Austere Systems IPO Overview

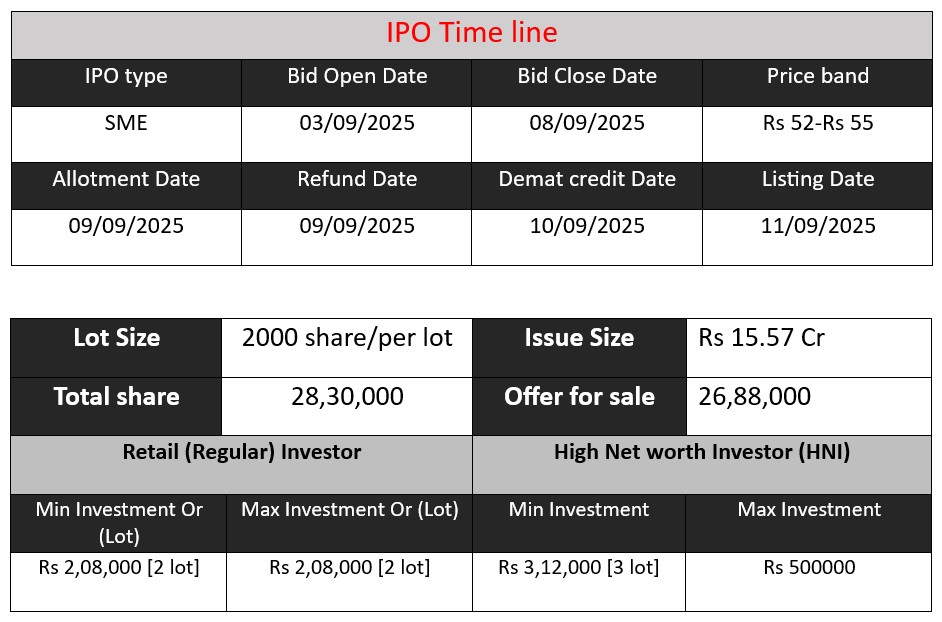

Austere Systems Limited’s SME IPO offers 28.3 lakh fresh equity shares at a price band of ₹52–55 per share, raising approximately ₹15.57 crore. The issue opens on September 3, 2025, and closes on September 8, 2025. Proceeds will be used for working capital (₹11.6 crore) and general corporate purposes (balance). Listing is expected on BSE SME on September 11, 2025.

Austere Systems Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 6.54 |

| NIIs | 405.42 |

| Retails | 369.09 |

| Total | 182.80 |

| Last Updated: 08 Sep 2025- 6 PM Source: NSE/BSE | |

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 32 | 52-55 |

| Last Updated: 10 Sep 2025- 6 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Goel Construction Core Business & Overview

Austere Systems Limited is a public limited company incorporated on 12 June 2015, registered in Pune, Maharashtra, India. Its CIN is U74900PN2015PLC155381. As of June 2024, it had an authorized capital of ₹12.5 crore and paid-up capital of ₹7.6 crore.

Services & Solutions

The company offers a wide portfolio of technology services including: Software Development & SaaS solutions, Mobile App and Web Development, ERP & MIS, E-commerce, AI & Data Analytics, Digital Transformation, Process Automation, Document Management, BPO, IT Consulting, and cloud services (notably as an AWS Public Partner).

Product Offerings

Austere Systems also develops in-house products such as Funds Disbursement & Monitoring, Election Monitoring systems, Soil Health & Testing platforms, SAAS-based Pharma ERP, and various workflow and management applications.

Strengths

- Diverse and Comprehensive Service Portfolio

From AI and ERP to mobile apps, cloud deployment, and testing, Austere offers end-to-end solutions—making it a one-stop IT partner. - Specialization in Underserved Markets

The company strategically serves rural and semi-urban regions in India through customized digital solutions and partnerships with state and local governments. - Strong Leadership & Technical Expertise

Leadership includes industry veterans: Rahul Gajanan Teni (CTO), Shikhir Gupta (MD & Chairman), and Piyush Gupta (CFO). Their experience spans major IT firms and technical domains like cloud, analytics, and ERP. - Execution Track Record & Employee Strength

With a team of 200+ professionals and over 100 projects delivered, Austere demonstrates solid execution capability across diverse domains. - Flexible Engagement & Development Models

Offers multiple engagement models—fixed-price, hourly, dedicated teams, and maintenance options—plus a client-inclusive development model rooted in Agile and RUP principles.

Potential Risks

- IPO-Stage Company

As a relatively small public company preparing for an IPO (SME segment), Austere is still scaling—exposing investors to early-stage operational risks and typical SME challenges. - Operational and Market Risks

Sustaining growth in competitive IT services and government sectors requires strong execution, which could be strained if new contracts slow or key clients exit—especially given limited publicly shared client lists or contracts. - Work Culture Concerns

According to Glassdoor reviews, there are employee-reported issues including project instability, poor job security, and problematic policies around experience certification, especially for freshers—highlighting possible internal unrest or HR inefficiencies

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 15.36 | 1.77 | 8.61 |

| FY 2024 | 18.56 | 4.14 | 12.24 |

| FY 2025 | 18.62 | 4.01 | 18.63 |

Revenue

- FY 2023: ₹15.36 crore

- FY 2024: ₹18.56 crore (growth of ~20.9%)

- FY 2025: ₹18.62 crore (flat growth of just ~0.3%)

Revenue grew strongly from FY 2023 to FY 2024, but almost stagnated in FY 2025. This shows the company might have reached a temporary saturation point or faced challenges in scaling service contracts.

Profit

- FY 2023: ₹1.77 crore

- FY 2024: ₹4.14 crore (sharp rise of ~134%)

- FY 2025: ₹4.01 crore (decline of ~3%)

Profit jumped significantly in FY 2024 due to better cost control and efficiency. However, it slightly declined in FY 2025 despite higher revenue, indicating pressure on margins (possibly due to rising employee costs, operational expenses, or pricing competition).

Assets

- FY 2023: ₹8.61 crore

- FY 2024: ₹12.24 crore (growth of ~42%)

- FY 2025: ₹18.63 crore (growth of ~52%)

Assets have grown steadily and strongly, almost doubling in three years. This reflects investments in infrastructure, technology, and expansion, positioning the company for future growth.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.