Sihora Industries IPO Overview

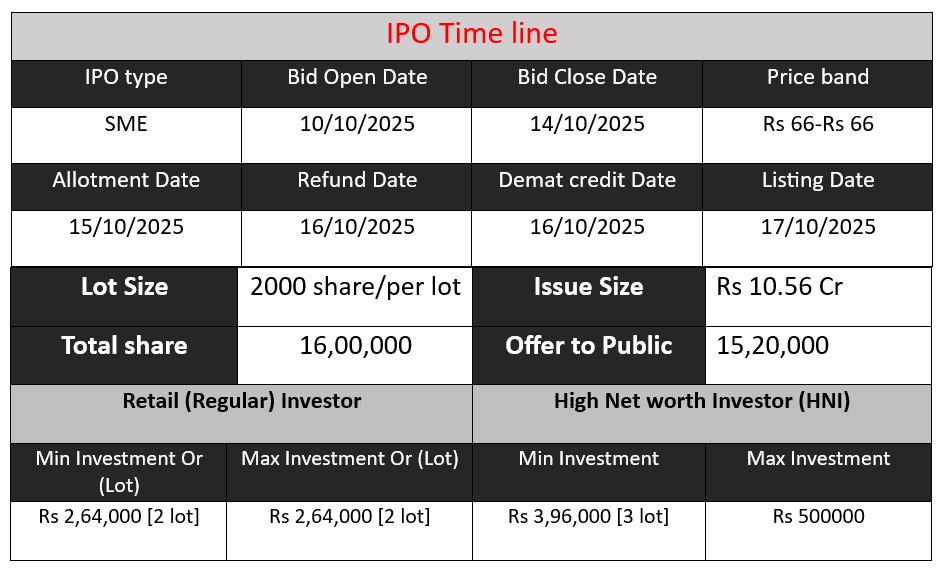

Sihora Industries’ SME IPO offers 16,00,000 equity shares at ₹66 each, raising ₹10.56 crore. The fresh issue runs from 10 October to 14 October 2025 on BSE-SME. Proceeds will fund plant & machinery, working capital, debt repayment and corporate purposes. Investors can bid in lots of 2,000 shares. Allotment, refund and listing timeline to follow.

Sihora Industries GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 0 | 66 |

| Last Updated: 14 Oct 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Basic Detail

Sihora Industries Core Business & Overview

Sihora Industries Limited is a Surat, Gujarat-based textile manufacturing company incorporated on 10 August 2023 as Sihora Industries Private Limited to take over the business of Sihora Narrow Fabrics, owned by promoter Mr. Gautam Vallabhbhai Sihora.

It was later converted into a public limited company on 17 July 2024. The company operates from an integrated manufacturing facility in Surat, covering the complete textile production process from yarn processing to weaving, printing, and finishing.

It produces a wide range of products such as narrow woven fabrics, laces, borders, digital printed fabrics, woven labels, zippers, elastics, technical textiles, and tapes. Legally registered under CIN: U13999GJ2023PLC143747, the company has an authorized capital of approximately ₹6.00 crore and a paid-up capital of about ₹3.73 crore.

Strengths

From the available materials, here are at least 3 significant strengths:

- Integrated Facility / Process Control

Because the company operates almost all processes under one roof (from yarn → weaving → printing → finishing etc.), it can better control quality, turnaround times, and costs. This vertical integration is often a competitive advantage in textiles. - Diversified Product Range

It offers a wide array of textile / accessory products: lace, borders, zippers, elastics, woven labels, digital printing etc. This helps it cater to multiple segments (fashion, industrial, technical textiles), which can smooth out demand fluctuations. - Strong Recent Financial Growth

As per FY2025, revenue has increased significantly, with profit after tax improving. Utilisation of capacity (for example, of narrow woven fabrics, zippers, elastics) is quite high. - Experienced Promoters / Management

The promoters are reported to have 17+ years in textile manufacturing. That experience helps in establishing supplier/customer relationships, managing operations etc. - Strategic Location

Surat, Gujarat is a well-known hub for textiles. Proximity to raw material supply chains, skilled/semi-skilled labor, infrastructure advantages for logistics. This helps reduce costs and facilitate smoother operations.

Risks

Likewise, here are at least three major risks or challenges for Sihora Industries:

- Reliance on Few Major Customers

A substantial part of its revenue comes from a small number of customers. If one or more big customers reduce orders, it could significantly impact revenue. - Raw Material Price Volatility & Dependency

Raw materials (especially yarns like polyester or viscose) constitute a large portion of input cost. Prices of such inputs are subject to fluctuations (due to crude oil, currency, global supply chain disruptions). Also dependency on certain raw materials may expose the company to supply issues. - Operating from a Single Location

All manufacturing is concentrated in one facility in Surat. This exposes the company to local risks: labor issues, regulatory changes, natural disasters, power/water supply reliability etc. Any disruption may hamper operations. - New / Limited Track Record

Since conversion to a public limited company is recent (2024) and full operations under this structure are still in early years, the company has limited history. This makes future performance more uncertain. - Competitive Pressure

The textile sector in India is quite competitive, with many players. Pressure on margins, demand for quality, innovation, branding etc. Also, shifting fashion trends may require agility. - Working Capital / Debt Exposure

The firm has some borrowings; it needs good cash flow to service debt and finance working capital. Also its IPO proceeds partly go into debt repayment and working capital. If cash flows weaken, that could stress liquidity.

Financial Performance Overview (₹ in Crore)

| Financial Year | Revenue | Profit | Assets |

| FY 2023 | 12.10 | 0.30 | 8.95 |

| FY 2024 | 11.56 | 0.60 | 14.34 |

| FY 2025 | 14.56 | 1.87 | 12.65 |

Revenue

- FY 2024 saw a slight decline in revenue to ₹11.56 crore from ₹12.10 crore in FY 2023 (↓ 4.5%), possibly due to operational transition or lower demand.

- However, in FY 2025, revenue rebounded strongly by about 26%, reaching ₹14.56 crore, showing a healthy recovery and business expansion.

Profit

- Profit improved consistently each year — from ₹0.30 crore in FY 2023 to ₹0.60 crore in FY 2024, and then sharply to ₹1.87 crore in FY 2025.

- The FY 2025 jump indicates better cost control, higher efficiency, and improved margins, possibly supported by economies of scale.

Assets

- Assets grew significantly in FY 2024 (₹14.34 crore vs ₹8.95 crore), suggesting capacity expansion or investment in infrastructure.

- In FY 2025, assets slightly reduced to ₹12.65 crore, likely due to debt repayment or revaluation adjustments, but remain above FY 2023 levels.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.