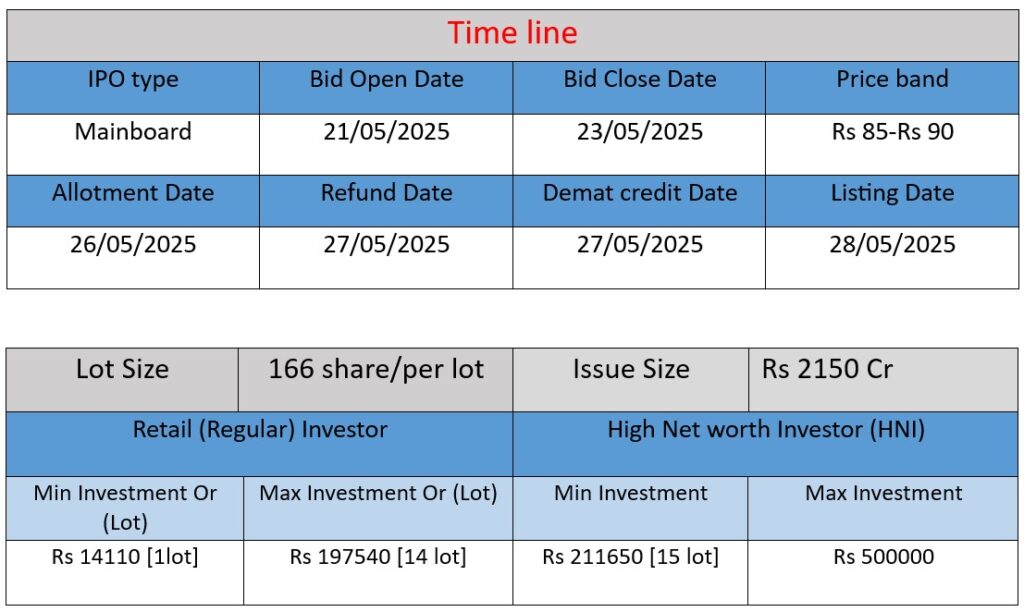

Belrise Industries Ltd files DRHP for ₹2,150 crore IPO comprising fresh issue of ₹700 crore and OFS of ₹1,450 crore. The funds will be used to repay ₹400 crore debt, support working capital needs, and general corporate purposes. A leading Tier-1 auto component maker, Belrise operates 30+ plants and serves top OEMs like Bajaj, Tata, and Hero. The IPO aims to strengthen its financial and market position.

Core Business Focus

Belrise Industries Limited, formerly known as Badve Engineering Ltd., is a prominent Tier-1 automotive component manufacturer in India. The company has grown into a significant player in the automotive industry, serving both domestic and international markets. Below is a comprehensive overview of the company’s operations, strengths, and potential risks, based on information from multiple sources.

Operations and Business Activities

Core Operations:

- Product Portfolio: Belrise specializes in manufacturing safety-critical automotive components, including chassis systems, body-in-white (BIW) components, polymer parts, suspension systems, exhaust systems, and steel castings. These products cater to two-wheelers, three-wheelers, four-wheelers, and commercial vehicles, encompassing both internal combustion engine (ICE) and electric vehicle (EV) powertrains .

- Manufacturing Footprint: The company operates over 30 manufacturing facilities across 7 states in India, strategically located near Original Equipment Manufacturers (OEMs) to ensure efficient supply chain management .

- Clientele: Belrise serves a diverse range of clients, including major domestic and international OEMs such as Bajaj Auto, Hero MotoCorp, Honda Motors, Tata Motors, Ashok Leyland, and Jaguar Land Rover .

Financial Performance:

- Revenue: In the fiscal year 2024, Belrise reported revenue from operations of ₹7,484 crore .

- Net Profit: The company achieved a net profit of ₹310 crore in the same fiscal year .

- Operating Margin: Belrise maintained an operating margin of 12.54% .

Strengths: Competitive Advantages

1. Market Leadership:

- Belrise holds a 24% market share in India’s two-wheeler metal components segment, positioning it among the top three companies in this category .

- 2. Technological Innovation:

- The company has a strong track record in process engineering and technology, ensuring high levels of manufacturing proficiency across its facilities. It proactively integrates new technologies to align with the evolving demands of the automotive industry .

- 3. Strategic Partnerships:

- Belrise has established long-standing relationships with global OEMs, offering a variety of products tailored to their specific needs. Its collaborative business model involves strategically locating manufacturing facilities near customers to ensure a reliable supply chain .

