All Time Plastics IPO Overview

All Time Plastics Limited is launching a ₹400.60 crore IPO, combining a ₹280 crore fresh issue (1.02 crore shares) and a ₹120.60 crore offer‑for‑sale of 43.85 lakh shares. The IPO opens for subscription on 7 August 2025 and closes on 11 August 2025, with anchor bids on 6 August. Proceeds will be used for ₹143 crore for debt repayment, ₹113.7 crore for Manekpur plant machinery and ASRS, and the remainder for general corporate purposes.

JSW Cement Subscription and GMP Status

| Subscription Rate Source: NSE/BSE | |||

| Category | Shares Offered | Shares Bid For | Subscription (x) |

| QIBs | 29,49,238 | 2,99,29,230 | 10.15 |

| NIIs | 22,68,393 | 3,05,54,334 | 13.47 |

| Retails | 52,92,916 | 2,72,28,528 | 5.14 |

| Employees | 35,750 | 2,79,450 | 7.82 |

| Shareholders | |||

| Total | 1,05,46,297 | 8,79,91,542 | 8.34 |

| Last Updated: 11 Aug 2025 Time: 10 PM (Note: This data is updated every 2 hours) | |||

| GMP (₹) | IPO Price (₹) |

| 8 | 275 |

| Last Updated: 11 Aug 2025 Time: 10 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

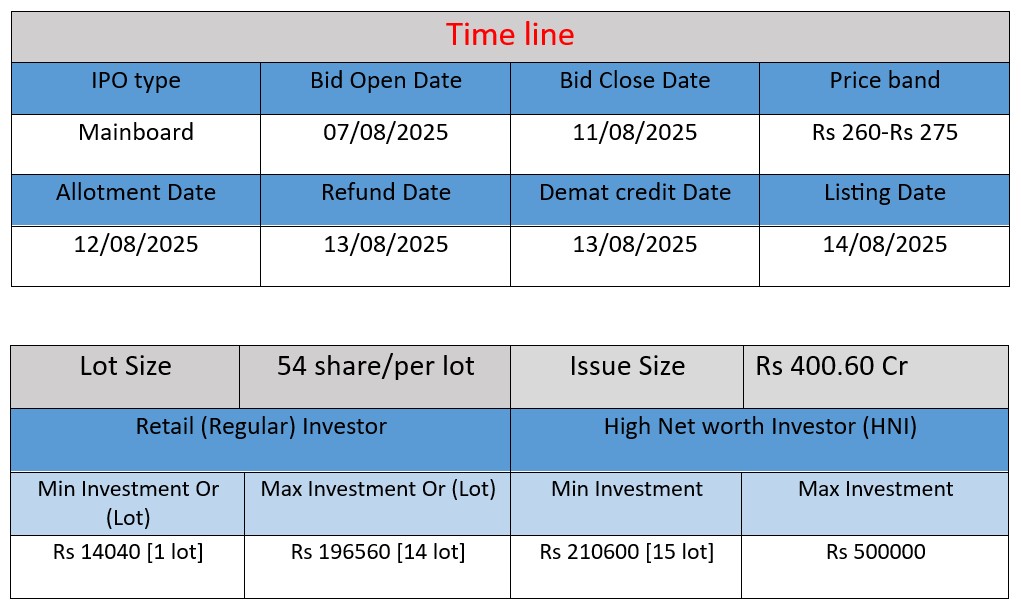

IPO Key Date

Core Business & Overview

All Time Plastics Limited (ATPL), founded in 1971, is a major Indian manufacturer and exporter of plastic houseware, kitchenware, bathware, children’s products, and storage solutions. It operates a white-label (B2B OEM) manufacturing model, supplying global retailers like IKEA, Tesco, Asda, Michaels, Walmart, and Target. It also markets a small share of products under its own consumer brand, “All Time Branded Products”.

As of March 31, 2025, ATPL offered around 1,848 SKUs spanning eight product categories: Prep Time (kitchen tools), Containers, Organisation, Hangers, Mealtime, Cleaning, Bath Time, and Junior products. The company exports to 25–29 countries, contributing around 75–90% of revenues from exports .

