Airfloa Rail Technology IPO Overview

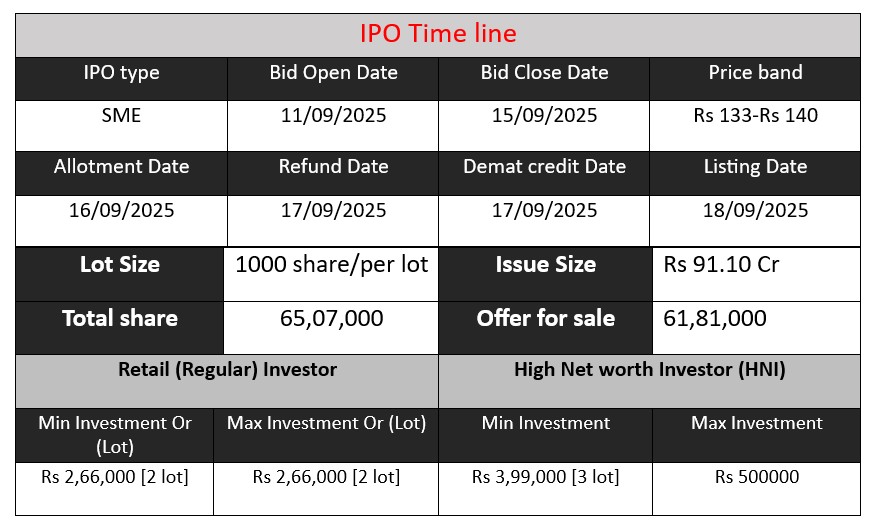

Airfloa Rail Technology Limited launches a ₹91.10 crore fresh SME IPO, offering 65.07 lakh equity shares at a ₹133–₹140 price band. Subscription opens on 11 September 2025 and closes on 15 September 2025. Proceeds will fund machinery capex, debt repayment, working capital, and general corporate purposes. Shares will be listed on the BSE SME platform on 18 September 2025

Airfloa Rail Technology GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 175 | 133-140 |

| Last Updated: 16 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Airfloa Rail Technology Core Business & Overview

Founded in December 1998 (as Air Flow Equipments India Pvt. Ltd.), the company transitioned to Airfloa Rail Technology Limited in August 2024 and converted to a public limited company in November 2024.

Core business revolves around manufacturing critical precision components and turnkey interior furnishing solutions for railway rolling stock, primarily serving Indian Railways and metro systems (including Integral Coach Factory and other coach factories). Products include seating systems, sliding doors, windows, diffusers, roof panels, PAPIS units, and complete coach interiors.

Additionally, the company operates in the aerospace and defence sectors—producing high-precision machined parts, AMCA ground simulators, artillery tank bodies, and related equipment.

Strengths

- Long-standing track record & quality certifications

- Over 25 years of operations and adherence to high-quality norms, including ISO 9001:2015, EN 15085-2, and BMS certifications.

- Turnkey, integrated solutions & advanced facilities

- Offers end-to-end solutions: design, manufacturing, assembly, and installation. Operates advanced Chennai-based manufacturing facilities with forging, machining, composite (FRP), powder-coating, and assembly lines.

- High-profile project portfolio & diversified clientele

- Involved in prestigious railway projects such as Vande Bharat Express, Agra–Kanpur Metro, RRTS, Vistadome coaches, Kolkata Metro, Sri Lankan DEMU trains. Aerospace/defence work adds further diversification.

- Strong operational metrics

- Impressive return ratios: ROE 30.6%, ROCE 26.3%, EBITDA margin 24.6%, PAT margin 13.3%, Debt-Equity 0.54 (standalone)

- Healthy order book

- Order book size: ₹375.9 cr as of August 2025, or ₹306.36 lakhs (₹306.4 cr) as of May 31, 2025, signifying strong demand and business pipeline.

Risks

- High dependence on Indian Railways

- Around 80% of revenue comes from Indian Railways, making the company vulnerable to policy shifts, tendering delays, and budget changes.

- Tender-based business model & competition

- Growth is contingent upon winning competitive bids. Strong domestic and global competition creates execution uncertainty.

- Input cost volatility

- Raw materials like steel, aluminium, composites, and FRP are subject to price fluctuations, which can erode margins if not efficiently managed.

- Working capital intensity & financial obligations

- Large portion of IPO proceeds will fund working capital. The company also carries significant borrowings (₹59–60 crore) with potential liquidity strain.

- Sectoral and regulatory exposure in aerospace & defence

- These sectors entail stringent approvals, longer project cycles, and higher technological risk—though they offer diversification, they add complexity.

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 95.17 | 1.49 | 163.89 |

| FY 2024 | 119.30 | 14.23 | 201.99 |

| FY 2025 | 192.39 | 25.55 | 256.94 |

Revenue

FY 2023: ₹95.17 Cr → FY 2024: ₹119.3 Cr → FY 2025: ₹192.39 Cr

Strong growth trend with over 102% growth in 2 years. Major jump in FY 2025 shows expansion in business, likely due to large orders in railway and defence projects.

Profit

FY 2023: ₹1.49 Cr → FY 2024: ₹14.23 Cr → FY 2025: ₹25.55 Cr

Profitability surged, especially from FY 2023 to FY 2024 (almost 9.5x increase). Indicates improved cost control, higher-margin projects, and scaling efficiency.

Total Assets

FY 2023: ₹163.89 Cr → FY 2024: ₹201.99 Cr → FY 2025: ₹256.94 Cr

Continuous rise in asset base, showing reinvestment and capacity expansion. Asset growth supports revenue expansion, signaling healthy financial strength.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.