Bluestone Jewellery IPO Overview

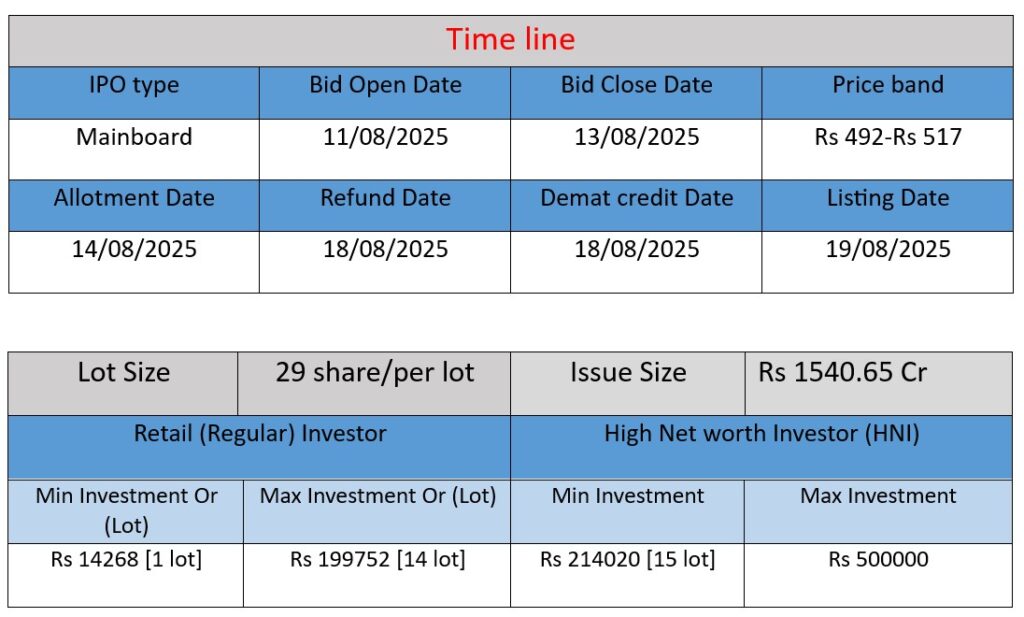

Bluestone Jewellery IPO opens on August 11, 2025, and closes on August 13, 2025, with an issue size of ₹1,540.65 crore. The offer includes a ₹820 crore fresh issue and a ₹720.65 crore Offer for Sale (OFS). Share price band is ₹492-₹517 per share. Funds will be used for working capital and general corporate purposes. Listing is scheduled for August 19, 2025, on BSE and NSE.

Bluestone Jewellery Subscription and GMP Status

| Subscription Rate Source: NSE/BSE | |||

| Category | Shares Offered | Shares Bid For | Subscription (x) |

| QIBs | 88,62,990 | 3,79,61,783 | 4.28 |

| NIIs | 45,90,859 | 25,19,549 | 0.55 |

| Retails | 30,60,572 | 40,12,266 | 1.31 |

| Employees | – | – | – |

| Shareholders | – | – | – |

| Total | 1,65,14,421 | 4,44,93,598 | 2.69 |

| Last Updated: 13 Aug 2025 Time: 4 PM (Note: This data is updated every 2 hours) | |||

| GMP (₹) | IPO Price (₹) |

| 517 | |

| Last Updated: 13 Aug 2025 Time: 4 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

Bluestone’s business model combines online and offline retail, with a presence in over 275 stores across 117 cities and towns in India. The company’s product offerings include daily wear, occasion-led, and contemporary jewellery designs, with a focus on diamond-studded pieces. Bluestone maintains in-house manufacturing facilities in Mumbai, Jaipur, and Surat, which contribute to its high gross margins.

Strengths

- Omnichannel Presence: Bluestone’s ability to integrate online and offline sales channels provides customers with a seamless shopping experience.

- Design Innovation: The company consistently introduces new jewellery collections, with six new collections launched in FY25, catering to evolving customer preferences.

- In-House Manufacturing: Bluestone’s vertically integrated operations enable better control over product quality and cost, enhancing its competitive edge.

Risks

- Financial Losses: The company reported a 56% increase in net losses, from ₹142 crore in FY24 to ₹222 crore in FY25, indicating challenges in achieving profitability.

- Declining Online Sales: Despite its digital-first approach, Bluestone’s online sales contribution decreased from 15% in FY23 to just 6% in FY25, raising concerns about the effectiveness of its online strategy.

- High Inventory Levels: The company has accumulated losses amounting to ₹2,458 crore as of March 31, 2025, which could impact its financial stability and operations.

Financial Performance Overview (₹ in Crore)

| Financial Year | Revenue | Profit | Assets |

| FY 2023 | 770.73 | -167.24 | 1255.49 |

| FY 2024 | 1265.84 | -142.24 | 2453.49 |

| FY 2025 | 1770 | -221.84 | 3532.28 |

Revenue:

Bluestone Jewellery’s revenue has shown strong growth over the three years, increasing from ₹770.73 crore in FY 2023 to ₹1770 crore in FY 2025. This indicates the company is expanding its sales and market reach steadily.

Profit:

Despite increasing revenue, the company has been operating at a loss each year. The losses reduced slightly from ₹-167.24 crore in FY 2023 to ₹-142.24 crore in FY 2024 but then increased again to ₹-221.84 crore in FY 2025. This suggests challenges in managing costs or scaling profitability.

Assets:

Total assets have grown significantly, nearly tripling from ₹1255.49 crore in FY 2023 to ₹3532.28 crore in FY 2025. This reflects investments in inventory, stores, manufacturing, or other operational assets to support growth.

✅ Pros

- Strong revenue growth over the last three years.

- Omnichannel presence with both online and offline stores.

- Vertically integrated manufacturing for better quality control.

- Focus on popular diamond and gemstone jewellery segments.

- Funds aimed at reducing debt and supporting expansion.

❌ Cons

- The company has reported consecutive net losses.

- Declining online sales contribution despite digital-first model.

- High inventory and operational costs impacting profitability.

- Competitive jewellery market with established players.

- IPO pricing on the higher side compared to peers.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.