Bharat Rohan Airborne IPO Overview

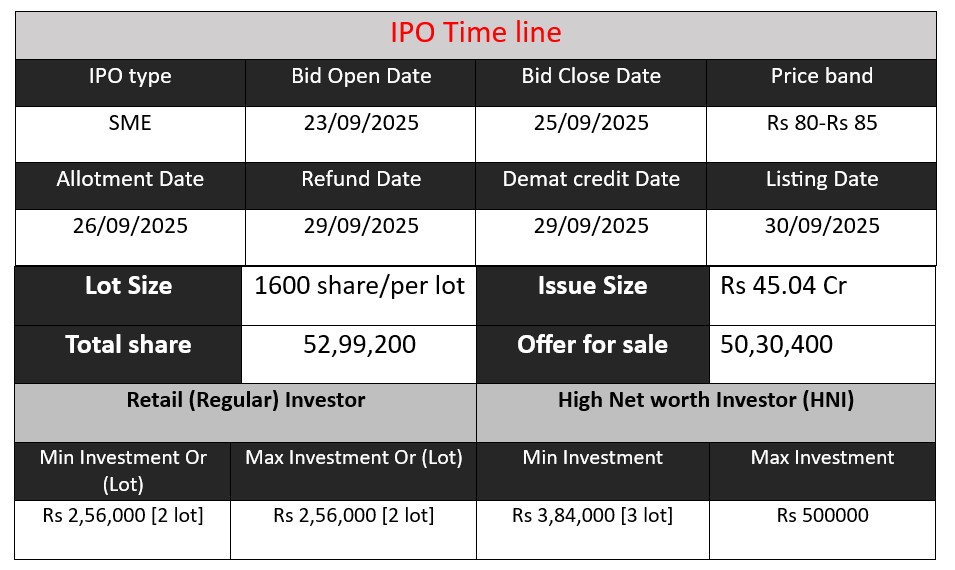

BharatRohan Airborne Innovations Ltd. is launching an SME IPO from 23 September 2025 to 25 September 2025, offering 52,99,200 equity shares in a fresh issue valued at around ₹45.04 crore at a price band of ₹80-85 per share. The proceeds will fund capital expenditure (new equipment), purchase of commercial vehicles, working capital requirements, and general corporate purposes. Listing is proposed on BSE-SME around 30 September 2025.

Bharat Rohan Airborne GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 8 | 80-85 |

| Last Updated: 25 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Bharat Rohan Airborne Core Business & Overview

BharatRohan Airborne Innovations Ltd. was incorporated in June 2016. It was founded by Amandeep Panwar and Rishabh Choudhary.

Business Model / Core Focus

The company is an agritech firm that uses drone / UAV platforms together with hyperspectral imaging (HSI) and associated analytics to offer precision agriculture / crop monitoring. Its services include advisory (crop health, pest/disease, nutrient management), integrated crop management (ICM), sale of branded agri-inputs (“Pravir”), and procuring / selling residue-free and traceable agricultural outputs (“SourceAssure”) from its network of farmers.

Geographic Reach & Scale

Initially serving farmers in Uttar Pradesh and Rajasthan, expanding operations to Gujarat and other states. As of recent reports, it supports tens of thousands of farmers, covering large acreage (for example, 20,000-200,000 acres in different stages).

Recent Developments

The company has raised seed / pre-IPO funding (e.g. USD 2.3 million) for expanding its drone-based crop monitoring services, building capacity, sensor development, and scaling to more states. Also, in 2025 it has IPO plans on the BSE SME platform.

