ANB Metal Cast IPO Overview

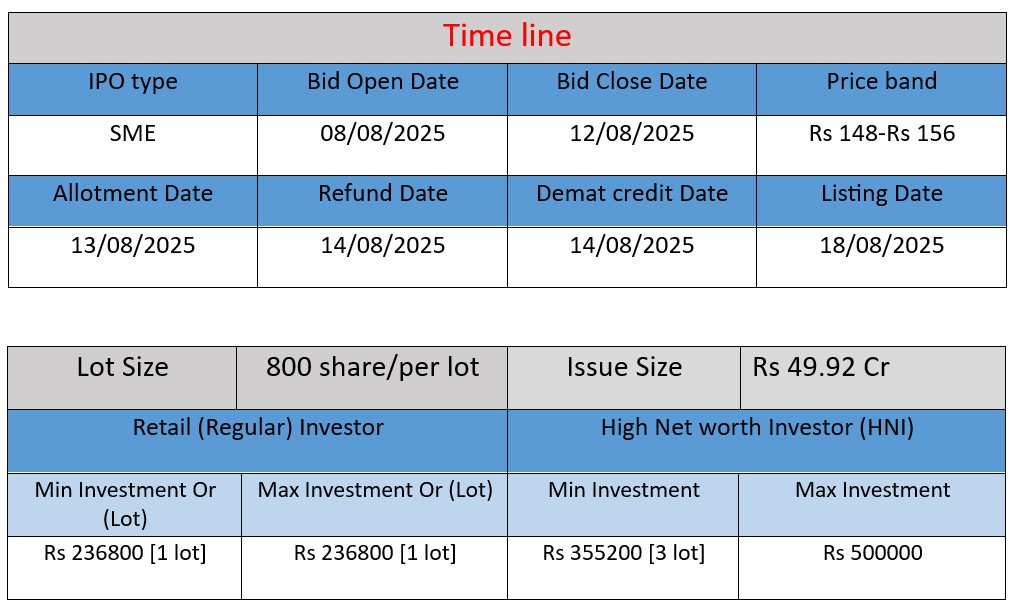

ANB Metal Cast Ltd’s SME IPO opens on August 8 2025 and closes on August 12 2025, issuing 32 lakh fresh equity shares (total issue size ₹49.92 crore) at ₹148–156 per share. The funds will support expansion of manufacturing facilities, working capital, and general corporate purposes.

ANB Metal Cast Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 1.04 |

| NIIs | 2.05 |

| Retails | 2.13 |

| Total | 1.64 |

| Last Updated: 12 Aug 2025 Time: 8 PM (Note: This data is updated every 2 hours) Source: NSE/BSE | |

| GMP (₹) | IPO Price (₹) |

| 156 | |

| Last Updated: 12 Aug 2025 Time: 8 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

- About: Founded in 2019 and headquartered in Rajkot, Gujarat, ANB Metal Cast Limited specializes in manufacturing high-quality aluminium extrusion products, including motor bodies, solar profiles, round bars, channels, railings, sliding windows, and hardware and kitchen profiles.

- Facilities & Technology: The company operates a modern 50,000 sq ft in-house manufacturing facility equipped with CNC, VMC, CAD/CAM tooling, and die-making capabilities. It also maintains stringent quality control procedures and testing labs.

- Certifications: ANB holds multiple ISO certifications—ISO 9001:2015 (quality), ISO 14001 (environment), and ISO 45001 (health & safety)—underscoring its commitment to quality and responsible operations.

Strengths

ANB Metal Cast’s key strengths include:

- Diverse & Customizable Offerings: The company serves a wide array of industries (electronics, automotive, solar, architecture, mechanical), offering tailored extrusion solutions via an expanding die inventory.

- Robust In-house Capabilities: Its ownership of tooling, production, and quality inspection—from design to final product—enables end-to-end control and faster delivery.

- Quality & Certifications: ISO accreditations and rigorous testing (chemical, mechanical, dimensional, etc.) ensure high reliability and consistency.

- Experienced Leadership: Led by Promoter & MD Avnishkumar Dhirajlal Gajera, who has over a decade of experience in metals and manufacturing—adding depth to strategic execution.

Potential Risks

- Regional Concentration: Heavy reliance on Gujarat for operations and revenue makes the company vulnerable to localized economic and regulatory shifts.

- Customer & Supplier Dependency: A small number of large customers and a limited supplier base—often without long-term contracts—pose concentration and supply chain risks.

- Raw Material Volatility: Fluctuations in aluminium scrap prices or availability could pressure margins and production continuity.

Competitive Landscape & Regulation: Operating in a crowded industry with regulatory overlays adds pressure on pricing and compliance.

Financial Performance Overview (₹ in Crore)

| Financial Year | Revenue | Profit | Total Assets |

| FY 2023 | ₹84.27 Cr | ₹1.85 Cr | ₹44.02 Cr |

| FY 2024 | ₹112.12 Cr | ₹5.34 Cr | ₹63.58 Cr |

| FY 2025 | ₹162.57 Cr | ₹10.25 Cr | ₹98.05 Cr |

Revenue

- FY23 to FY24: Revenue grew from ₹84.27 Cr to ₹112.12 Cr — an increase of 33.06%, showing strong sales performance.

- FY24 to FY25: Revenue jumped to ₹162.57 Cr — a growth of 44.99%, indicating robust business expansion.

Profit

- FY23 to FY24: Profit rose from ₹1.85 Cr to ₹5.34 Cr — a 188.65% increase, suggesting better cost control and higher margins.

- FY24 to FY25: Profit reached ₹10.25 Cr — another 91.77% jump, reflecting solid profitability and operational efficiency.

Total

- FY23 to FY24: Assets increased from ₹44.02 Cr to ₹63.58 Cr — a 44.45% rise, likely due to investment in capacity or machinery.

- FY24 to FY25: Grew to ₹98.05 Cr — a 54.26% growth, showing expansion and asset buildup to support increasing operations.

✅ Pros

- Strong revenue and profit growth over the last 3 years.

- In-house manufacturing with ISO-certified quality control.

- Serving diverse industries with customizable aluminium products.

- Expansion-focused IPO with clear fund utilization.

- Experienced promoter with industry background.

❌ Cons

- Business operations are regionally concentrated in Gujarat.

- High dependency on a few customers and suppliers.

- Exposed to fluctuations in raw material (aluminium) prices.

- Competitive and fragmented aluminium industry.

- SME IPO—lower liquidity and higher volatility post-listing.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.