Aptus Pharma IPO Overview

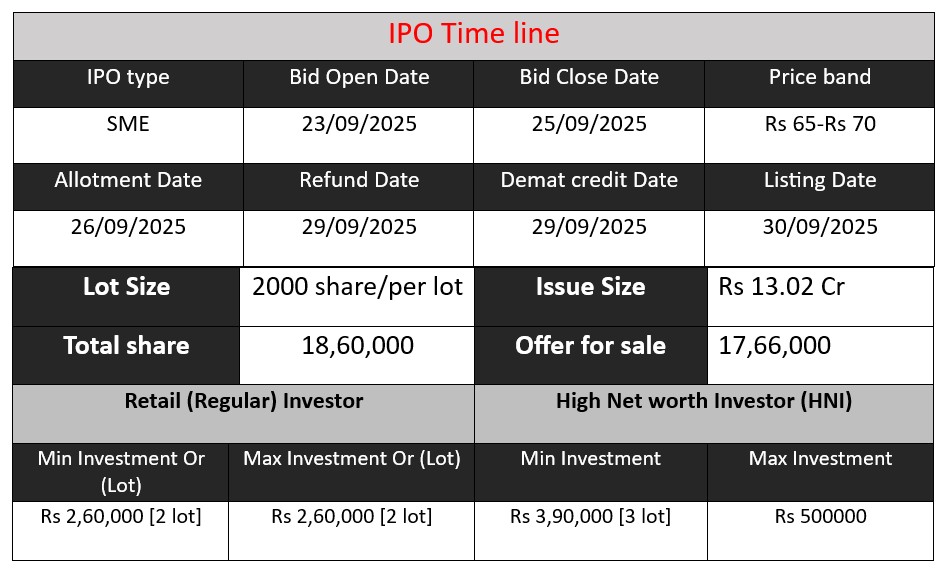

Aptus Pharma Limited IPO opens on September 23, 2025, and closes on September 25, 2025. The company is issuing shares worth ₹13.02 crore at a price band of ₹65-70 per share with a lot size of 2,000 shares. The IPO aims to fund business expansion, working capital requirements, and general corporate purposes. Investors can participate in this promising pharmaceutical company’s growth opportunity listed on BSE SME.

Aptus Pharma GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 4 | 65-70 |

| Last Updated: 25 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Aptus Pharma Core Business & Overview

Aptus Pharma Limited, established in 2010, is an Indian pharmaceutical company specializing in the marketing and distribution of finished pharmaceutical formulations. Operating primarily under a contract manufacturing model, the company collaborates with partner units for production while focusing on distribution and market expansion.

Therapeutic Segments

Aptus Pharma offers a diverse portfolio of 194 formulations across more than 11 therapeutic areas, including:

- Antacids & PPIs

- Pain Management

- Anti-Inflammatories

- Antibiotics

- Cardiology & Antidiabetics

- Neuropsychiatry

- Dental

- Injectables

- Syrups & Sachets

- Nutraceuticals

The company operates from Ahmedabad, Gujarat, with a warehouse spanning 15,732 sq. ft., supported by a network of 125 distributors and a sales team of 54 employees.

Strengths

- Diversified Product Portfolio: Aptus Pharma’s extensive range of formulations across multiple therapeutic segments enhances its market presence and reduces dependency on any single product line.

- Robust Distribution Network: The company’s established relationships with numerous distributors facilitate widespread market reach and efficient product delivery.

- Strategic Manufacturing Partnerships: Collaborations with contract manufacturers enable Aptus Pharma to maintain cost-efficiency while ensuring consistent product quality.

- Commitment to Quality Standards: The company adheres to ISO 9001:2015, ISO 14001:2015, and ISO 45001:2018 certifications, along with GMP & GDP certifications, underscoring its dedication to quality management and safety.

- Experienced Management Team: Aptus Pharma boasts a skilled and committed leadership team, driving the company’s strategic initiatives and operational excellence.

Risks

- Regulatory Challenges: The pharmaceutical industry is subject to stringent regulatory approvals and compliance requirements, which can impact product availability and market entry.

- Dependence on Third-Party Manufacturers: Reliance on contract manufacturers exposes the company to risks related to production delays, quality issues, and cost fluctuations.

- Financial Sustainability: As a relatively small company with limited operating history, Aptus Pharma may face challenges in scaling operations and maintaining consistent financial performance.

- Market Competition: The pharmaceutical sector is highly competitive, with numerous domestic and international players, leading to pricing pressures and potential loss of market share.

Financial Performance Overview (₹ in Crore)

| Financial Metric | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 13.9 | 17.86 | 24.56 |

| Profit | 0.19 | 0.8 | 3.1 |

| Assets | 6.21 | 10.03 | 21.92 |

Revenue:

- Revenue has shown strong growth over the three years, increasing from ₹13.9 Cr in FY23 to ₹24.56 Cr in FY25.

- The growth rate from FY23 to FY24 is approximately 28.5%, and from FY24 to FY25 is approximately 37.5%, indicating accelerating business expansion.

Profit:

- Profit has increased significantly, from ₹0.19 Cr in FY23 to ₹3.1 Cr in FY25.

- This shows the company is not only growing revenue but also improving operational efficiency and cost management.

- Profit margin has improved drastically:

- FY23: 1.37%

- FY24: 4.48%

- FY25: 12.62%

- This upward trend suggests better control over expenses and a scalable business model.

Assets:

- Total assets have increased from ₹6.21 Cr in FY23 to ₹21.92 Cr in FY25, reflecting substantial investment in growth, likely in inventory, distribution network, and working capital.

- The asset base more than tripled in three years, which is consistent with the company’s expansion in revenue and operations.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.