Core Work / Key Capabilities

- Drone + Hyperspectral Imaging & Data Analytics

The core technical capability: using UAVs/drones fitted with hyperspectral imaging (HSI) sensors to capture crop data (stress, disease, nutrient deficiency etc.). Often before visible symptoms appear. This enables early diagnostics and corrective intervention. - Decision Support System (DSS) & Platforms

They have built platforms (e.g. “CropAssure”) for advisory to farmers, based on the data collected. Advice in pest/disease control, nutrient/pesticide usage, etc. Also a “SourceAssure” system for traceability in produce. - Integrated Agri-Input / Output Chain

Not just advisory; they sell branded inputs under their label (“Pravir”), and also procure and market farm produce that meet certain standards (residue-free, traceable). This vertical integration helps them capture value along several points of the agriculture value chain. - Partnerships and Expansion

They work with farmer-producer organizations (FPOs), NGOs, institutional buyers such as FMCG players, retail, exporters. Also, R&D partnerships, sensor manufacturers etc. They are scaling their operations to more acreage and more farmers.

Strengths

From recent data, some of the company’s strong points are:

- Strong revenue & profit growth over recent years. e.g. revenues moved from ₹6.5 crore in FY23 → ₹28.2 crore in FY25; PAT also rising similarly.

- Low debt / healthy balance sheet: Their borrowings are small compared to net worth. Debt/equity is low.

- Vertical integration gives control across input → monitoring → output, which helps in value capture, traceability, and possibly margin retention.

- Technology advantage: Use of hyperspectral imaging, early detection of crop issues, data analytics, plus alternative and more precise intervention. That differentiates from traditional agritech advisory.

- Growing farmer base & acreage: Scaling up to more states and more acreage helps economies of scale.

Risks

No company is without risks. For BharatRohan, some of the more significant risks are:

- Working capital lock-in & receivables / inventory burdens

There is mention of heavy receivables and inventory relative to revenue, which can strain cash flows. - Dependence on farmer adoption & weather / seasonal risks

Their model depends on farmers using the advisory, inputs etc. Agricultural cycles, weather variability, pest outbreaks etc., can affect demand or effectiveness. If drones’ advisory fails or is delayed, or farmers don’t adopt, there’s risk. Also, agriculture is subject to climatic risks. - Regulatory / licensing risks

Drone use, sensor data, agricultural input / output regulation, FSSAI licensing (for trading / manufacturing) etc. Any changes in regulation of drone operations, agriculture inputs, or licensing could impact operations. For example, there’s mention of pending regulatory approval for FSSAI trading licence. - Customer / supplier concentration

A large portion of revenue may come from a handful of customers or from a handful of geographies. Also dependence on key suppliers for sensors or drone components. If any major customer is lost or supplier disruptions occur, it could hurt. - Technology risk / operational risk

High reliance on advanced technology (sensors, drones, image processing, mapping etc.). If there are failures or delays in performance or cost of sensors or drones changes (availability, import tariffs etc.), that can impact margins or capacity.

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 6.47 | 1.81 | 5.27 |

| FY 2024 | 18.95 | 6.90 | 22.33 |

| FY 2025 | 28.17 | 7.59 | 42.01 |

Revenue

- FY 2023: ₹6.47 crore

- FY 2024: ₹18.95 crore → almost 3x growth

- FY 2025: ₹28.17 crore → 49% growth over FY24

Revenue has grown at a strong pace. The company moved from a small base in FY23 to a significantly larger scale in FY25, showing rapid adoption of its services and expansion into new regions. Growth rate slowed in FY25 compared to FY24 but remains healthy.

Profit

- FY 2023: ₹1.81 crore

- FY 2024: ₹6.90 crore → 281% jump

- FY 2025: ₹7.59 crore → modest 10% growth

Profitability grew sharply in FY24, but growth in FY25 slowed despite revenue expansion. This indicates rising costs (possibly operational expansion, technology, or working capital strain). Margins may be under slight pressure, though still positive.

Total Assets

- FY 2023: ₹5.27 crore

- FY 2024: ₹22.33 crore → 4x jump

- FY 2025: ₹42.01 crore → 88% increase

Asset base expanded aggressively, reflecting investment in drones, sensors, technology, and working capital. While this supports growth, it also increases the need for efficient utilization to maintain returns.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.