Mittal Sections IPO Overview

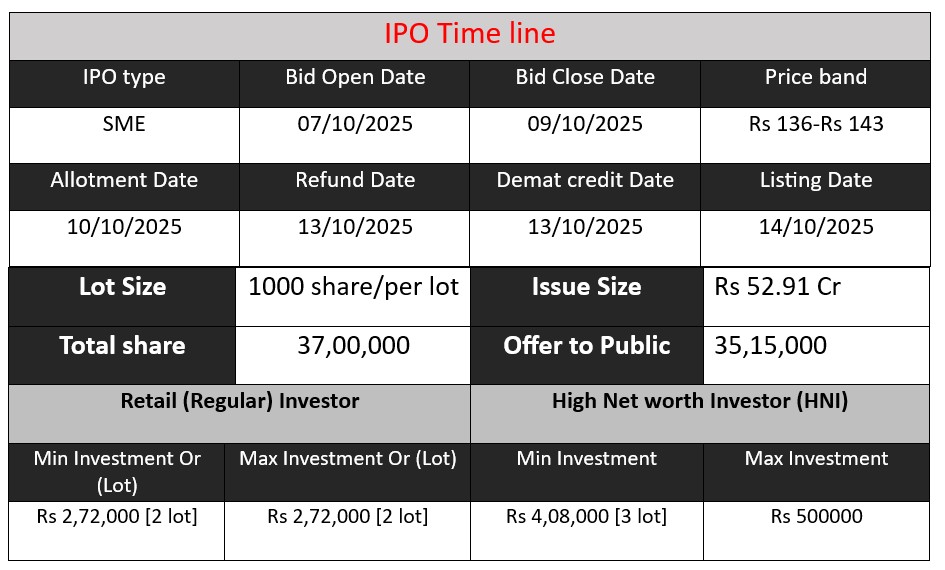

Mittal Sections Ltd IPO opens from October 7 to October 9, 2025, offering 3.7 million equity shares at ₹136–₹143 per share, aiming to raise ₹52.91 crore. The fresh issue proceeds will fund capacity expansion, working capital, and debt reduction. The listing is scheduled for October 14, 2025, on the BSE SME platform.

Mittal Sections GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 0 | 136-143 |

| Last Updated: 9 Oct 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Basic Detail

Mittal Sections Core Business & Overview

Mittal Sections Limited (MSL) is a prominent steel manufacturing company based in Ahmedabad, Gujarat, India. Established in 2009, MSL specializes in producing a diverse range of mild steel structural and sectional products, including MS flat bars, round bars, angles, and channels. These products are marketed under its in-house brand, “MSL-Mittal,” and cater to various industries such as construction, automotive, and engineering.

Core Operations

- Product Portfolio: MSL offers over 55 stock-keeping units (SKUs), encompassing products like MS flat bars, round bars, angles, and channels. These products are utilized across construction, automotive, and engineering sectors.

- Manufacturing Facilities: The company operates two ISO 9001:2015 certified manufacturing units in Changodar, Ahmedabad, with a combined annual capacity of 36,000 metric tonnes per annum (MTPA). Plans are underway to expand this capacity to 96,000 MTPA by FY2026.

- Market Reach: MSL distributes its products through a robust network of brokers and dealers, ensuring widespread availability across India.

Strengths

- Established Brand: With over 15 years in the steel manufacturing industry, MSL has built a reputation for quality and reliability under the “MSL-Mittal” brand.

- Capacity Expansion: The planned increase in production capacity demonstrates MSL’s commitment to meeting growing market demand and enhancing operational efficiency.

- Strong Financial Performance: The company has shown consistent improvement in financial metrics, including rising margins and a return on equity (ROE) above 25%, indicating robust financial health.

Risks

- Industry Cyclicality: The steel industry is subject to cyclical demand fluctuations, which can impact MSL’s revenue and profitability.

- Raw Material Price Volatility: Fluctuations in the prices of raw materials like iron ore and coal can affect production costs and margins.

- Debt Levels: While MSL has managed to reduce its debt-equity ratio, high levels of debt can pose financial risks, especially during periods of economic downturn

Financial Performance Overview (₹ in Crore)

| Financial Metric | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 167.18 | 161.48 | 136.86 |

| Profit | 0.56 | 1.89 | 3.61 |

| Assets | 33.37 | 29.04 | 45.41 |

Revenue

- Revenue has shown a declining trend over the three years: from ₹167.18 crore in FY 2023 to ₹136.86 crore in FY 2025.

- This drop of 18% over two years could indicate challenges such as reduced demand, pricing pressures, or competition in the steel sector.

Profit

- Despite falling revenue, net profit has increased significantly: from ₹0.56 crore in FY 2023 to ₹3.61 crore in FY 2025.

- This suggests improved operational efficiency, cost control, or better product mix. The company is becoming more profitable even with lower sales.

Assets

- Total assets decreased in FY 2024 to ₹29.04 crore but surged to ₹45.41 crore in FY 2025.

- The increase in assets could be due to expansion, capital investment in manufacturing facilities, or higher inventory levels, reflecting growth plans despite declining revenue.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.