One of the most important — and most misunderstood — aspects of futures trading is margin and leverage. Many traders only know that futures allow them to trade large amounts with small capital, but they do not fully understand the level of risk involved.

In the futures market, you do not pay the full value of the contract. Instead, you deposit a margin, which gives you the power to control a much larger position. This system creates leverage.

When used wisely, leverage can increase profits. When used carelessly, it can quickly wipe out a trading account.

In this article, we will clearly understand:

- What futures margin is

- Types of margins in futures trading

- What leverage means and how it is calculated

- What a margin call is

- The real risk impact of leverage

What Is Futures Margin?

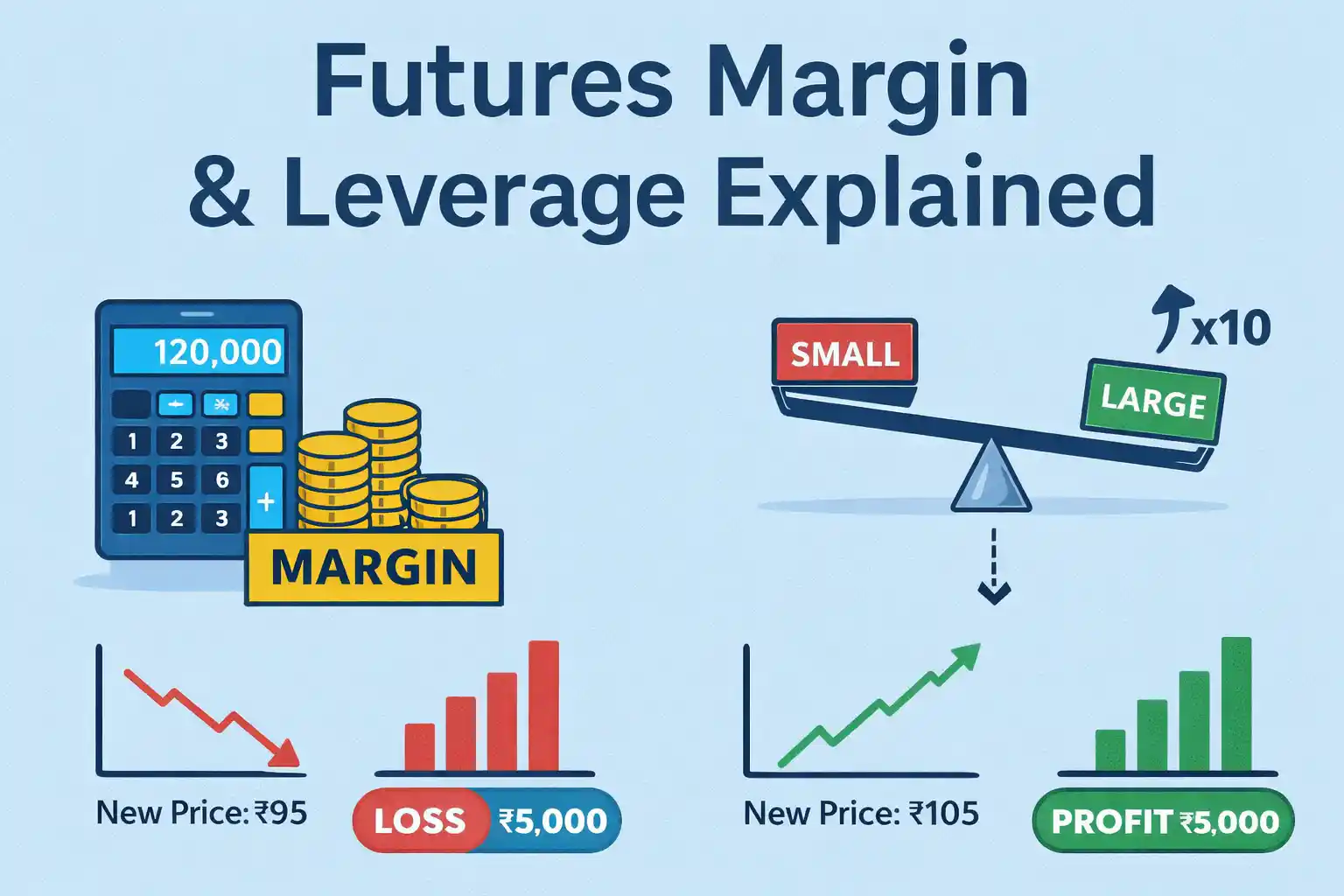

Margin is a security deposit required to open and maintain a futures position.

Important:

- It is not the full contract value

- It is only a percentage of the contract value

Example

Suppose:

- Nifty Futures Contract Value = ₹10,00,000

- Required Margin = ₹1,20,000

You are controlling a ₹10 lakh contract by paying only ₹1.2 lakh.

This is why futures trading appears attractive — but it also increases risk.

Types of Futures Margin

Futures margin is divided into different components.

(A) Initial Margin

This is the minimum amount required to open a futures position.

Example:

If the initial margin required is ₹1,20,000, you must have at least this amount in your trading account before placing the trade.

(B) Maintenance Margin

This is the minimum balance that must remain in your account to keep the position open.

If losses reduce your margin below this level:

- The broker will issue a margin call.

(C) Mark-to-Market (MTM) Adjustment

In futures trading, profit and loss are settled daily.

If the market moves against your position:

- Losses are deducted from your margin

- Your available margin decreases

If margin becomes too low, you may need to add more funds.

What Is Leverage?

Leverage means controlling a large contract value with a smaller amount of capital.

Formula:

Leverage = Total Contract Value ÷ Margin Paid

Example

- Contract Value = ₹10,00,000

- Margin Paid = ₹1,00,000

Leverage = 10x

This means:

A 1% move in the market results in a 10% impact on your capital.

The Real Impact of Leverage (Profit & Loss Example)

Suppose:

- You invest ₹1,00,000 as margin

- You control ₹10,00,000 exposure

Scenario 1: Market Rises 2%

Profit = ₹20,000

Return on capital = 20%

Scenario 2: Market Falls 2%

Loss = ₹20,000

20% of your capital is gone in one day.

If the market moves 5% against you:

- Loss = ₹50,000

- Half your capital is wiped out.

This shows how powerful and risky leverage can be.

What Is a Margin Call?

When your margin balance falls below the maintenance level:

- The broker sends a notification

- You are required to deposit additional funds

If you fail to add funds:

- The broker may automatically close (square off) your position

This can lock in significant losses.

Why High-Leverage Traders Often Fail

Common mistakes include:

- Using full available capital in one trade

- Not placing stop-loss orders

- Overconfidence

- Ignoring small price movements

In leveraged trading, even small market moves can cause large account damage.

How to Use Leverage Safely

Professional traders:

✔ Do not use full margin capacity

✔ Risk only a small percentage of total capital

✔ Always use stop-loss

✔ Follow proper position sizing

Leverage does not mean taking bigger risks.

It means managing capital more efficiently.

Final Understanding

- Margin is a security deposit for futures trading

- Leverage multiplies both profit and loss

- Daily MTM adjustments affect your margin

- Discipline and risk management are essential

Understanding margin and leverage is critical for survival in futures trading. Without proper knowledge and control, leverage can quickly become dangerous.