Anantam Highways InvIT IPO Overview

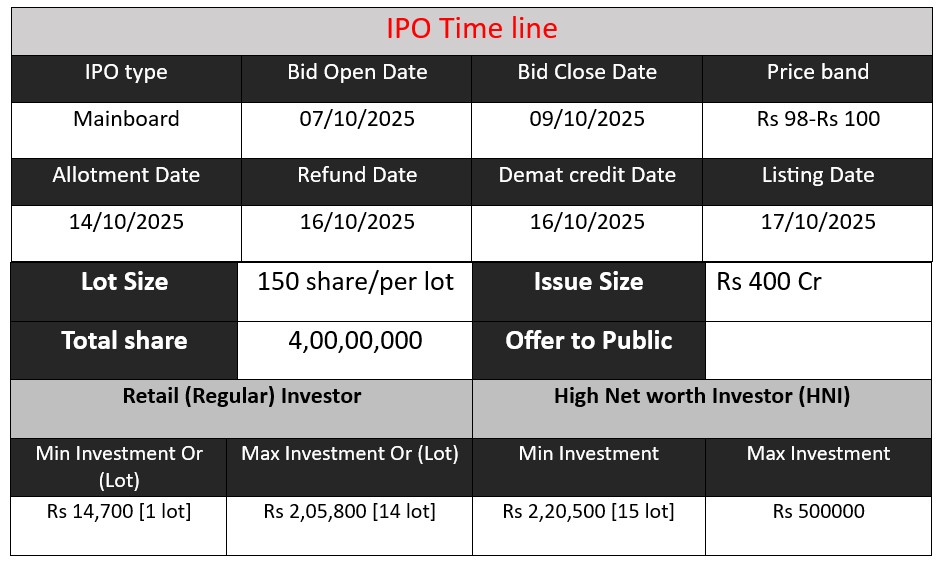

Anantam Highways InvIT IPO opens on 7 October 2025 and closes on 9 October 2025, raising ₹400 crore through the issue. The IPO offers units of the infrastructure trust, backed by seven NHAI HAM road projects, to provide stable, long-term returns. Funds raised will be used for debt repayment and operational expansion, making it a key investment opportunity in India’s road infrastructure sector.

Anantam Highways InvIT GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 0 | 98-100 |

| Last Updated: 9 Oct 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Basic Detail

Anantam Highways InvIT Core Business & Overview

Anantam Highways InvIT Limited is a newly established Infrastructure Investment Trust (InvIT) in India, focusing on road infrastructure assets. Sponsored by Alpha Alternatives Fund Advisors LLP, the trust was registered with SEBI on August 19, 2024, and commenced operations in July 2024.

Core Operations : Anantam Highways InvIT is primarily engaged in investing in operational road assets under the Hybrid Annuity Model (HAM) of the National Highways Authority of India (NHAI). The trust’s portfolio includes seven NHAI HAM road projects spanning 272 kilometers across six Indian states. These assets generate stable, inflation-linked annuity revenues, mitigating traffic risk and providing long-term income visibility.

Strengths

- Stable Revenue Streams: The trust’s assets are backed by government contracts under the HAM framework, ensuring predictable cash flows.

- Experienced Management: Led by Alpha Alternatives, a multi-strategy asset management firm with expertise across various asset classes, the trust benefits from strong governance and operational oversight.

- Strategic Asset Portfolio: The focus on operational assets under the HAM model reduces construction-related risks and enhances the trust’s financial stability.

Risks

- Model Concentration: The trust’s reliance on the HAM framework may expose it to regulatory changes and policy risks associated with government contracts.

- Limited Track Record: As a newly established entity, Anantam Highways InvIT has a limited operational history, which may pose challenges in assessing long-term performance.

- Market Liquidity: The InvIT market in India is still developing, and investor participation remains relatively low, potentially affecting liquidity and valuation.

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 2590.22 | -178.48 | 2425.48 |

| FY 2024 | 2525.69 | -160.05 | 3530.23 |

| FY 2025 | 926.55 | 410.62 | 4151.92 |

Revenue:

- Revenue declined slightly from ₹2590.22 crore in FY 2023 to ₹2525.69 crore in FY 2024, showing a marginal decrease of 2.5%.

- FY 2025 shows a sharp drop in revenue to ₹926.55 crore. This could indicate asset divestments, partial operations, or one-time adjustments affecting revenue reporting.

Profit:

- The company posted losses in FY 2023 (-₹178.48 crore) and FY 2024 (-₹160.05 crore), indicating operational challenges in these years.

- FY 2025 saw a remarkable turnaround with a profit of ₹410.62 crore. This indicates improved operational efficiency, higherrevenue from specific assets, or gains from divestments or other non-recurring income.

Assets:

- Total assets have steadily increased from ₹2425.48 crore in FY 2023 to ₹4151.92 crore in FY 2025.

- This growth suggests expansion of the asset base, likely through acquisition of operational road projects or infrastructure assets under the InvIT structure.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.