholders bear the investment risk.

Also, credit risk (if underlying investee entities default) though mitigated by high credit quality instruments, remains a possibility. - Regulatory / Compliance Risk

The life insurance business is heavily regulated (by IRDAI in India). Changes in regulatory norms (capital requirements, solvency norms, product rules, commission caps, investment restrictions) may affect profitability or operations.

Compliance lapses or adverse regulatory action (e.g. penalties, restrictions) could damage reputation and finances. - Competition & Market Share Pressure

The Indian life insurance sector is competitive and dominated by a few large players (e.g. LIC, SBI Life, HDFC Life, ICICI Prudential). Gaining market share, maintaining margins, and differentiating in a crowded space is challenging.

Also, if competitors offer more innovative digital solutions or cost advantages, Canara HSBC Life must keep pace. - Concentration / Single Partner Dependence

A large dependency on a few banks (notably Canara Bank) means that any issue with those partners disproportionately affects its operations.

Financial Performance Overview (₹ in Crore)

| Financial Year | Revenue | Profit | Assets |

| FY 2023 | 8,354.49 | 15.27 | 30,548.89 |

| FY 2024 | 11,755.71 | 75.65 | 37,815.80 |

| FY 2025 | 10,626.40 | 81.15 | 41,852.09 |

Revenue

- FY 2023 → FY 2024: Revenue grew 40.7%, indicating strong expansion — possibly driven by higher new business premiums and better policy renewals.

- FY 2024 → FY 2025: Revenue dropped 9.6%, suggesting a slowdown, which might be due to market volatility or moderation in new premium inflows.

Revenue increased from ₹ 8,354 cr to ₹ 10,626 cr — a net growth of ~27% over two years, reflecting a healthy long-term upward trend.

Profit

- FY 2023 → FY 2024: Profit rose sharply from ₹ 15.27 cr to ₹ 75.65 cr — a 395% increase, showing strong operational improvement, cost efficiency, or better investment returns.

- FY 2024 → FY 2025: Profit further increased to ₹ 81.15 cr, a 7% rise, indicating stability and consistent performance even with slightly lower revenue.

The steady rise in profit despite lower revenue in FY 2025 highlights improved underwriting margins and investment discipline.

Asset

- FY 2023 → FY 2024: Assets grew 23.8%, showing business expansion and higher investments.

- FY 2024 → FY 2025: Assets grew 10.7%, continuing a positive trajectory.

Assets increased from ₹ 30,549 cr to ₹ 41,852 cr — a total growth of 37%, suggesting strong capital accumulation and balance-sheet strengthening.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.