4. Diversified Product Portfolio:

- The company’s product offerings are largely EV-agnostic, with products suitable for both electric vehicles and internal combustion engine applications constituting 74.22% of its revenue in 2024 .

Risks: Challenges and Concerns

1. High Debt Levels:

- As of September 30, 2024, Belrise’s total outstanding debt stood at ₹2,588.3 crore on a consolidated basis. The company plans to utilize proceeds from its ₹2,150 crore Initial Public Offering (IPO) to pare down this debt .

2. Dependence on Automotive Sector:

- Belrise’s performance is closely tied to the automotive industry’s health. Economic downturns, changes in consumer preferences, or disruptions in the automotive sector could adversely affect the company’s operations.

3. Competitive Market:

- The automotive components industry is highly competitive, with numerous players vying for market share. Maintaining technological edge and cost competitiveness is crucial for sustained growth.

4. Employee Satisfaction:

- According to employee reviews, Belrise has an overall rating of 3.8 out of 5. While job security holds the highest rating at 3.7, career growth is rated lower at 3.2, indicating potential areas for improvement in employee development and advancement opportunities

In summary, Belrise Industries Limited has established itself as a significant player in the automotive components industry, leveraging its extensive manufacturing capabilities, technological innovation, and strategic partnerships. However, the company faces challenges related to debt management, market dependence, and employee satisfaction that need to be addressed to ensure sustained growth and competitiveness.

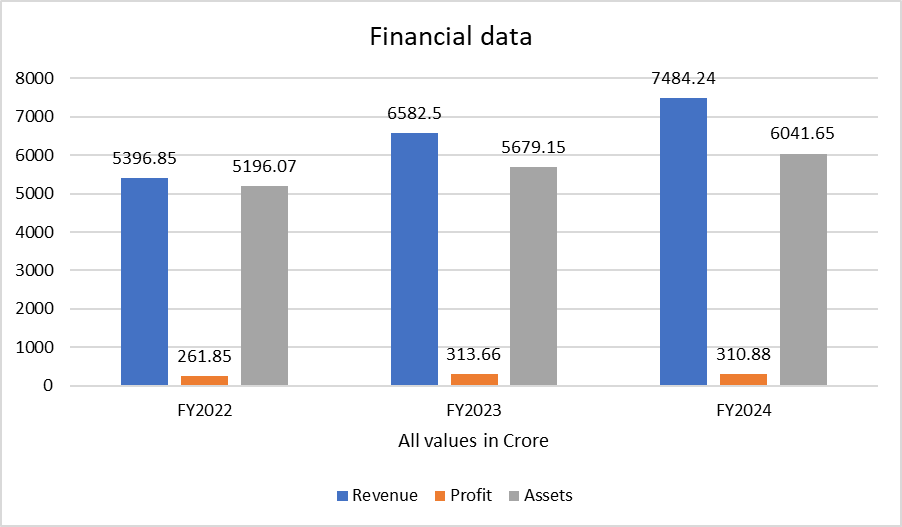

Based on the data provided for Belrise Industries Limited, here is a brief financial performance analysis across FY2022 to FY2024:

Revenue

- FY2022: ₹5,396.85 crore

- FY2023: ₹6,582.50 crore

- FY2024: ₹7,484.24 crore

Analysis:

Revenue increased steadily over the years — 21.99% growth in FY2023 and 13.69% in FY2024. This indicates healthy business expansion and demand for the company’s offerings.

Profit

- FY2022: ₹261.85 crore

- FY2023: ₹313.66 crore

- FY2024: ₹310.88 crore

Analysis:

Profit peaked in FY2023 with a 19.76% rise over FY2022. Although revenue increased in FY2024, profit slightly dipped by 0.89%, possibly due to higher costs, raw material prices, or operational expenses.

Total Assets

- FY2022: ₹5,196.07 crore

- FY2023: ₹5,679.15 crore

- FY2024: ₹6,041.65 crore

Analysis:

Assets have grown consistently, reflecting ongoing investments in infrastructure, technology, or capacity expansion. Asset growth from FY2023 to FY2024 is 6.38%, indicating stable capital deployment.

Summary

- Revenue: Strong and consistent growth.

- Profit: Peaked in FY2023, marginal dip in FY2024.

- Assets: Steady expansion, highlighting long-term growth planning.