Strengths

1. Established global B2B supply relationships

ATPL enjoys long-standing ties with global retail majors—most notably IKEA, which alone accounts for over ~55–59% of its revenue, and the top 4 clients together represent ~78% of sales. This demonstrates deep trust and consistent business volume.

2. Broad and responsive product portfolio

With nearly 1,848 SKUs across eight categories, including the launch of 598 new SKUs in FY25, ATPL shows strong design agility and customer responsiveness.

3. Strategically located, high-capacity facilities

The company operates automated injection-moulding plants in Daman, Silvassa, and Manekpur with over 140 machines and installed capacity of ~33,000 metric tonnes. These sites are near ports and petrochemical clusters, reducing logistics and raw material costs.

4. Strong financial risk profile

CRISIL reaffirmed ATPL as CRISIL A-/Stable, reflecting sound financial management, efficient working capital operations (debtors ~30–45 days, inventory ~60–70 days), and moderate gearing. The company’s net worth and debt metrics remain comfortable.

Potential Risks

1. Extreme customer concentration

Dependence on a few major clients (IKEA alone 55–59%, top four ~78%) introduces revenue risk—any order reduction or termination significantly affects financial performance and negotiating power is limited.

2. High export dependency & currency risk

About 75–90% of revenue comes from exports; thus, ATPL is sensitive to global demand cycles and currency fluctuations. Appreciation of the rupee or weakening overseas markets can erode profits.

3. Raw material price volatility and regulatory environment

The company relies heavily on polymers like polypropylene and polyethylene, whose prices are tied to global crude and forex rates. Sudden increases materially impact margins. Increasing environmental regulations, anti-plastic sentiment, and sustainability mandates also pose compliance pressure.

4. Weak brand equity

Only 7–8% of revenue stems from its own branded consumer line, limiting pricing power and brand recall compared to established competitors like Milton or Cello. This keeps margins squeezed in the OEM model.

5. Operational and infrastructure risks

ATPL’s facilities require stable utilities (power, water), and operational disruptions—whether from labor unrest, tech failures, or plant shutdowns—could adversely affect capacity and delivery timelines. Supply chain disruptions or dependence on a limited set of suppliers could also pose threats.

Financial Performance Overview (₹ in Crore)

| Financial year | FY 2023 | FY 2024 | FY 2025 |

| Revenue | ₹443.49 | ₹512.85 | ₹558.17 |

| Profit | ₹28.27 | ₹44.79 | ₹47.29 |

| Assets | ₹400.48 | ₹415.46 | ₹562.32 |

Revenue

- FY2023: ₹443.49 crore

- FY2024: ₹512.85 crore (+15.6% growth YoY)

- FY2025: ₹558.17 crore (+8.8% growth YoY)

Revenue has shown consistent growth over the three years,indicating increased order flow, particularly from global clients like IKEA and other B2B partners. While FY2024 saw robust double-digit growth, FY2025 growth slightly slowed but remained healthy.

Profit

- FY2023: ₹28.27 crore

- FY2024: ₹44.79 crore (+58.4% growth YoY)

- FY2025: ₹47.29 crore (+5.6% growth YoY)

Profit saw a sharp jump in FY2024 due to better operating efficiency, favorable product mix, and possibly improved realizations. The modest increase in FY2025 suggests stabilizing margins and increased costs due to expansion or input volatility.

Total Assets

- FY2023: ₹400.48 crore

- FY2024: ₹415.46 crore (+3.7% growth YoY)

- FY2025: ₹562.32 crore (+35.3% growth YoY)

A significant jump in assets in FY2025 points to capacity expansion, especially the addition of advanced machinery (like ASRS systems), as noted in the IPO purpose. This investment aims to support long-term growth and improve automation.

✅ Pros

- Strong relationships with global retail giants like IKEA and Walmart.

- Diversified product portfolio with over 1,800 SKUs.

- Consistent revenue and profit growth over the last 3 years.

- Strategically located automated manufacturing units.

- Use of IPO proceeds for capacity expansion and debt reduction.

❌ Cons

- Heavy dependence on top 4 clients, especially IKEA (55–59% revenue).

- High export reliance (75–90%) exposes business to currency and global demand risks.

- Limited brand presence in the domestic market.

- Exposure to raw material (polymer) price volatility.

- Regulatory risks related to single-use plastics and sustainability concerns.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.